FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

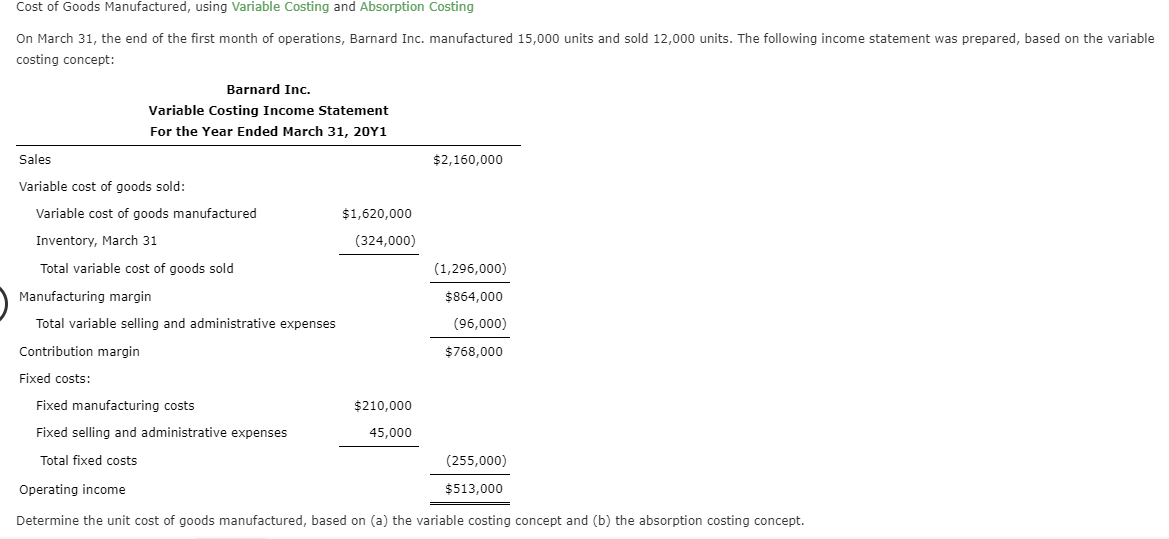

Transcribed Image Text:Cost of Goods Manufactured, using Variable Costing and Absorption Costing

On March 31, the end of the first month of operations, Barnard Inc. manufactured 15,000 units and sold 12,000 units. The following income statement was prepared, based on the variable

costing concept:

Barnard Inc.

Variable Costing Income Statement

For the Year Ended March 31, 20Y1

Sales

$2,160,000

Variable cost of goods sold:

Variable cost of goods manufactured

$1,620,000

Inventory, March 31

(324,000)

Total variable cost of goods sold

(1,296,000)

Manufacturing margin

$864,000

Total variable selling and administrative expenses

(96,000)

Contribution margin

$768,000

Fixed costs:

Fixed manufacturing costs

$210,000

Fixed selling and administrative expenses

45,000

Total fixed costs

(255,000)

$513,000

Operating income

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardh9arrow_forwardOn November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: Weatherford Company Absorption Costing Income Statement For the Month Ended November 30 Sales (6,100 units) Cost of goods sold: Cost of goods manufactured (7,000 units) Inventory, November 30 (1,000 units) Total cost of goods sold Gross profit $161,000 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, November 30 (23,000) $201,300 138,000 $63,300 Selling and administrative expenses 35,910 Income from operations $27,390 Assume the fixed manufacturing costs were $38,640 and the fixed selling and administrative expenses were $17,590 Prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Weatherford Company Variable Costing Income Statement For the Month Ended November 30 201,300arrow_forward

- Give true answerarrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin CompanyAbsorption Costing Income StatementFor the Month Ended April 30 Sales (6,600 units) $178,200 Cost of goods sold: Cost of goods manufactured (7,700 units) $146,300 Inventory, April 30 (1,100 units) (20,900) Total cost of goods sold (125,400) Gross profit $52,800 Selling and administrative expenses (32,280) Operating income $20,520 If the fixed manufacturing costs were $39,501 and the fixed selling and administrative expenses were $15,810, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin CompanyVariable Costing Income StatementFor the Month Ended April 30 $Sales Variable cost of goods sold: $Variable cost of goods manufactured…arrow_forwardProvide correct solutionarrow_forward

- On October 31, the end of the first month of operations, Maryville Equipment Company pre- pared the following income statement, based on the variable costing concept: Maryville Equipment Company Variable Costing Income Statement For the Month Ended October 31 Sales (220,000 units).... $ 7,920,000 Variable cost of goods sold: Variable cost of goods manufactured . Inventory, October 31 (45,000 units) .. Total variable cost of goods sold... Manufacturing margin....... Variable selling and administrative expenses $ 6,360,000 (1,080,000) (5,280,000) $ 2,640,000 (330,000) $ 2,310,000 Contribution margin... Fixed costs: Fixed manufacturing costs ... Fixed selling and administrative expenses.. $ 530,000 100,000 Total fixed costs.... (630,000) $ 1,680,000 Operating income... Prepare an income statement under absorption costing.arrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Jopl Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (4,600 units) Cost of goods sold: Cost of goods manufactured (5,200 units) Inventory, April 30 (700 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Joplin Company Variable Costing Income Statement For the Month Ended April 30 Variable cost of goods sold: If the fixed manufacturing costs were $29,484 and the fixed selling and administrative expenses were $12,590, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. 1:110 $109,200 (14,700) Fixed costs: $138,000 (94,500) $43,500 (25,700) $17,800arrow_forward2. On February 28, the end of the first month of operations, Kibitz Computer Technology prepared the following income statement, based on the variable costing concept: Kibitz Computer Technology Variable Costing Income Statement For the Month Ended February 28 Sales (250,000 units) 2$ 67,000,000 Variable cost of goods sold: Variable cost of goods manufactured $ 46,000,000 Inventory, February 28 (5,500,000) Total variable cost of goods sold 40,500,000 Manufacturing margin 2$ 26,500,000 Total variable selling and admin. expenses 2,400,000 Contribution margin 2$ 24,100,000 Fixed Costs Fixed manufacturing costs $ 8,500,000 Fixed selling and admin. Expenses 375,000 Total fixed costs 8,875,000 Income from operations 15,225,000 Prepare an income statement under absorption costing.arrow_forward

- Absorption Statement Absorption costing does not distinguish between variable and fixed costs. All manufacturing costs are included in the cost of goods sold. Saxon, Inc.Absorption Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Cost of goods sold: Cost of goods manufactured $840,000 Ending inventory (168,000) Total cost of goods sold (672,000) Gross profit $528,000 Selling and administrative expenses (289,000) Operating income $239,000 Variable Statement Under variable costing, the cost of goods manufactured includes only variable manufacturing costs. This type of income statement includes a computation of manufacturing margin. Saxon, Inc.Variable Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Variable cost of goods sold: Variable cost of goods manufactured $600,000 Ending inventory (120,000) Total variable cost of goods sold (480,000) Manufacturing…arrow_forwardAbsorption costing does not distinguish between variable and fixed costs. All manufacturing costs are included in the cost of goods sold. Saxon, Inc.Absorption Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Cost of goods sold: Cost of goods manufactured $840,000 Ending inventory (210,000) Total cost of goods sold (630,000) Gross profit $570,000 Selling and administrative expenses (290,000) Operating income $280,000 Variable Statement Under variable costing, the cost of goods manufactured includes only variable manufacturing costs. This type of income statement includes a computation of manufacturing margin. Saxon, Inc.Variable Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Variable cost of goods sold: Variable cost of goods manufactured $600,000 Ending inventory (150,000) Total variable cost of goods sold (450,000) Manufacturing margin $750,000…arrow_forwardOn March 31, the end of the first year of operations, Barnard Inc., manufactured 5,500 units and sold 4,700 units. The following income statement was prepared, based on the variable costing concept: Barnard Inc.Variable Costing Income StatementFor the Year Ended March 31, 20Y1 Sales $940,000 Variable cost of goods sold: Variable cost of goods manufactured $528,000 Inventory, March 31 (76,800) Total variable cost of goods sold (451,200) Manufacturing margin $488,800 Total variable selling and administrative expenses (112,800) Contribution margin $376,000 Fixed costs: Fixed manufacturing costs $242,000 Fixed selling and administrative expenses 75,200 Total fixed costs (317,200) Operating income $58,800 Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept. Variable costing $fill in the blank 1 Absorption costing…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education