FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

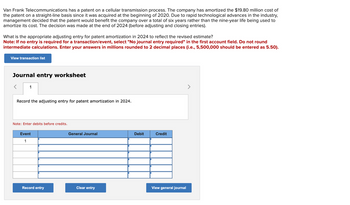

Transcribed Image Text:Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the $19.80 million cost of

the patent on a straight-line basis since it was acquired at the beginning of 2020. Due to rapid technological advances in the industry,

management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to

amortize its cost. The decision was made at the end of 2024 (before adjusting and closing entries).

What is the appropriate adjusting entry for patent amortization in 2024 to reflect the revised estimate?

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).

View transaction list

Journal entry worksheet

<

1

Record the adjusting entry for patent amortization in 2024.

Note: Enter debits before credits.

Event

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2012, when it was acquired at a cost of $9 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2016 (before adjusting and closing entries). Required: Prepare the appropriate adjusting entry for patent amortization in 2016 to reflect the revised estimate.arrow_forwardDuring 2021, Concord Corporation spent $168,480 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2021, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $41,040 related to the patent were incurred as of October 1, 2021.arrow_forwardAstrolech Semiconductor incurred the following costs in 2021 related to a new product design: Research for new semiconductor design Development of the new product Legal and filing fees for a patent for the new design $3,720,000 906, 000 115, 000 $4,741,000 Tetal The development costs were incurred after technological and commercial feasibility was established and after the future eco benefits were deemed probable. The project was successfully completed, and the new product was patented before the ene 2021 fiscal yeat Required: 4 Calculate the amount of research and development expense (R&D) AstroTech should eport in its 2021U.S. GAAP income related to this project. 2. Repeat Requirement 1 assuming that Astroledh prepates its financial statements according to International Eimancial Repe Standards (IFRS). Research and development expense under U S. GAAP Research and development expense under IFRSarrow_forward

- The following costs were incurred by Mark Corporation during 2020: Legal fees paid to attorneys in connection with a patent application related to a new invention developed by the company's laboratory personnel: $40,000. Salaries of personnel involved in searching for applications of new research findings: $150,000. Cost of machinery acquired on January 1, 2020: $355,000. The machinery will be used in a current research and development project, as well as several other R&D projects over the next eight years, after which the machine is expected to be sold for $15,000. Mark Corporation uses straight-line depreciation. Costs of design, construction, and testing of preproduction prototypes of potential new product lines for the company: $70,000. Cost of developing a valuable new product that was successfully patented: $100,000. Cost of marketing research to promote the new product: $60,000. Required:Calculate the total research and development expense that should appear in Mark's…arrow_forwardMartin's Cove Marina has a September 30 year end. On August 15, 2021, it purchased a new marine crane to assist it with the autumn pull out of the boats in the marina. The physical life of the crane is expected to be 15 years, but Martin plans to keep the crane for only 10 years as this represents the asset's useful life to the company and at which point they will trade it in for a newer model. The original cost of the crane is $50,000. The amount of depreciation that Martin should show in its financial statements for the year ended September 30, 2021 is Select one: A. $3,333. x B. $417. C. $5,000. D. $625.arrow_forwardOrtiz Box Company purchased a patent on a box - folding machine for $160,000 on July 1, 2012. The useful life was estimated at 20 years. There were 19 years remaining on the patent when it was purchased. In early 2019, the CEO of Ortiz noted a decrease, industry - wide, in the demand for folded boxes. The CEO estimated that the patent had a remaining useful life of 5 years. An impairment analysis was done as of June 30, 2019. Expected annual cash flows over the next 5 years were estimated at $20,000. The discount rate used by Ortiz is 5%. How much amortization expense was recognized by Ortiz in 2019 and 2020, respectively? Select one: a. $4,211 b. $7,330 c. $ 7,818 d. $12,870 e. $12, 659arrow_forward

- Splish Brothers Industries had one patent recorded on its books as of January 1, 2020. This patent had a book value of $480,000 and a remaining useful life of 8 years. During 2020, Splish Brothers incurred research and development costs of $92,000 and brought a patent infringement suit against a competitor. On December 1, 2020, Splish Brothers received the good news that its patent was valid and that its competitor could not use the process Splish Brothers had patented. The company incurred $127,500 to defend this patent. At what amount should patent(s) be reported on the December 31, 2020, balance sheet, assuming monthly amortization of patents? The amount to be reported $arrow_forwardFlint Corp. erected and placed into service an offshore oil platform on January 1, 2023, at a cost of $10 million. Flint is legally required to dismantle and remove the platform at the end of its eight-year useful life. Flint estimates that it will cost $1.0 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 10%. Using (a) factor Table A.2, (b) a financial calculator, or (c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume that none of the $1.0 million cost relates to production. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Click here to view the factor table. Click here to view the factor…arrow_forwardOn January 1, 2023, a company acquired an established coal mine. The company anticipates operating the mine for four years, and subsequently, it is obligated by law to dismantle the mine. The estimated dismantling cost is $500,000. The company utilizes straight-line depreciation and an accretion rate of 10%. The relevant present value factor is 0.68301. What is the amount of accretion expense that the company will report for the year ending December 31, 2024 (i.e., end of year 2)?arrow_forward

- Sonic Company has the following research and development activities during 2017-2020:In 2017, Sonic spent $400,000 to develop a new production process. It has applied for a patent for the new process and believed that it will be successful. Economic viability has not been achieved at end of 2017.On 1 February 2018, patent applied in 2017 was granted. Legal costs involved were $200,000. Patent was granted for 20 years where the developed process will be useful for the next ten years' operation.In the beginning of January 2019, there was infringement of patent by a competitor. Sonic spent $100,000 in defending against the patent infringement successfully. Sonic decided the patent can be used till the end of 2029.On 31 December 2020, Sonic estimated that the process only has a value-in-use of $200,000.RequiredPrepare all the journal entries to record the transactions during 2017-2020, including any amortization involved. Financial year end of the Sonic Company is 31 December.arrow_forwardMartinez Corporation uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $9.00 million and had an estimated useful life of 8 years with no residual value. In early April 2020, a part costing $790,000 and designed to increase the machinery’s efficiency was added. The machine’s estimated useful life did not change with this addition. By December 31, 2020, new technology had been introduced that would speed up the obsolescence of Martinez’s equipment. Martinez’s controller estimates that expected undiscounted future net cash flows on the equipment would be $5.67 million, and that expected discounted future net cash flows on the equipment would be $5.22 million. Fair value of the equipment at December 31, 2020, was estimated to be $5.04 million. Martinez intends to continue using the equipment, but estimates that its remaining useful life is now four years. Martinez uses straight-line depreciation. Assume that Martinez is a private…arrow_forwardOn January 2, 2025, Ivanhoe Co. bought a trademark from Rice, Inc. for $1641000. An independent research company estimated that the remaining useful life of the trademark was 10 years. Its unamortized cost on Rice's books was $1969200. Ivanhoe expects that the trademark will produce 25% of its cash flows in year 1, 20% in year 2, 15% in year 3, and 10% in the remaining years. In Ivanhoe's 2025 income statement, what amount should be reported as amortization expense? Select answer from the options below - $410250 $318200 $273500 $164100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education