Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

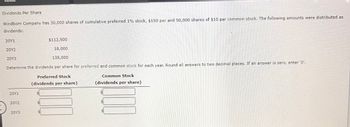

Transcribed Image Text:Dividends Per Share

Windborn Company has 30,000 shares of cumulative preferred 1% stock, $150 par and 50,000 shares of $10 par common stock. The following amounts were distributed as

dividends:

20Y1

20Y2

18,000

135,000

Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'.

20Y3

20Y1

20Y2

20Y3

$112,500

Preferred Stock

(dividends per share)

G

LA

Common Stock

(dividends per share)

U

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardGiven the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows: A. Issued 15,000 shares of 20 par common stock at 30, receiving cash. B. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. C. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. D. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. E. Paid the cash dividends declared in (D). F. Purchased 8,000 shares of treasury common stock at 33 per share. G. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. H. Paid the cash dividends to the preferred stockholders. I. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (F). J. Recorded the payment of semiannual interest on the bonds issued in (C) and the amortization of the premium for six months. The amortization is determined using the straight-line method. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 20Y8, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follow were taken from the records of Equinox Products Inc. Income statement data: Advertising expense 150,000 Cost of goods sold 3,700,000 Delivery expense 30,000 Depreciation expenseoffice buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Income tax expense 140,500 Interest expense 21,000 Interest revenue 30,000 Miscellaneous administrative expense 7,500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,313,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Bonds payable, 5%, due in 10 years 500,000 Cash 282,850 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued, 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 700,000 Income tax payable 44,000 Interest receivable 1,200 Inventory (December 31, 20Y8),at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock, 80 par (30,000 shares authorized; 20,000 shares issued) 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 20Y8 8,197,220 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 A. Prepare a multiple-step income statement for the year ended December 31, 20Y8. B. Prepare a retained earnings statement for the year ended December 31, 20Y8. C. Prepare a balance sheet in report form as of December 31, 20Y8.arrow_forward

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardErrol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?arrow_forwardCOMMON AND PREFERRED CASH DIVIDENDS Ramirez Company currently has 100,000 shares of 1 par common stock outstanding and 5,000 shares of 50 par preferred stock outstanding. On July 10, the board of directors declared a semiannual dividend of 0.30 per share on common stock to shareholders of record on August 1, payable on August 5. On July 15, the board of directors declared a semiannual dividend of 5 per share on preferred stock to shareholders of record on August 5, payable on August 10. Prepare journal entries for the declaration and payment of the common and preferred stock cash dividends.arrow_forward

- Dividends Per Share Windborn Company has 20,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: 20Y1 $30,00020Y2 16,00020Y3 60,000Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock(dividends per share) Common Stock (dividends per share)20Y1 $fill in the blank 1$fill in the blank 220Y2 $fill in the blank 3$fill in the blank 420Y3 $fill in the blank 5$fill in the blank 6arrow_forwardWindborn Company has 30,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: 20Y1 $75,000 20Y2 15,000 20Y3 90,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'.arrow_forwardDividends Per Share Windborn Company has 20,000 shares of cumulative preferred 1% stock, $50 par and 50,00 shares of $15 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y1 20Y2 $20,000 4,000 30,000 20Y3 Preferred Stock (dividends per share) Common Stock (dividends per share) $arrow_forward

- Dividends Per Share Seacrest Company has 10,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y1 20Y2 20Y3 $20,000 5,000 30,000 Preferred Stock (dividends per share) $ $ 1 0.50 1.50 Common Stock (dividends per share) $ 0.2 0 0.49 Xarrow_forwardWindborn Company has 25,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y1 20Y2 20Y3 $75,000 30,000 112,500 Preferred Stock (dividends per share) $ Common Stock (dividends per share) 0arrow_forwardSandpiper Company has 25,000 shares of cumulative preferred 3% stock, $100 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y1 20Y2 $187,500 60,000 225,000 20Y3 Preferred Stock (dividends per share) Common Stock (dividends per share)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College