ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

PLEAS ANSWER Q3 and Q4

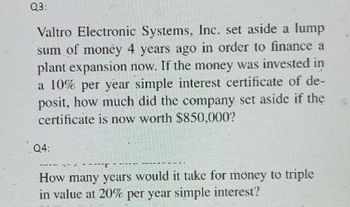

Transcribed Image Text:Q3:

Valtro Electronic Systems, Inc. set aside a lump

sum of money 4 years ago in order to finance a

plant expansion now. If the money was invested in

a 10% per year simple interest certificate of de-

posit, how much did the company set aside if the

certificate is now worth $850,000?

Q4:

KAN

THEY

T

How many years would it take for money to triple

in value at 20% per year simple interest'?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- D3)arrow_forwardThe following table shows cost payoffs for four decision variables and four states of nature. S₁ S2 di 20 20 S S3 54 8 19 4 d2 12 12 40 d3 10 10 16 16 16 d4 30 30 25 20 20 9 110 14 14 Suppose the decision maker assigns the probability for S₁ = 0.10; S2 = 0.40; S3 = 0.20; and S4 = 0.30, what is the expected value of best decision? 21.2 21.8 20 19.2arrow_forwardDon't give poor answerarrow_forward

- Channels 7 and 10 are the only television networks. They want to capture as much of the market as possible because it helps them earn more advertising revenue. Each channel can choose to show a cooking or a reality show on Sunday night. If they both airing cooking shows or both airing reality shows, Channel 10 gets 60% of the market. If Channel 10 is showing a cooking show and Channel 7 is showing a reality show, Channel 10 gets 70% of the market. If Channel 10 is showing a reality show and Channel 7 is showing a cooking show, Channel 7 gets 45% of the market. In a sequential game, Channel 7 moves first. What is true? Group of answer choices Channel 7 will choose reality. Channel 7 has a second mover advantage. Channel 10 will choose cooking. Channel 10 will choose reality. Channel 7 will choose cooking.arrow_forwardThere are two types of workers in financial industry: A (able) type and C (challenged) type. Potential employers in finance will pay $160,000 a year to a type A and $60,000 to a type C. Unfortunately, employers cannot observe the worker's type while each worker knows his or her own type. However, a market research informs all employers and workers that 60% of the population is type A and 40% is type C. a) Assume that employers in finance treat every applicant as a random draw from the population and pay all the same salary. Then, the pooling salary is $ thousands separator). (Hint: omit the b) Alternative employment opportunities outside of the financial industry yield the A types a salary of $125,000 and the C types a salary of $30,000. If the pooling salary in a) is offered to any applicant in finance, type workers will leave the financial industry and only type workers will stay in the industry. When this continues, the salary in finance will eventually reduce to $ (Hint: omit the…arrow_forwardExercise 1.4. There are two players. Each player is given an unmarked envelope and asked to put in it either nothing or $300 of his own money or $600. A referee collects the envelopes, opens them, gathers all the money, then adds 50% of that amount (using his own money) and divides the total into two equal parts which he then distributes to the players. (a) Represent this game frame with two alternative tables: the first table showing in each cell the amount of money distributed to Player 1 and the amount of money distributed to Player 2, the second table showing the change in wealth of each player (money received minus contribution). (b) Suppose that Player 1 has some animosity towards the referee and ranks the outcomes in terms of how much money the referee loses (the more, the better), while Player 2 is selfish and greedy and ranks the outcomes in terms of her own net gain. Represent the corresponding game using a table. (c) Is there a strict dominant-strategy equilibrium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education