FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

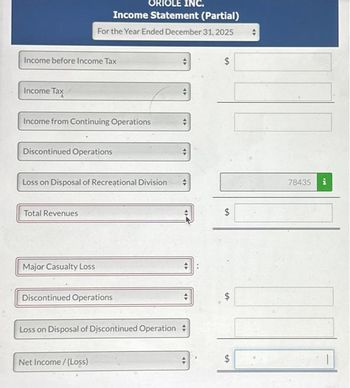

Transcribed Image Text:Income before Income Tax

Income Tax

Income from Continuing Operations

ORIOLE INC.

Income Statement (Partial)

For the Year Ended December 31, 2025

Discontinued Operations

Loss on Disposal of Recreational Division

Total Revenues

Major Casualty Loss

Discontinued Operations

Loss on Disposal of Discontinued Operation

Net Income /(Loss)

47

47

94

47

$

$

LA

$

$

tA

78435 i

1

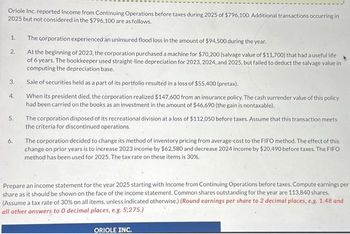

Transcribed Image Text:Oriole Inc. reported Income from Continuing Operations before taxes during 2025 of $796,100. Additional transactions occurring in

2025 but not considered in the $796,100 are as follows.

1. The corporation experienced an uninsured flood loss in the amount of $94,500 during the year.

At the beginning of 2023, the corporation purchased a machine for $70,200 (salvage value of $11,700) that had a useful life

of 6 years. The bookkeeper used straight-line depreciation for 2023, 2024, and 2025, but failed to deduct the salvage value in

computing the depreciation base.

2.

3.

4.

5.

6.

Sale of securities held as a part of its portfolio resulted in a loss of $55,400 (pretax).

When its president died, the corporation realized $147.600 from an insurance policy. The cash surrender value of this policy

had been carried on the books as an investment in the amount of $46,690 (the gain is nontaxable).

The corporation disposed of its recreational division at a loss of $112,050 before taxes. Assume that this transaction meets

the criteria for discontinued operations.

The corporation decided to change its method of inventory pricing from average-cost to the FIFO method. The effect of this

change on prior years is to increase 2023 income by $62,580 and decrease 2024 income by $20,490 before taxes. The FIFO

method has been used for 2025. The tax rate on these items is 30%.

Prepare an income statement for the year 2025 starting with Income from Continuing Operations before taxes. Compute earnings per

share as it should be shown on the face of the income statement. Common shares outstanding for the year are 113,840 shares.

(Assume a tax rate of 30% on all items, unless indicated otherwise.) (Round earnings per share to 2 decimal places, e.g. 1.48 and

all other answers to 0 decimal places, e.g. 5,275.)

ORIOLE INC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore §179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.) Asset Date Placed in Service Original Basis Machinery October 25 $ 104,000 Computer equipment February 3 44,000 Delivery truck* March 17 57,000 Furniture April 22 184,000 Total $ 389,000 *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $640,000. b. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus depreciation (but does not take §179 expense)? Note: Round your intermediate calculations to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33%…arrow_forwardFlounder Corporation, a clothing retailer, had income from operations (before tax) of $367,000, and recorded the following before-tax gains/(losses) for the year ended December 31, 2023: Gain on disposal of equipment Unrealized (loss/gain on FV-NI investments (Loss)/gain on disposal of building Gain on disposal of FV-NI investments 352.500 (25,380) (50,760) 63,920 Flounder also had the following account balances as at January 1, 2023 Retained earnings Accumulated other comprehensive income (this was due to a revaluation surplus on land) Accumulated other comprehensive income (this was due to gains on FV-OCI debt investments) $31,020 61.040 385,400 As at January 1, 2023, Flounder had one piece of land that had an original cost of $142,000 that it accounted for using the revaluation model. It was most recently revalued to fair value on December 31, 2022, when its carrying amount was adjusted to fair value of $203,040, In January 2023, the piece of land was sold for proceeds of $203,040.…arrow_forwardpreviously answers were incorrect. Can someone take another look?arrow_forward

- Lagace Ltd. suffered an unusual and infrequent loss of from a tornado during 2023 that was partially insured. In addition, the company realized a loss from the disposal of a building. Include calculation and disclosure of EPS. Income from operations before tax $5,1000,000 Loss from tornado $1,250,000 Insurance portion of loss from tornado $500000 Loss from disposal of a building $85000 Income tax rate 35% Common share outstanding during 2023 2,000,000 Prepare a partial income statement for Lagace, beginning with income from operations. Include disclosure of EPS. Display all amounts as positive numbersarrow_forwardThor, Inc reported depreciation on the income statement by the straight-line method on an asset with a four-year useful life. MACRS is used for the tax return. Income statement: $5 million each year. Tax Return: 2020 $7 million; 2021 $6 million; 2022 $4 million; 2023 $3 million. The income tax rate is 20% for all years. The current year is 2022. Which of the following statements is true regarding the differences between accounting and tax depreciation? The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is originating, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.6M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.4M. The 2022 beginning balance in the deferred tax liability is $.4M, the 2022 difference is reversing, and the desired ending balance in the 2022 deferred tax liability is $.6M. The 2022…arrow_forwardA company purchased new mining equipment in year 2014 by paying $500,000 cash. The company used MACRS-GDS depreciation for tax purposes and sold the asset in year 2016. Note that MACRS depreciations are based on calender years. what is the depreciation that company claimed on the asset for 2017? * explain in full detailarrow_forward

- On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $36 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2020, the book value of the equipment was $30 million and its tax basis was $20 million. At December 31, 2021, the book value of the equipment was $28 million and its tax basis was $12 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $50 million. Required: 1. Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameen's 2021 net income?arrow_forwardKk120.arrow_forwardOn 1 January 20X8 Davidoff Co decided to revalue its land for the first time. A qualified property valuer reported that the market value of the land on that date was $45,000. The land was originally purchased 6 years ago for $32,000 The required provision for income tax for the year ended 31 December 20X8 is $15,500. The difference between the carrying amounts of the net assets of Davidoff (including the revaluation of the land above) and their (lower) tax base at 31 December 20X8 is $38,000. The opening balance on the deferred tax account was $5,500. Davidoff’s rate of income tax is 30%. Required Prepare extracts of the financial statements to show the effect of the above transactions.arrow_forward

- Chaz Corporation has taxable income in 2021 of $312,000 for purposes of computing the §179 expense and acquired the following assets during the year: Asset Placed in Service Basis Office furniture September 12 $ 780,000 Computer equipment February 10 930,000 Delivery truck August 21 68,000 Qualified improvement property September 30 1,500,000 Total $ 3,278,000 What is the maximum total depreciation deduction that Chaz may deduct in 2021?arrow_forwardDengerarrow_forwardThe records for AC3220 Ltd. show the following data for calendar 2023: 1. Golf club dues were $3,800. 2. Machinery was acquired in January 2023 for $300,000. AC3220 uses straight-line depreciation over a ten-year life (no residual value). For tax purposes, AC3220 claimed 42,000 of CCA on the equipment for 2023. 4. Total meals and accommodations expensed for the year was 8,000. 5. 6. The estimated warranty liability related to 2023 sales was $19,600. Warranty repair costs paid during 2023 were $13,600. The remainder will be paid in 2024. Pre-tax accounting income is $250,000. The enacted income tax rate is 25%. Instructions Prepare a schedule (starting with pre-tax accounting income) to calculate taxable income. a) b) Prepare the required adjusting entries to record income taxes for 2023.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education