FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

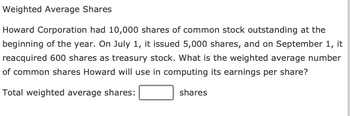

Transcribed Image Text:Weighted Average Shares

Howard Corporation had 10,000 shares of common stock outstanding at the

beginning of the year. On July 1, it issued 5,000 shares, and on September 1, it

reacquired 600 shares as treasury stock. What is the weighted average number

of common shares Howard will use in computing its earnings per share?

Total weighted average shares:

shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dogarrow_forwardFinancial statement data for the years ended December 31 for Cottontop Corporation follow: 20Y3 20Y2 Net income $768,750 $627,750 Preferred dividends $117,000 $117,000 Average number of common shares outstanding 55,000 shares 45,000 shares a. Determine the earnings per share for 20Y3 and 20Y2. Round your answers to two decimal places. 20Y3 $fill in the blank 1 per share 20Y2 $fill in the blank 2 per share b. Does the change in the earnings per share from 20Y2 to 20Y3 indicate a favorable or unfavorable trend?arrow_forwardEarnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,516,000 $2,425,000 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 80,000 shares 110,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places.arrow_forward

- Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,761,000 $2,532,500 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 90,000 shares 115,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Y6 Earnings per Share $fill in the blank 1 $fill in the blank 2 b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable? fill in the blankarrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 1,000 shares of 8%, $100 par, cumulative preferred stock and 43,000 shares of $10 par common stock. The amounts distributed as dividends follow. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. Round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $6,000 $ $ $ $ 2 8,000 $ $ $ $ 3 15,680 $ $ $ $arrow_forwardVaiarrow_forward

- Identifying and Analyzing Financial Statement Effects of Stock TransactionsMelo Company reports the following transactions relating to its stock accounts in the current year. Use the financial statement effects template to indicate the effects from each of these transactions.(a) Mar. 2 Issued 7,000 shares of $1 par value common stock at $30 cash per share.(b) Apr. 14 Issued 10,500 shares of $100 par value, 8% preferred stock at $250 cash per share.(c) June. 30 Purchased 2,100 shares of its own common stock at $22 cash per share.(d) Sep. 25 Sold 1,050 shares of its treasury stock at $26 cash per share.Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction.Note: Indicate a decrease in an account category by including a negative sign with the amount.arrow_forward) Calculate the weighted average number of shares for the following Shares outstanding 100,000 Date Shares changes Beginning balance 20,000 shares issued 50% stock dividend 50,000 shares issued 1Jan-07 120,000 180,000 230,000 230,000 1-Apr-07 1.Jun-07 1-0ct-07 31-Dec-07 Year end balancearrow_forwardDividends Per Share Windborn Company has 30,000 shares of cumulative preferred 1% stock, $150 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 18,000 135,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y3 20Y1 20Y2 20Y3 $112,500 Preferred Stock (dividends per share) G LA Common Stock (dividends per share) U Sarrow_forward

- A company had stock outstanding as follows during each of its first three years of operations: 4,000 shares of 9%, $100 par, cumulative preferred stock and 37,000 shares of $10 par common stock. The amounts distributed as dividends follow. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. Round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $27,000 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2 36,000 $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 $fill in the blank 8 3 55,880 $fill in the blank 9 $fill in the blank 10 $fill in the blank 11 $fill in the blank 12arrow_forwardDividends Per Share Oceanic Company has 30,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: 20Y1 $60,000 20Y2 12,000 20Y3 90,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock(dividends per share) Common Stock(dividends per share) 20Y1 $fill in the blank 1 $fill in the blank 2 20Y2 $fill in the blank 3 $fill in the blank 4 20Y3 $fill in the blank 5 $fill in the blank 6arrow_forwardDividends per share Windborn Company has 10,000 shares of cumulative preferred 1% stock, $50 par and 50,000 shares of $20 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock Common Stock (dividends per share) (dividends per share) 0. X 20Y1 20Y2 20Y3 Feedback $7,500 4,000 15,000 Check My Work 0.50 0.40 0.60 0.00 0.18 marrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education