FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

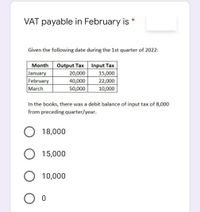

Transcribed Image Text:VAT payable in February is *

Given the following date during the 1st quarter of 2022:

Input Tax

15,000

22,000

10,000

Month

Output Tax

January

February

20,000

40,000

50,000

March

In the books, there was a debit balance of input tax of 8,000

from preceding quarter/year.

O 18,000

O 15,000

10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 25: Which statement regarding Form W-3 is inaccurate? Answer: O Form W-3 contains earnings information for multiple employees. А. В. O Form W-3 must be signed by the employer to be valid. С. O Form W-3 is submitted to the Social Security Administration and provided to each employee. D. O Form W-3 includes federal and state tax information.arrow_forwardCALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for Barney's Bagels for the week ended July 15 are shown below.The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%,both of which are levied on the first $7,000 of earnings.The Social Security tax rate is 6.2% on the first $128,400 of earnings. The Medicare rate is 1.45% on gross earnings. Calculate the employer's payroll taxes expense and prepare thejournal entry to record the employer'spayroll taxes expense for the week ended July 15of the current year.arrow_forwardPaid telephone bill for May, $260.arrow_forward

- A 90-day note is signed on October 21. The due date of the note is: ◇ January 19 O January 21 ◇ January 20 ◇ January 18arrow_forwardPLEASE SHOW ALL WORK You purchase goods on an invoice dated July 5 with terms of 4/15, n/45 ROG. If you receive the goods on July 23, calculate(a) the last day of the discount period, and (b) the last day of the credit period.b. Last day of credit period:arrow_forwardThen, prepare the journal entry assuming the payment is made within 10 days (the discount period).arrow_forward

- Swathmore Clothing Corporaton grants ts customers 30 deys' credit. The compeny uses the allowance method for tos uncollectible accounts receivable. During the year, a monthly bed debt accrual Is made by multiplying 2% times the amount of credt sales for the month. At the fiscal year-end of December 31, an aging of accounts recelveble schedule is prepared and the allowance for uncollectible accounts Is adjusted accordingly. Se & B S At the end of 2017, accounts recelvable were $592,000 and the allowance account had a credit balance of $56,000. Accounts recelvable activity for 2018 was as follows: Beginning balance Credit sales Collections $ 592,000 2,710,000 (2,573,000) (48,000) Write-offs Ending balance $ 681,000 The company's controller prepared the following aging summary of year-end accounts receivable: Summary Percent Uncollectible Age Group 0-60 days 61-90 days 91-120 days Over 120 days Amount $415,000 98,000 58,000 110,000 12 28 39 Total $681,000 Required: - Prepare a summary…arrow_forwardBlueside Crafts has a weekly payroll being paid on June 1st. As they are an accelerated threshold 2 remitter, the source deductions for this payroll will be due by what date?arrow_forwardAt Inner City Health Care, the total account receivable at the end of May is $100,00 and the monthly receipts total is 75.000, the total accounts receivable ath the end of june is 82.000 and the monthly receipts total is $31.000, the totat accounts receivable at the end of july is $86,000 and the monthly receipts total $20,000; the total accounts receivable at the end of August is $93,000 an the monthly receipts total is $45,000. What is the account receivable ratio for each month? Show your calculations in the space provided. Which month has the healthiest accounts receivable ratio? Why?arrow_forward

- Mar 15) issued check No. 417, payable to payroll, in payment of sales salaries expense for the first half of the month, $20,100. Cashed the check and paid the employeesarrow_forwardBramble Company's budgeted sales and direct materials purchases are as follows. January February 268,400 March Budgeted Sales $244.000 (a) 305,000 Bramble's sales are 30% cash and 70% credit. Credit sales are collected 10% in the month of sale, 50% in the month following sale, and 36% in the second month following sale; 4% are uncollectible. Bramble's purchases are 50% cash and 50% on account. Purchases on account are paid 40% in the month of purchase, and 60% in the month following purchase. (b) Budgeted D.M. Purchases Prepare a schedule of expected collections from customers for March. Total collections $36,600 43.920 46,360 BRAMBLE COMPANY Schedule of Expected Collections from Customers Total payments $ March Prepare a schedule of expected payments for direct materials for March. BRAMBLE COMPANY Schedule of Expected Payments for Direct Materials Marcharrow_forwardA company receives rent for subletting part of its office block. Rent, receivable quarterly in advance, is received as follows: Date of receipt Period covered $ 1 October 20X1 3 months to 31 December 20X1 7,500 30 December 20X1 3 months to 31 March 20X2 7,500 4 April 20X2 3 months to 30 June 20X2 9,000 1 July 20X2 3 months to 30 September 20X2 9,000 1 October 20X2 3 months to 31 December 20X2 9,000 What figures, based on these receipts, should appear in the company's financial statements for the year ended 30 November 20X2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education