FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

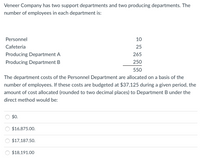

Transcribed Image Text:Veneer Company has two support departments and two producing departments. The number of employees in each department is:

- Personnel: 10

- Cafeteria: 25

- Producing Department A: 265

- Producing Department B: 250

Total: 550

The department costs of the Personnel Department are allocated on the basis of the number of employees. If these costs are budgeted at $37,125 during a given period, the amount of cost allocated (rounded to two decimal places) to Department B under the direct method would be:

- $0.00

- $16,875.00

- $17,187.50

- $18,191.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the direct method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has the following information about its two service departments and two production departments, Cutting and Assembly: Number of Square Feet Employees Janitorial Department 100 20 Cafeteria Department 10,000 10 Cutting Department 2,000 60 Assembly Department 8,000 20 The percentage (proportional) usage of the Janitorial Department by the Cutting Department is Oa. 10% Ob. 80% Oc. 9.9% Od. 20%arrow_forwardThe following departmental information is for the four departments at Samoa Industries. Departmental Total Cost Cost Driver Square Feet Number of Employees Janitorial $150,000 Square footage serviced 200 40 Cafeteria 50,000 Number of employees 20,000 12 Cutting 1,125,000 4,000 120 Assembly 1,100,000 16,000 40 The Janitorial and Cafeteria departments are support departments. Samoa uses the sequential method to allocate support department costs, first allocating the costs from the Janitorial Department to the Cafeteria, Cutting, and Assembly departments. Question Content Area 1. Determine the dollar amount of the Janitorial Department costs to be allocated to the (a) Cafeteria, (b) Cutting, and (c) Assembly departments. Department Amount a. Cafeteria Department fill in the blank 1 of 3$ b. Cutting Department fill in the blank 2 of 3$ c. Assembly Department fill in the blank 3 of 3$…arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forward

- Departmental information for the four departments at Samoa Industries is provided below. Total Cost Cost Driver Square Feet Number of Employees Janitorial $150,000 Square footage serviced 200 40 Cafeteria 50,000 Number of employees 20,000 12 Cutting 1,125,000 4,000 120 Assembly 1,100,000 16,000 40 The Janitorial and Cafeteria departments are support departments. Determine the dollar amount of the Janitorial Department costs to be allocated to the (a) Cutting and (b) Assembly departments using the direct method. a. Cutting Department b. Assembly Departmentarrow_forwardHighland Publishing Company is a large organization offering a variety of printing and binding work. The Printing and Binding departments are supported by three service departments. The costs of these service departments are allocated to other departments in the order listed below. The Personnel cost is allocated based on number of employees. The Custodial Services cost is allocated based on square feet of space occupied and the Maintenance cost is allocated based on machine-hours. Department Total Labor-Hours Square Feet of Space Occupied Number of Employees Machine-Hours Direct Labor-Hours Personnel 16,400 12,600 27 Custodial Services 8,600 3,900 49 Maintenance 14,300 10,200 65 Printing 30,600 40,300 109 162,000 13,000 Binding 101,000 21,000 307 41,000 80,000 170,900 88,000 557 203,000 93,000 Budgeted overhead costs in each department for the current year are shown below: Personnel $ 320,000 Custodial Services 65,300 Maintenance 93,300…arrow_forwardMervon Company has two operating departments: Mixing and Bottling. Mixing occupies 24,660 square feet. Bottling occupies 16,440 square feet. Indirect factory costs include maintenance costs of $234,000. If maintenance costs are allocated to operating departments based on square footage occupied, determine the amount of maintenance costs allocated to each operating department.arrow_forward

- A%7arrow_forwardThe Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $536,250 are allocated on the basis of machine hours. The Accounting Department's costs of $151,200 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $240,000 and $440,000, respectively. Maintenance Accounting A B Machine hours 755 95 2,400 350 Number of employees 2 2 8 4 What is the Maintenance Department's cost allocated to Department A using the direct method? Multiple Choice $578,400. O $422,000. $284,000. $468,000.arrow_forwardTenet Engineering, Incorporated operates two user divisions as separate cost objects. To determine the costs of each division, the company allocates common costs to the divisions. During the past month, the following common costs were incurred: Computer services (85% fixed) Building occupancy Personnel costs Total common costs $ 268,000 658,000 108,000 $ 1,034,000 The following information is available concerning various activity measures and service usages by each of the divisions: Area occupied (square feet) Payroll Computer time (hours) Computer storage (megabytes) Equipment value Operating profit (pre-allocations) Division A 25, 200 $ 453,000 320 5,400 $ 296,000 $ 735,000 Division B 50,400 $ 253,000 340 0 $ 346,000 $ 675,000 If common computer service costs are allocated using computer time as the allocation basis, what is the computer cost allocated to Division B? Note: Do not round intermediate calculations.arrow_forward

- Renata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Square Feet Asset Values Employees Materials 26 30,000 $ 9,300 Personnel 13 12,000 2,480 Manufacturing Packaging 52 66,000 37,820 39 12,000 12,400 Total 130 120,000 $ 62,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Insurance Total Cost $ 82,700 Number of employees Allocation Base 52,000 Square feet occupied 23,500 Asset values $ 158,200 Allocate each of the three indirect expenses to the four departments.arrow_forwardCakeCo, Incorporated has three operating departments. Information about these departments is listed below. Maintenance is service department at CakeCo that incurred $14,400 of costs during the period. If allocated maintenance cost is based on floor space occupied by each of the operating departments, compute the amount of maintenance cost allocated to the Baking Department. Department Direct Expenses Square Feet 1,500 2,250 750 Mixing $ 26,000 Baking 20,000 Packaging 14,000 $320. $960. $6,000. $9,450. $7,200. 9arrow_forwardThe cost of operating the Maintenance Department is to be allocated to four production departments based on the floor space each occupies. Department A occupies 600 m²; Department B, 900 m²; Department C, 1200 m²; and Department D, 600 m². If the July cost was $17,600, how much of the cost of operating the Maintenance Department should be allocated to each production department? The operating cost for Department A is $ (Simplify your answer.) The operating cost for Department B is $ (Simplify your answer.) The operating cost for Department C is $ (Simplify your answer.) The operating cost for Department D is $ (Simplify your answer.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education