FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:1

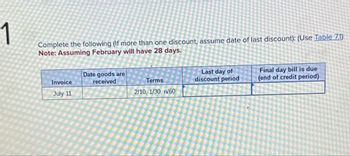

Complete the following (If more than one discount, assume date of last discount): (Use Table 7.1)

Note: Assuming February will have 28 days.

Invoice

July 11

Date goods are

received

Terms

Last day of

discount period

Final day bill is due

(end of credit period)

2/10, 1/30, n/60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- uppose you have a revolving credit account at an annual percentage rate of 12%, and your previous monthly balance is $389.79. Find your new balance (in $) if your account showed the following activity. Use the unpaid balance method. (Round your answer to the nearest cent.) Statement of Account Billing cycle: July 1–31 DATE DESCRIPTION OF TRANSACTIONS CHARGES July 04 Kit and Capoodle Pets $109.08 July 08 Payment 61.00 July 16 Cash advance 98.82 July 22 Mountain Vineyards 31.37 July 29 Vu Video (credit) 95.97 $arrow_forwardMerchandise costing $539 is sold for 1848 on terms 2/10, n/30. If the buyer pays within the discount period, when collection of cash within the 10 days the credit to accounts receivable will be $arrow_forwardK An invoice is dated June 18 with terms 3/10-50 ex. Find the final discount date and the net payment date. The net payment date is 20 days after the final discount date. The final discount date is The net payment date is June July ▼ ▼ CHEarrow_forward

- For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.1% per month on the average daily balance Find (a) the average daily balance, (b) the monthly finance charge, and (e) the account balance for the next billing Previous Balance: $485.26 January 13 Billing Date January 15 Retums January 20 Clothes January 27 Bus Sickets February 2 Payment February 6 Flowers $105.09 $114.34 $76.83 $130 $64.41 (a) The average daily balance is (Round to the nearest cent as needed.) (b) The finance charge is (Round to the nearest cent as needed) (c) The account balance for the next billing is $ (Round to the nearest cent as needed.)arrow_forwardCalculate the missing information on the following revolving credit account. Interest is calculated on the unpaid or previous month's balance. Do not enter the percent symbol in your answer. Round your answers for finance charge and new balance to the nearest cent. Annual Monthly Purchases Payments Previous Percentage Periodic Finance and Cash and New Balance Rate (APR) Rate Charge Advances Credits Balance $2,440.00 $1,281.60 $3,679.00arrow_forwardA credit card has a monthly rate of 1.23%. In the January 1-January 31 itemized biling, the average daily balance is $706 23. The payment due date is February 9. Find the interest due on this date using the average daily balance method. Round answer to the nearest cent EIERarrow_forward

- You have a revolving credit account at an annual percentage rate of 18%. Use the average daily balance method to find the new balance given the following statement of account.arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forwardWant helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education