FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

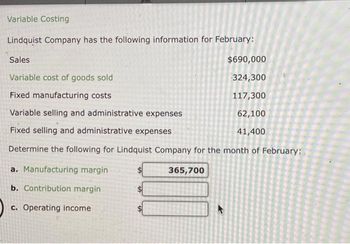

Transcribed Image Text:Variable Costing

Lindquist Company has the following information for February:

Sales

$690,000

Variable cost of goods sold

324,300

Fixed manufacturing costs

117,300

Variable selling and administrative expenses

62,100

Fixed selling and administrative expenses

41,400

Determine the following for Lindquist Company for the month of February:

a. Manufacturing margin

b. Contribution margin

c. Operating income

365,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give image formatarrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense The total gross margin for the month under absorption costing is: Multiple Choice $81,900 $21,840 $128,430 $139,230 $ 144 0 3,020 2,730 290 $ 47 $21 $ 16 $9 $90,600 $35,490arrow_forwardThe following data is for a company that produces a single product. Selling price 193 Units in beginning inventory Units produced 3,090 2,910 Units sold Variable costs per unit: Direct materials 53 Direct labor 59 2$ Variable manufacturing overhead Variable selling and administrative expense 15 13 Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ 89,610 $ 8,730 Required: a. What is the unit product cost for the month under variable costing? b. What is the unit product cost for the month under absorption costing? c. Prepare a contribution format income statement for the month using variable costing. d. Prepare an income statement for the month using absorption costing. e. Reconcile the variable costing and absorption costing net operating incomes for the month. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E What is the unit product cost for the month under variable costing? Cost Per…arrow_forward

- Give me answer for this questionarrow_forwardAbsorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 29,300 hats, of which 27,800 were sold. Operating data for the month are summarized as follows: Sales $177,920 Manufacturing costs: Direct materials $105,480 Direct labor 29,300 Variable manufacturing cost 11,720 Fixed manufacturing cost 11,720 158,220 Selling and administrative expenses: Variable $8,340 Fixed 6,090 14,430 During August, Head Gear Inc. manufactured 26,300 hats and sold 27,800 hats. Operating data for August are summarized as follows: Sales $177,920 Manufacturing costs: Direct materials $94,680 Direct labor 26,300 Variable manufacturing cost 10,520 Fixed manufacturing cost 11,720 143,220 Selling and administrative expenses: Variable $8,340 Fixed 6,090 14,430 Required: 1a. Prepare income…arrow_forwardCost of Goods Manufactured, using Variable Costing and Absorption Costing On March 31, the end of the first month of operations, Barnard Inc. manufactured 15,000 units and sold 12,000 units. The following income statement was prepared, based on the variable costing concept: Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Sales $2,160,000 Variable cost of goods sold: Variable cost of goods manufactured $1,620,000 Inventory, March 31 (324,000) Total variable cost of goods sold (1,296,000) Manufacturing margin $864,000 Total variable selling and administrative expenses (96,000) Contribution margin $768,000 Fixed costs: Fixed manufacturing costs $210,000 Fixed selling and administrative expenses 45,000 Total fixed costs (255,000) $513,000 Operating income Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.arrow_forward

- Variable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (6, 100 units) $201, 300 Cost of goods sold: Cost of goods manufactured (7, 100 units) $163,300 Inventory, April 30 (1,000 units) (23,000) Total cost of goods sold (140, 300) Gross profit $61,000 Selling and administrative expenses (36,830) Operating income $24, 170 If the fixed manufacturing costs were $ 44,091 and the fixed selling and administrative expenses were $18, 040, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 $Sales Variable cost of goods sold: $- Select - - Select - - Select - $- Select - - Select - $ - Select - Fixed costs: $Variable cost of goods sold Fixed…arrow_forwardMarley Company has the following information for March: Sales $912,000 Variable cost of goods sold 474,000 Fixed manufacturing costs 82,000 Variable selling and administrative expenses 238,100 Fixed selling and administrative expenses 54,700 Determine the following for Marley Company for the month of March: a. Manufacturing margin $fill in the blank 1 b. Contribution margin $fill in the blank 2 c. Operating income $fill in the blank 3arrow_forwardA manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense 154 2,560 2,230 330 51 24 $. 15 16 $92,160 $11,150 The tegross margin for the month under absorption costing is: Multiple Chotce $62.440 S15.610, K Prev 4: of 10 Next > ere to searcharrow_forward

- Franklin Modems, Inc. makes modem cards that are used In notebook computers. The company completed the following transactions during year 1. All purchases and sales were made with cash. 1. Acquired $820,000 of cash from the owners. 2. Purchased $305,900 of manufacturing equipment. The equipment has a $37,000 salvage value and a four-year useful life. 3. The company started and completed 5,700 modems. Direct materials purchased and used amounted to $47 per unit. 4. Direct labor costs amounted to $32 per unit. 5. The cost of manufacturing supplies used amounted to $11 per unit. 6. The company paid $57,800 to rent the manufacturing facility. 7. Franklin sold all 5,70e units at a cash price of $155 per unit. 8. The sales staff was paid a $9.50 per unit sales commission. 9. Paid $46,eee to purchase equipment for administrative offices. The equipment was expected to have a $3,700 salvage value and a three-year useful life. 10. Administrative expenses consisting of office rental and salaries…arrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (5,600 units) Cost of goods sold: Cost of goods manufactured (6,600 units) Inventory, April 30 (900 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Variable cost of goods sold: $138,600 (18,900) Fixed costs: $162,400 If the fixed manufacturing costs were $30,492 and the fixed selling and administrative expenses were $12,600, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 (119,700) $42,700 (25,720) $16,980arrow_forward5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education