FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

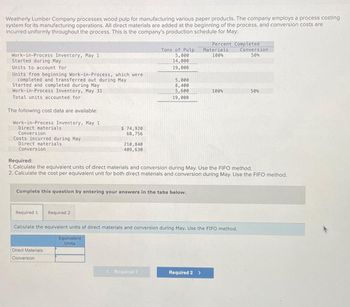

Transcribed Image Text:Weatherly Lumber Company processes wood pulp for manufacturing various paper products. The company employs a process costing

system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are

incurred uniformly throughout the process. This is the company's production schedule for May:

Tons of Pulp

Percent Completed

Materials

Conversion

Work-in-Process Inventory, May 1

5,000

100%

50%

Started during May

14,000

Units to account for

19,000

Units from beginning Work-in-Process, which were

completed and transferred out during May

5,000

Started and completed during May

8,400

5,600

100%

50%

19,000

Work-in-Process Inventory, May 31

Total units accounted for

The following cost data are available:

Work-in-Process Inventory, May 1

Direct materials

Conversion

Costs incurred during May

Direct materials

Conversion

Required:

$ 74,920

68,756

210,840

409,630

1. Calculate the equivalent units of direct materials and conversion during May. Use the FIFO method.

2. Calculate the cost per equivalent unit for both direct materials and conversion during May. Use the FIFO method.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Calculate the equivalent units of direct materials and conversion during May. Use the FIFO method.

Direct Materials

Conversion

Equivalent

Units

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forward1. The number of units in work in process inventory at the end of the period. 2. Equivalent units of production for direct materials and conversion 3. Costs per equivalent unit for direct materials and conversion. 4. Cost of the units started and completed during the period.arrow_forwardRequired information [The following information applies to the questions displayed below.] The first production department of Stone Incorporated reports the following for April. Beginning work in process inventory Units started this period Completed and transferred out. Ending work in process inventory Beginning work in process inventory Direct materials Units The production department had the cost information below. Conversion Costs added this period Direct materials Conversion Total costs to account for 60,000 322,000 300,000 82,000 $ 118,472 48,594 850,368 649,296 Direct Materials Conversion Percent Complete 60% 80% $ 167,066 1,499,664 $1,666,730 a. Compute cost per equivalent unit for both direct materials and conversion. Note: Round "Cost per EUP" to 2 decimal places. Percent Complete 40% 30%arrow_forward

- . . Exercise 8-39 (Algo) Compute Costs per Equivalent Unit: FIFO Method (LO 8-2, 5) . The following cost information is available for July for the Crest Plant at Calvert Company: Beginning work-in-process inventory Materials cost Conversion cost Total Current costs Materials cost Conversion cost Total Materials are added at the beginning of the process. The following quantities have been recorded: Beginning inventory, 49,500 partially complete gallons, 15 percent complete with respect to conversion costs. Units started in July, 89,500 gallons. . Units transferred out in July, 99,500 gallons. Ending inventory, 39,500 gallons, 65 percent complete with respect to conversion costs. $ 65,500 44,500 $ 110,000 Direct Materials Conversion Costs $ 215,000 465,000 $ 680,000 Required: Compute the cost per equivalent unit for direct materials and for conversion costs for July using the FIFO method. Note: Round your answers to 2 decimal places. Cost per Equivalent Unitarrow_forwardI need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forward4. Requirement 1. Compute the equivalent units of production for direct materials and for conversion costs for the mixing Department. Complete the partial production cost report below for the mixing Department, showing the equivalent units of production for direct materials and for conversion costs.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education