FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Determine the expected collections on its receivable for the month of June. Indicate the amounts collected in June for sales in April, May, and June, respectively. (requires 4 answers: April, May, June and Total Amount)

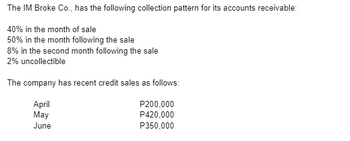

Transcribed Image Text:The IM Broke Co., has the following collection pattern for its accounts receivable:

40% in the month of sale

50% in the month following the sale

8% in the second month following the sale

2% uncollectible

The company has recent credit sales as follows:

April

P200,000

May

P420,000

June

P350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 21%. Complete the account activity table for Kathy. Month PreviousMonth'sBalance FinanceCharge(in $) Purchasesand CashAdvances Paymentsand Credits New BalanceEnd of Month(in $) March $720.00 $ $129.97 $65.00 $arrow_forwardKathy Hansen has a revolving credit account. The finance charge is calculated on the previous month’s balance, and the annual percentage rate is 27%. Complete the account activity table for Kathy. (round your answer to the nearest cent.)arrow_forwardb. If the inventory costs $5 per unit and will be financed through the bank at 6 percent per annum, what is the monthly financing cost and the total for the four months? (Round your intermediate calculations and final answers to 2 decimal places. Do not leave any empty spaces; input a 0 wherever it is required.) Financing cost October November December January Total financing cost tAarrow_forward

- For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.6% per month on the average daily balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous Balance: $754.46 July 8 Billing Date Payment July 15 July 25 Lunch August 2 Concert tickets $300 $53.79 $76.67 (a) The average daily balance is $. (Round to the nearest cent as needed.) (b) The finance charge is $. (Round to the nearest cent as needed.) (c) The account balance for the next billing is $. (Round to the nearest cent as needed.)arrow_forwardPrime Products hopes to borrow $51,000 on April 1 and repay it plus interest of $860 on June 30. The following data are available for the months April through June, during which the loan will be used: a. On April 1, the start of the loan period, the cash balance will be $24,400. Accounts receivable on April 1 will total $151,200, of which $129,600 will be collected during April and $17,280 will be collected during May. The remainder will be uncollectible. b. The company estimates 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% are bad debts that are never collected. Budgeted sales and expenses for the three- month period follow: Sales (all on account) Merchandise purchases Payroll Lease payments April $285,000 $194,000 May $ 548,000 June $ 251,000 $ 179,000 $ 171,000 $ 35,400 $ 35,400 $ 19,900 $ 35,800 $ 35,800 $ 35,800 Advertising Equipment purchases Depreciation $ 64,400 $ 64,400 $…arrow_forwardProBuilder has the following June 30 fiscal-year-end unadjusted balances: Allowance for Sales Discounts, $0; and Accounts Receivable, $10,000. Of the $10,000 of receivables, $2,000 are within a 3% discount period, meaning that it expects buyers to take $60 in future discounts arising from this period’s sales. a. Prepare the June 30 fiscal-year-end adjusting journal entry for future sales discounts. b. Assume the same facts above and that there is a $10 fiscal-year-end unadjusted credit balance in the Allowance for Sales Discounts. Prepare the June 30 fiscal-year-end adjusting journal entry for future sales discounts.arrow_forward

- Complete the following: Invoice April 27 Date goods are received Terms 4/10 EOM Last day of discount period Final day bill is due (end of credit period)arrow_forwardSchedule of cash payments for a service company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $123,700 April 117,500 Мay 106,900 Depreciation, insurance, and property taxes represent $27,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 72% of the remainder of the expenses are expected to be paid in the month in which they are incurred with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May. Horizon Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March Аpril Мay March expenses: Paid in March Paid in April April expenses: Paid in April Paid in May May expenses: Paid in Mayarrow_forwardBased on the information given below, what is the "Days Revenue in Accounts Receivable" for the quarter ending September 30? For this problem, assume that the quarter has 90 days. (Round your answer to 2 decimal places. For example, 12.3456 should be entered as 12.35.) Month Revenues A/R at End of Quarter July *186,049 26,843 August 208,033 85,406 September 209,968 63,674 TOTALS ? ?arrow_forward

- Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 21%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Month Previous Month's Balance (in $) Finance Charge (in $) Purchases and Cash Advances Payments and Credits New Balance End of Month (in $) June $824.08 $14.42 $159.38 $300.00 $697.88 July $ $ $72.59 $140.00 $ Need Help? Read Itarrow_forwardSchedule of cash payments for a service company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $152,100 April 139,900 May 127,300 Depreciation, insurance, and property taxes represent $32,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 62% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month.arrow_forwardConsider the following credit card activity for the month of September: Date Balance September 1 $0 September 7 $331 September 13 $935 September 21 $1,552 September 25 $ 2,208 If this card's annual APR is 20.9% and the September balance is not paid during the grace period, how much interest is owed for September? There are 30 days in September. Round your answer to the nearest dollar.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education