Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

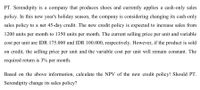

Transcribed Image Text:PT. Serendipity is a company that produces shoes and currently applies a cash-only sales

policy. In this new year's holiday season, the company is considering changing its cash-only

sales policy to a net 45-day credit. The new credit policy is expected to increase sales from

1200 units per month to 1350 units per month. The current selling price per unit and variable

cost per unit are IDR 175.000 and IDR 100.000, respectively. However, if the product is sold

on credit, the selling price per unit and the variable cost per unit will remain constant. The

required return is 3% per month.

Based on the above information, calculate the NPV of the new credit policy! Should PT.

Serendipity change its sales policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Equate Inc. sells products with a cost of $25,000 during the year to customer for $55,000. It is Equate’s policy to accept returns up to 60 days after the date of purchase. Equate estimates that there is a 60% probability that returns will be 3% of sales and a 40% probability that returns will be 2.5% of sales. What is the transaction price under a) expected value method b) most likely amount method? Choices: A: $53,460 B: $53,350 A: $53,350 B: $53,460 A: $53,460 B: $54,450 A: $54,450 B: $53,460 A: $53,350 B: $53,350arrow_forwardLarkspur Inc. sells prepaid telephone cards to customers. Larkspur then pays the telecommunications company, TeleExpress, for the actual use of its telephone lines related to the prepaid telephone cards. Assume that Larkspur sells $5,700 of prepaid cards in January 2020. It then pays TeleExpress based on usage, which turns out to be 50% in February, 30% in March, and 20% in April. The total payment by Larkspur for TeleExpress lines over the three months is $2,100. Indicate how much income Larkspur should recognize in January, February, March, and April under IFRS. (Do not leave any answer field blank. Enter O for amounts.) Month Income January $ February $ March 2$ April 2$arrow_forwardSaucier & Co. currently sells 1,400 units a month for total monthly sales of $98,500. The company is considering replacing its current cash only credit policy with a net 30 policy. The variable cost per unit is $18 and the monthly interest rate is 1.1 percent. What is the switch break-even level of sales? Assume the selling price per unit and the variable costs per unit remain constant. A. 1,743 units B. 1,467 units C. 1,421 units D. 1,406 units E. 1,548 unitsarrow_forward

- ABC Office Furniture sells its primary product, an office chair, at R150 per unit. Total credit sales for the previous financial year were 4 000 units. The variable cost to manufacture one chair is R60 and the total fixed costs for the year are R80 000. The entity’s credit terms are 2/10 net 45 and it is considering tightening its credit standards to 3/7 net 30. This is expected to result in a 5% decrease in sales, but bad debt is expected to decrease from 2% of credit sales to 1%. The average collection period is expected to decrease from the current 45 days to 30 days. In the past, 20% of debtors accepted the discount. This percentage is not expected to change. The entity’s cost of capital is 14%. Assume 365 days per year. To calculate the effect of the tightening of credit standards, the entity needs to calculate the following: ■ the profit loss or gain from a decrease or an increase in sales ■ the cost of the marginal investment in accounts receivable ■ the cost of marginal bad…arrow_forwardDetermine the monthly break-even in total dollar sales.arrow_forwardPlease helparrow_forward

- Ayayai Inc. sells prepaid telephone cards to customers. Ayayai then pays the telecommunications company, TeleExpress, for the actual use of its telephone lines related to the prepaid telephone cards. Assume that Ayayai sells $4,100 of prepaid cards in January 2020. It then pays TeleExpress based on usage, which turns out to be 55% in February, 25% in March, and 20% in April. The total payment by Ayayai for TeleExpress lines over the 3 months is $3,000.Indicate how much income Ayayai should recognize in January, February, March, and April. (If answer is 0, please enter 0. Do not leave any fields blank.) January income February income March income April incomearrow_forwardRegency Rug Repair Company is trying to decide whether it should relax its credit standards. The firm repairs 72,000 rugs per year at an average price of $32 each. Bad-debt expenses are 1% of sales, the average collection period is 40 days, and the variable cost per unit is $28. Regency expects that if it does relax its credit standards, the average collection period will increase to 48 days and that bad debts will increase to 1.5% of sales. Sales will increase by 4,000 repairs per year. If the firm has a required rate of return on equal-risk investments of 14%, what recommendation would you give the firm? Use your analysis to justify your answer. (Note: Use a 365-day year.)arrow_forwardLevi Strauss has some of its jeans stone - washed under a contract with independent U.S. Garment Corp. If U.S. Garment's operating cost per machine is $22,000 for year 1 and then it increases by 8% per year through year 10, what is the equivalent uniform annual cost per machine (years 1-10) at an interest rate of 10% per year? The correct answer to this problem is $30, 012, but i need help working out the steps to get there.arrow_forward

- Gardner Company currently makes all sales on credit and offers no cash discount. The firm is considering offering a 2 2% cash discount for payment within 15 days. The firm's current average collection period is 60 60 days, sales are 40 comma 000 40,000units, selling price is $ 45 45 per unit, and variable cost per unit is $ 36 36. The firm expects that the change in credit terms will result in an increase in sales to 42 comma 000 42,000 units, that 70 70% of the sales will take the discount, and that the average collection period will fall to 30 30 days. If the firm's required rate of return on equal-risk investments is 25 25%, should the proposed discount be offered? (Note: Assume a365-day year.)arrow_forwardI only need an answer to question 1, had previously asked this question and the answer I was given is incorrect, see attachmentarrow_forwardSHOW YOUR SOLUTION IN GOOD ACCOUNTING FORM. THANK YOU A company sells its product at P30 per unit.Unit variable cost is P22 and total fixed coststotal to P100,000 per month. The companycurrently pays salaries of P40,000 per monthbut with no commission. It is considering acompensation plan whereby the salespeoplewould receive 5% commission based onsales, but their salaries would be decreasedto P25,000 per month. At what sales level isthe company indifferent between the twocompensation plans?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education