PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

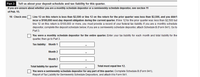

Transcribed Image Text:Part 2: Tell us about your deposit schedule and tax liability for this quarter.

If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11

of Pub. 15.

16 Check one:O Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't

incur a $100,000 next-day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but

line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule

depositor, complete the deposit schedule below; if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to

Part 3.

O You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the

quarter, then go to Part 3.

Tax liability: Month 1

Month 2

Month 3

Total liability for quarter

Total must equal line 12.

O You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941),

Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941.

Transcribed Image Text:Complete Form 941 for the 2nd quarter of 2020 for Smith's Distributing Co. (employer identification #11-3333333). Assume that Smith's Distributing (located at 819 Main Street, Fremont, CA

94538) chooses to complete and mail Form 941 on the due date. Based on the lookback period, Smith's Distributing is a monthly depositor. Assume that all necessary deposits were made on a

timely basis and that the employer made deposits equal to the total amount owed for the quarter. All five employees worked during each of the three months, and the company does not choose to

allow a third party to discuss the form with the IRS. Note that the form is signed by the company's president, Juan Wilhelm (telephone #510-555-8293). Second quarter earnings, and associated

taxes withheld from employee earnings, are as follows.

Notes:

• For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

April Taxes May Taxes June Taxes 2nd Quarter Earnings

FWT

$930.00

$885.00

$905.00

$12,920

Social Security $263.50

$255.44

$282.10

$12,920

Medicare

$61.63

$59.74

$65.98

$12,920

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Payroll Accounting Jet Enterprises has the following data available for its April 30, 2019, payroll: *All subject to Social Security and Medicare matching and withholding of 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.70% and state unemployment taxes of 0.90% are payable on $405,700 of the wages earned. Required: 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. ( Note: Round to the nearest penny.) 2. CONCEPTUAL CONNECTION Jet would like to hire a new employee at a salary of $65,000. Assuming payroll taxes are as described above (with unemployment taxes paid on the first $9,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 25% of gross pay, what will be the total cost of this employee for Jet?arrow_forwardPayroll Accounting McLaughlin Manufacturing has the following data available for its March 31, 2019, payroll: *All Subject to Social Security and Medicare matching and withholding at 6.2% and 1.45%, re9eetivety. Federal unemployment taxes of 0.50% and state unemployment taxes of 0.80% are payable on the first $1,000,000. Required: 1. Compute the taxes payable and wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. ( Note: Round to the nearest penny) 2. CONCEPTUAL CONNECTION McLaughlin Manufacturing would like to hire a new employee at a salary of $80,000. Assuming payroll taxes are as described above (with unemployment taxes paid on the first $7,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 28% of gross pay, what will be the total cost of this employee for McLaughlin?arrow_forwardDuring the fourth quarter of 2019, there were seven biweekly paydays on Friday (October 4, 18; November 1, 15, 29;December 13, 27) for Quality Repairs. Using the forms supplied on pages 4-46 to 4-49, complete the following forthe fourth quarter:a. Complete the Federal Deposit Information Worksheets reflecting electronic deposits (monthly depositor).The employer’s phone number is (501) 555-7331. Federal deposit liability each pay, $677.68.b. Employer’s Quarterly Federal Tax Return, Form 941. The form is signed by you as president on January31, 2020.c. Employer’s Report of State Income Tax Withheld for the quarter, due on or before January 31, 2020.Quarterly Payroll DataTotal Earnings 5 Employees OASDI HI FIT SIT$18,750.00 $1,162.50 $271.88 $1,875.00 $1,312.50Employer’s OASDI $1,162.50Employer’s HI 271.88Federal deposit liability each pay 677.68arrow_forward

- On October 1, 2021, Oberley Corporation loans one of its employees $24,000 and accepts a 12-month, 10% note receivable. Calculate the amount of interest revenue Oberley will recognize in 2021 and 2022.arrow_forwardb. Provide a June 28 journal entry to record the employer's payroll taxes, which have not yet been paid to the government. Date June 28, 2023 June 28, 2023 June 28, 2023 June 28, 2023 C. Payroll Tax Expense FICA Payable Date Account Debit Provide a June 30 journal entry to show the payment of all amounts owed to employees, government agencies, and a health insurance provider. Account Credit Debit Credit 2 0arrow_forwardOn January 1, 2019, a company sells a piece of equipment for a list price of $260,000. It receives $30,000 and accepts a note receivable for the remainder. The balance due is on December 31, 2021, and the note pays an annual interest of 3% every December 31st. Required: Assuming the customer’s borrowing rate is 5%, prepare all journal entries for 2019 and 2020 under IFRS.arrow_forward

- On November 1, 2023, Tommy Tunes accepted a $15,200, 6-month, 4% note from customer Tammy Notune. Required: Prepare the journal entry for the receipt of the note receivable in 2023. Prepare the necessary year-end adjusting journal entry (assume a December 31 year end). Prepare collection of the note receivable at maturity in 2024.arrow_forwardOn December 31, 2019, Don accepted a note receivable from Mike’s Builders for $1,000 as a good faith promise to pay for electrical engineering services rendered that week. The terms of the note are: Face $1,000, Interest 7%, Due in 180 Days. Prepare the journal entry for Don on March 31, 2020 (quarterly) pertaining to the note. Pay close attention to what I am asking for.arrow_forwardThe employees of Lillian's Interiors are paid on a semimonthly basis. Required: Compute the FICA taxes for the employees for December 31, 2022, pay period. All employees are single and have been employed for the entire calendar year. Note: Round "Social Security Tax" and "Medicare Tax" to 2 decimal places.arrow_forward

- XYZ Co.'s accumulated deposit liability for the lookback period of July 1, 2020, to June 30, 2021, was $ 160,000. XYZ must deposit its payroll taxes in 2022 under which of the following deposit schedules? Group of answer choices A. quarterly B. monthly C. semiweekly D. one banking dayarrow_forwardOn February 1, 2021, a company loans one of its employees $21,000 and accepts a nine-month, 8% note receivable. Calculate the amount of interest revenue the company will recognize in 2021.arrow_forwardOn July 1, 2021, a company loans one of its employees $27,000 and accepts a eight-month, 8% note receivable. Calculate the amount of interest revenue the company will recognize in 2021 and 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning