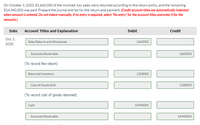

Sweet Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30% of an order at the retailer’s expense. Sales are made only to retailers who have good credit ratings. Past experience indicates that the normal return rate is 12%. The costs of recovery are expected to be immaterial, and the textbooks are expected to be resold at a profit.

Assume Sweet prepares financial statements on October 31, 2020, the close of the fiscal year. No other returns are anticipated. Indicate the amounts reported on the income statement and balance related to the above transactions.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- ramon hernandez saw the following advertisement for a used volkswagen bug and decided to work out the numbers to be sure the ad had no errors. cash price $7,880 down payment $0 annual percentage rate 14.53% deferred price $11,131.80 or 60 payments at $185.53 per month a. calculate the amount financed: $7,880 b. calculate the finance charge. (round your answer to the nearest cent.): $3,251.80 c. calculate the apr by table lookup. (use table 14.1(b).) (round your answers to 2 decimal places.): 14.50% to 14.75% d. calculate the monthly payment by formula. (round your answer to the nearest cent.): ?? Calculate the monthly payment by table lookup at 14.50% (Use table 14.2 round your answer to the nearest cent): ??arrow_forwardKMW Incorporated sells finance textbooks for $166 each. The variable cost per book is $46 and the fixed cost per year is $31, 600. The process of creating a textbook costs $166,000 and the average book has a life span of three years. What is the economic or NPV break-even number of books that must be sold each year given a discount rate of 12 percent? Multiple Choice 260 225 839 304arrow_forwardYou sell $5 million dollars' worth of delivery trucks to Walmart on account and offer them a 2% discount if they pay within 15 days, with the invoice due after 45 days (2/15, n/45). Unfortunately, Walmart returns all of the trucks after one week because they discover that the model you sold them is not approved for use in California. Which of the following is part of the correct journal entry to make at the time that Walmart returns the trucks? DEBIT to Sales Returns of $5 million CREDIT to Sales Discount of $100,000 CREDIT to Accounts Receivable of $4.9 million CREDIT to Sales Revenue of $5 millionarrow_forward

- CIA Review, Inc. provides review courses twice each year for students studying to take the CIA exam. The cost of textbooks is included in the registration fee. Text material requires constant updating and is useful for only one course. To minimize printing costs and ensure the availability of books on the first day of class, CIA Review has books printed and delivered to its offices two weeks in advance of the first class. To ensure that enough books are available, CIA Review normally orders 10 percent more than expected enrollment. Usually, there is an oversupply, and books are thrown away. However, demand occasionally exceeds expectations by more than 10 percent and there are too few books available for student use CIA Review has been forced to turn away students because of a lack of textbooks. CIA Review expects to enroll approximately 200 students per course. The tuition fee is $810 per student. The cost of teachers is $22,000 per course, textbooks cost $59 each, and other operating…arrow_forwardGolden Gate Novelties (GGN) sells souvenir key chains at the local airport. GGN charges $12.00 per chain. The variable cost for a chain, including the wholesale cost of the chain, packaging, the commission paid to the airport operator, and so on, is $10.40. The annual fixed cost for GGN is $15,000. Required: a. How many cases must Golden Gate Novelties sell every year to break even? Note: Do not round intermediate calculations. b. The owner of GGN believes that the company can sell 12,500 chains a year. What is the margin of safety in terms of the number of chains? a. Break-even point b. Margin of safety chains chainsarrow_forwardOHaganBooks.com generates revenue through it o'Books e-book service. Author royalties and copyright fees cost the company $5 per novel, and the monthly cost of operating and maintaining the service amounts to $446. The company is currently charging customers $8 per novel. Find the associated cost, revenue, and profit functions and use them to determine how many novels must be sold in order to make a profit. (Hint: If the break-even is where they make no profit, you must round up to make a profit.) To make a profit they must sell at least:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education