FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

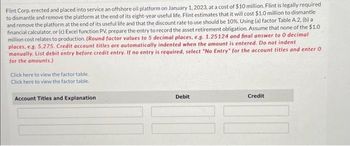

Transcribed Image Text:Flint Corp. erected and placed into service an offshore oil platform on January 1, 2023, at a cost of $10 million. Flint is legally required

to dismantle and remove the platform at the end of its eight-year useful life. Flint estimates that it will cost $1.0 million to dismantle

and remove the platform at the end of its useful life and that the discount rate to use should be 10%. Using (a) factor Table A.2, (b) a

financial calculator, or (c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume that none of the $1.0

million cost relates to production. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal

places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent

manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0

for the amounts.)

Click here to view the factor table.

Click here to view the factor table.

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Munabhaiarrow_forwardOn December 31, 2025, Cullumber Company acquired a computer from Plato Corporation by issuing a $614,000.00 zero-interest- bearing note, payable in full on December 31, 2029. Cullumber Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer is expected to have a 5-year life and a $76,000 salvage value. Click here to view factor tables. (a) Prepare the journal entry for the purchase on December 31, 2025. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, eg. 58,971.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31,2025 eTextbook and Media List of Accounts Debit Creditarrow_forward9arrow_forward

- Lifeline Biofuels bult an oil rig at a cost of $4.5 million that it places into service on the first day of the current year. The company estimates the oil rig will have a useful life of 20 years (with no salvage value), after which Federal regulations require that the oil rig must be dismantled and the land area restored. The expected fair value of this asset retirement project is $845,000. The present value of these asset retirement costs is $263,000 based on the 6% after - tax discount rate Under US. GAAP, what is the company's accretion expense for the first year? A. $42,250 OB. $15.780 OC. $13,150 OD. S0arrow_forwardOn December 1, 2021, HP Corp. is contemplating to invest into a new equipment costing P2,500,000 plus an installation cost of P200,000 to replace its old equipment that has a book value of P400,000 and a remaining useful life of 4 years. The estimated useful life of the new equipment is 4 years and has a salvage value of P500,000. If the company will favor the replacement decisions, the old equipment can be sold for P150,000 but additional working capital investment must be made amounting to P400,000. However, the company must incur a repair cost of P180,000 to continuously use the old equipment. The annual cash operating costs of the old equipment is P4,000,000 while the annual cash operating cost of the new equipment is P2,400,00. At the end of the useful life, cost to remove the new equipment will amount to P100,000. The company uses a tax rate of 35%, requires a payback period is 2.5 years or less, and accepts a minimum accounting rate of return is 15%. Compute for the net…arrow_forwardin blasting and removing buildings, purchased and took delivery of a new c E10-8 On January 1, 2020, Murray Demolition, a Hamilton, Ontario, company specializing four years, at which time it should be able to be sold for $60,000. Murray Demoli- $140,000 plus HST on the truck, which is expected to be useful to the business for tion has always used the straight-line basis of calculating amortization. The new uses only the best and newest equipment on their worksites. The business spent truck to add to its growing fleet. Murray Demolition has a high-class reputation and dump owners want to see the amortization schedules for the straight-line, UOP. and D methods just to be sure this makes sense. The business expects the truck to he ful for 200,000 kilometres-60,000 kilometres in Year 1, 50,000 kilometres in eache Years 2 and 3, and 40,000 kilometres in Year 4. Is there a problem with continuing to use the straight-line method?arrow_forward

- Please do not give image formatarrow_forwardManatee Corporation purchased a special conveyor system on December 31, 2025. The purchase agreement stipulated that Manatee should pay $50,000 at the time of purchase and $15,000 at the end of each of the next 5 years. The conveyor system should be recorded on December 31, 2025, at what amount, assuming an appropriate interest rate of 8%?arrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2020, when it was acquired at a cost of $21.6 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the beginning of 2024. Required: Prepare the year-end journal entry for patent amortization in 2024. No amortization was recorded during the year. Record amortization expensearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education