FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate the equivalent units of direct materials and conversion during May. Use the FIFO method.

Equivalent

Units

Direct Materials

Conversion

< Required 1

Required 2 >

Required 1 Required 2

Calculate the cost per equivalent unit for both direct materials and conversion during May. Use the FIFO method. (Round your

answers to 2 decimal places.)

Direct Materials

Conversion

Costs per

Equivalent Unit

< Required 1

Required 2 >

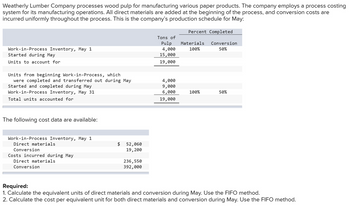

Transcribed Image Text:Weatherly Lumber Company processes wood pulp for manufacturing various paper products. The company employs a process costing

system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are

incurred uniformly throughout the process. This is the company's production schedule for May:

Work-in-Process Inventory, May 1

Started during May

Units to account for

Units from beginning Work-in-Process, which

were completed and transferred out during May

Started and completed during May

Work-in-Process Inventory, May 31

Total units accounted for

The following cost data are available:

Work-in-Process Inventory, May 1

Direct materials

Conversion

Costs incurred during May

Direct materials

Conversion

$

52,060

19, 200

236,550

392,000

Tons of

Pulp

4,000

15,000

19,000

4,000

9,000

6,000

19,000

Percent Completed

Materials Conversion

100%

50%

100%

50%

Required:

1. Calculate the equivalent units of direct materials and conversion during May. Use the FIFO method.

2. Calculate the cost per equivalent unit for both direct materials and conversion during May. Use the FIFO method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Longboard Company has a process costing system. All materials are introduced at the beginning of the process in Department One. The following information is available for the month of January Work in process, July 1 (408 complete for conversion) Started Completed and transferred to Department 2 Work in process, July 31 (60% complete for conversion) What are the equivalent units for the month of July if the company uses the FIFO method? Multiple Choice Materials 2.280 and Conversion 1.900 O Materials 2,280 and Conversion 1.936 Materials 2.280 and Conversion 2.088 Materies 1,900 and Conversion 1936 Units Male 1900 and Conversion 2.08 380 1,900 1,800 480arrow_forwardin detailsarrow_forwardThe following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $35,700 of direct materials. ACCOUNT Work in Process-Forging Department Date Nov. Item 1 Bal., 3,400 units, 60% completed 30 Direct materials, 31,000 units 30 Direct labor 30 Factory overhead 30 Goods finished, 2 units 30 Bal., 2,700 units, 80% completed LA Debit 316,200 33,410 46,140 Credit ? ACCOUNT NO. Balance Debit Credit 40,596 356,796 390,206 436,346 ? ? a. Determine the number of units transferred to the next department. units b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of conversion c. Determine the cost of units started and completed in November.arrow_forward

- The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Date Item August 1 Bal., 9,000 units, 2/5 completed 31 Direct materials, 162,000 units 31 Direct labor 31 Factory overhead 31 Goods finished, 164,100 units 31 Bal., ? units, 2/5 completed Debit Credit Line Item Description Inventory in process, August 1 Started and completed in August Transferred to finished goods in August Inventory in process, August 31 Total 226,800 62,690 35,266 328,560 Balance Balance Debit Credit a. Determine the number of units in work in process inventory at August 31. units 15,120 241,920 304,610 339,876 11,316 11,316 b. Determine the equivalent units of production for direct materials and conversion costs in August. If an amount is zero, enter in "0". Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs For August…arrow_forwardWeatherly Lumber Company processes wood pulp for manufacturing various paper products. The company employs a process costing system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. This is the company's production schedule for May: Tons of Pulp Percent Completed Materials Conversion Work-in-Process Inventory, May 1 5,000 100% 50% Started during May 14,000 Units to account for 19,000 Units from beginning Work-in-Process, which were completed and transferred out during May 5,000 Started and completed during May 8,400 5,600 100% 50% 19,000 Work-in-Process Inventory, May 31 Total units accounted for The following cost data are available: Work-in-Process Inventory, May 1 Direct materials Conversion Costs incurred during May Direct materials Conversion Required: $ 74,920 68,756 210,840 409,630 1. Calculate the equivalent units of direct materials and conversion during May. Use…arrow_forwardCarlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department started 12,300 units during November. The following production activity in both units and costs refers to the Assembly department's November activities. Assembly Department Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Cost of beginning work in process Direct materials Conversion Costs added this month Direct materials Conversion Beginning work in process To complete beginning work in process Direct materials Conversion Started and completed Direct materials Conversion Completed and transferred out Ending work in process Direct materials Conversion Units 3,200 12,300 10, 200 5,300 Total costs accounted for Percent Complete for Direct Materials 75% $ 1,143 624 1,143 13,827 17,856 CARLBERG COMPANY Cost assignment-FIFO EUP Assign costs to the Assembly department's output-specifically, the units transferred…arrow_forward

- Carlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department started 12,200 units during November. The following production activity in both units and costs refers to the Assembly department's November activities. Assembly Department Beginning work in process inventory. Units started this period Units completed and transferred out Ending work in process inventory Cost of beginning work in process Direct materials Conversion Costs added this month Direct materials Conversion Cost per Equivalent Unit of Production Costs added this period Costs of beginning work in process Total costs + Equivalent units of production Cost per equivalent unit of production Units 3,000 12,200 10,000 5,200 Direct Materials $ Percent. Complete for Direct Materials 70% $ 1,484 804 12,936 16,926 85% Calculate the Assembly department's cost per equivalent unit of production for materials and for conversion for November. Use the weighted average method. 1,484 1,484 $ $ 2,288…arrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Date Item August 1 Bal., 9,000 units, 2/5 completed 31 Direct materials, 162,000 units 31 Direct labor 31 Factory overhead 31 Goods finished, 164,100 units 31 Bal., ? units, 4/5 completed Line Item Description Inventory in process, August 1 Started and completed in August Transferred to finished goods in August Inventory in process, August 31 Total Debit Credit 275,400 74,380 41,834 a. Determine the number of units in work in process inventory at August 31. units 2002 394,380 b. Determine the equivalent units of production for direct materials and conversion costs in August. If an amount is zero, enter in "0". Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs For August Whole Units Balance Balance Debit Credit 18,360 293,760 368,140…arrow_forwardThe following information concerns production in the Forging Department for June. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $18,000 of direct materials. ACCOUNT Work in Process-Forging Department Debit Credit Date Item June 1 Bal., 1,800 units, 60% completed 30 Direct materials, 25,800 units 30 Direct labor 30 Factory overhead 30 Goods transferred, ? units 30 Bal., 2,800 units, 70% completed Cost per equivalent units of $9.60 for Direct Materials and $3.00 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in June $ 247,680 43,300 33,740 b. Cost of units transferred to the next department during June $ c. Cost of ending work in process…arrow_forward

- Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forwardElliott Company produces large quantities of a standardized product. The following information is available for the first process in its production activities for March. Units Costs Beginning work in process inventory Started 3,000 Beginning work in process inventory 30,000 Direct materials $ 3,180 Ending work in process inventory 6,000 Conversion 13,896 status of ending work in process inventory Direct materials added Materials-Percent complete Direct labor added $ 17,076 212,310 170,910 239,274 $639,570 Conversion-Percent complete Overhead applied (140% of direct labor) Total costs to account for Ending work in process inventory $ 61,500 Prepare a process cost summary report for this process using the weighted-average method. (Round "Cost per EUP" to 2 decimal places.) Total Costs to Account for: Total costs to account for: $ 0 Total costs accounted for $ 0 Difference due to rounding cost/unit Unit Reconciliation: *********** *********** OLO 100% 25% 5 of 5 یarrow_forwardWeatherly Lumber Company processes wood pulp for manufacturing various paper products. The company employs a process costing system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. This is the company’s production schedule for May: Tons of Pulp Percent Completed Materials Conversion Work-in-Process Inventory, May 1 5,000 100% 50% Started during May 15,000 Units to account for 20,000 Units from beginning Work-in-Process, which were completed and transferred out during May 5,000 Started and completed during May 12,000 Work-in-Process Inventory, May 31 3,000 100% 50% Total units accounted for 20,000 The following cost data are available: Work-in-Process Inventory, May 1 Direct materials $ 94,000 Conversion 133,120 Costs incurred during May Direct materials 229,800 Conversion 376,000 Required: 1. Calculate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Expert Answers to Latest Homework Questions

Q: BoAt Company had no beginning inventory and adds all materials at the very beginning of its only…

Q: Variable manufacturing overhead is applied to products on the basis of

standard direct labor-hours.…

Q: What is Nicole 's total stockholder equity?

Q: Please answer the general accounting question

Q: help in general account answer

Q: Assemblers at Schweitzer Engineering are categorized as:

a. Product and direct material costs.

b.…

Q: The representation of a one-dimensional velocity distribution function for a gas, with increasing…

Q: Do fast answer of this general accounting question

Q: Need help this question general accounting

Q: Financial Accounting

Q: Step by step answer to this accounting problem

Q: General Accounting

Q: Ashton Enterprises has net working capital of... Please need answer the general accounting question

Q: Solution to this accounting problem

Q: FInd Accounting answer

Q: Question

Q: Teller Co. is planning to sell 900 boxes of ceramic tile, with production

estimated at 870 boxes…

Q: Please give me correct answer the accounting question

Q: What is the result of this disposal transaction on these general accounting question?

Q: The direct labor price variance?

Q: Production estimates for July for Starling Co. are as follows:

Estimated inventory (units), July 1…