FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

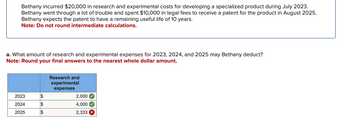

Transcribed Image Text:Bethany incurred $20,000 in research and experimental costs for developing a specialized product during July 2023.

Bethany went through a lot of trouble and spent $10,000 in legal fees to receive a patent for the product in August 2025.

Bethany expects the patent to have a remaining useful life of 10 years.

Note: Do not round intermediate calculations.

a. What amount of research and experimental expenses for 2023, 2024, and 2025 may Bethany deduct?

Note: Round your final answers to the nearest whole dollar amount.

Research and

experimental

expenses

2023

$

2,000

2024

$

4,000

2025

$

2,333 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which set of cahs flows is worth more now? Assume that your grandmother wants to give you a generous gift. She wants you to choose which one of the following sets of cash flows you would like to receive: Option A: Receive a one-time gift of $10, 000 today. Option B: Receive a $1400 gift each year for the next 10 years. The first $1400 would be received 1 year from today. Option C: Receive a one-time gift of $17,000 10 years from today. Compute the Present Value of each of these options if you expect the interest rate to be 3% annually for the next 10 years. Which of these options does financial theory suggest you should choose? Option A would be worth $? today. Option B would be worth $? today. Option C would be worth $? today. Financial theory supports choosing Option ?arrow_forwardPatricia Gomez owns a company called Ceram-Lite which manufactures ceramic kitchenware. Over the past 10 years, Ceram-Lite has enjoyed steady growth. However, recently, there has been increased competition in kitchenware as a result of successful TV shows like Celebrity Chef. Gomez, Ceram-Lite's CEO, believes an aggressive strategy will be needed to meet the company's goals. You have been provided with the following information for the current year (2022) for Ceram- Lite's flagship Dutch Oven dish, which Gomez has indicated will be the focus product for the upcoming holiday season: Variable Costs (per dutch oven) Direct Materials Direct Manufacturing Labour Variable Overhead (manufacturing, marketing, distribution, and customer service) Total Variable cost per dutch oven Fixed Costs Selling Price Expected Sales Income tax rate Manufacturing Marketing, distribution, and customer service Total Fixed Costs 50,000 units 555 $ $ $ 18 30 28 76 $ 18,000 $ 155,760 $ 173,760 $ 88 $4,399,500 38%arrow_forwardTommy will receive a royalty payment of $ 28699 per year for the next 25 years, beginning one year from now, as a result of an app he has developed. If a discount rate of 6 percent is applied, how much are the future rights worth now? (Use excel function)arrow_forward

- Soved Assume the totol cost of a college educotion will be $200,000 when your child enters college in 16 years. You presently have $55,000 to Invest. What annualrote of Interest must you earn on your Investment to cover the cost of your child's college education? (Do not round Intermediate calculations. Enter your answer ac o percent rounded to 2 decimal places, e.g., 32.16.) Annual rate of interestarrow_forwardDuring 2020, Jeff has the following startup costs for his new lawn-care business: · Employee Training & Orientation Costs: $5,000 · Legal and Accounting fees: $8,000 · Market Research and Surveys: $4,000 Jeff’s business begins operations on January 1, 2021. Determine the amount that Jeff should deduct and when. Group of answer choices $5,000 in the 2020 tax year. $5,800 in the 2020 tax year. $5,800 in the 2021 tax year. $17,000 in the 2021 tax year.arrow_forwardIf a CFP® professional engaging in financial planning represents his compensation method as fee-only, then which of the following is an acceptable form of compensation for him? A) Fees collected on the management of a client's investment assets VOC CA 103000 Ane Mon som mempun B) A commission earned on the sale of a variable annuity D de pe imp hun 2001 que 200 OC) A commission earned on the sale of a term life policy O D) A commission earned on the sale of a whole life policyarrow_forward

- please answer within 30 minutes..arrow_forwardP3-13 (similar to) Present value. Prestigious University is offering a new admission and tuition payment plan for all alumni. On the birth of a child, parents can guarantee admission to Prestigious if they pay the first year's tuition. The university will pay an annual rate of return of 7% on the deposited tuition, and a full refund will be available if the child chooses another university. The tuition is expected to be $16,000 a year at Prestigious 19 years from now. What would parents pay today if they just gave birth to a new baby and the child will attend college in 19 years? How much is the required payment to secure admission for their child if the interest rate falls to 2%? What would parents pay today if they just gave birth to a new baby and the child will attend college in 19 years? (Round to the nearest cent)arrow_forwardTammy had the following aggregate results from her 2019 investing activity: STCG $300,000 LTCG $450,000 STCL $260,000*** LTCL $390,000*** *** These are negative numbers, obviously. After the “netting procedure” described in the textbook, what is / are Tammy’s net 2019 result(s)?arrow_forward

- 4. Mr. Richman has offered to give the New Life Hospice Center $100,000 today or $300,000 when he dies. If the hospice center earns 14% on its investments, and it expects Mr. Richman to live for 12 years, which alternative should they take? Take the gift now or later? Discuss in narrative and include your calculations and citations with your answer.arrow_forwardReasons detailing how a max $20,000 scholarship would improve someone's situation.arrow_forwardSubject - account Please help me. Thankyou .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education