Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

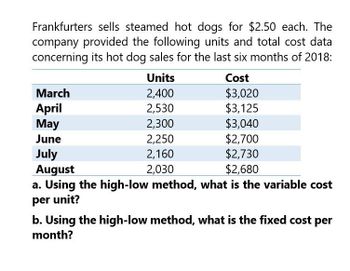

Transcribed Image Text:Frankfurters sells steamed hot dogs for $2.50 each. The

company provided the following units and total cost data

concerning its hot dog sales for the last six months of 2018:

Units

Cost

March

2,400

$3,020

April

2,530

$3,125

May

2,300

$3,040

June

2,250

$2,700

July

2,160

$2,730

August

2,030

$2,680

a. Using the high-low method, what is the variable cost

per unit?

b. Using the high-low method, what is the fixed cost per

month?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TJ's Cheese Cake Factory, Inc. sells original cheese cake for $16 each. The company provided the following units and total cost data concerning its cake sales for each month during 2011: Cost a. b. January February March C. d. April May June July August September October November December 55,000 59,000 60,000 64,000 67,000 71,000 74,000 77,000 75,000 68,000 62,000 73,000 Units 2,500 2,800 3,000 4,200 4,500 5,500 Use the linear regression method to estimate fixed and variable costs. Interpret and evaluate your regression model and results. Write out the cost formula. Estimate total costs in a month when 6,000 cakes are produced and sold. Estimate total profit in a month when 6,000 cakes are produced and sold. e. You are working on the budget for October 2012 and expect 10,000 cakes will be produced and sold. Estimate total costs in a month when 10,000 cakes are produced and sold. Will you use the estimated cost in your budget? Why? f. How does linear regression differ from the high-low…arrow_forwardOriole Industries produces and sells a cell phone-operated home security control systems. Information regarding the costs and sales during May 2022 is as follows. Unit selling price Unit variable costs Total monthly fixed costs Units sold $55.00 $31.90 $125,000 8,300 Prepare a CVP income statement for Oriole Industries for the month of May. (Round per unit answers to 2 decimal places, e.g. 15.25.) Oriole Industries CVP Income Statement $ $ Total $ $ Per Unit Percent of Sales % % %arrow_forwardCorp uses the LIFO method. Using the information provided, what is the unit cost of the 17 units remaining in inventory at month end?. Beginning of the month: 30 units of Product BN4, each costing $14. Week 1: Buys 12 units for $15 each • Week 2: Buys 20 units for $16 each Week 4: Sells 45 units for $32 each Answer: A. $14 B. $15 C. $16 D. $32arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPlease calculate the operating income then calculate the per unit amounts in the chart.arrow_forwardPlease provide this question solution general Accountingarrow_forward

- Crane Industries produces and sells a cell phone-operated home security control systems. Information regarding the costs and sales during May 2022 is as follows. Unit selling price $45.00 Unit variable costs $25.20 Total monthly fixed costs $124,000 Units sold 8,400 Prepare a CVP income statement for Crane Industries for the month of May. (Round per unit answers to 2 decimal places, e.g. 15.25.)arrow_forward1arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]Shadee Corp. expects to sell 650 sun visors in May and 420 in June. Each visor sells for $17. Shadee’s beginning and ending finished goods inventories for May are 85 and 55 units, respectively. Ending finished goods inventory for June will be 55 units. Suppose that each visor takes 0.50 direct labor hours to produce and Shadee pays its workers $7 per hour.Required:Determine Shadee's budgeted direct labor cost for May and June. (Do not round your intermediate values. Round your answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College