ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

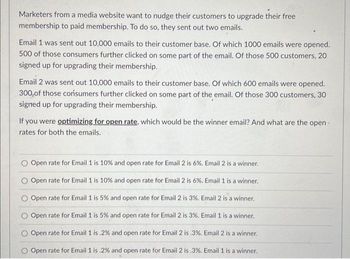

Transcribed Image Text:Marketers from a media website want to nudge their customers to upgrade their free

membership to paid membership. To do so, they sent out two emails.

Email 1 was sent out 10,000 emails to their customer base. Of which 1000 emails were opened.

500 of those consumers further clicked on some part of the email. Of those 500 customers, 20

signed up for upgrading their membership.

Email 2 was sent out 10,000 emails to their customer base. Of which 600 emails were opened.

300 of those consumers further clicked on some part of the email. Of those 300 customers, 30

signed up for upgrading their membership.

If you were optimizing for open rate, which would be the winner email? And what are the open-

rates for both the emails.

Open rate for Email 1 is 10% and open rate for Email 2 is 6%. Email 2 is a winner.

O Open rate for Email 1 is 10% and open rate for Email 2 is 6%. Email 1 is a winner.

Open rate for Email 1 is 5% and open rate for Email 2 is 3%. Email 2 is a winner.

Open rate for Email 1 is 5% and open rate for Email 2 is 3%. Email 1 is a winner.

Open rate for Email 1 is.2% and open rate for Email 2 is .3%. Email 2 is a winner.

Open rate for Email 1 is .2% and open rate for Email 2 is .3%. Email 1 is a winner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- AirPorter (AP) Don't offer Offer Don't offer AP earns $8,000 LimoZeenz (LZ) AP earns $10,000 LZ earns $16,000 LZ earns $8,000 AP earns $15,000 AP earns $12,000 Offer LZ earns $12,000 AirPorter offers the discount, but LimoZeenz does not. Both LimoZeenz and AirPorter do not offer the discount. There is no Nash equilibrium. LimoZeenz offers the discount, but AirPorter does not. LZ earns $6,000 LimoZeenz and AirPorter and are the only two airport shuttle. Each firm must decide on whether to offer its customers a mid-week discount for airport transportation. The table above shows the payoff matrix for profits earned by each company based on either offering or not offering the discount. Refer to the table above, what is the Nash equilibrium in this game?arrow_forwardYou are considering subscribing to Hulu. You are willing to pay up to $39 per year for a subscription. The current annual price is $109. Calculate your consumer surplus under these circumstances.arrow_forwardDisney operates two theme parks in California: Disneyland and California Adventure. Disney has long charged the same price for the two parks, currently $400 per day for a four-person family. However with fewer tourists and more local visitors over the past year, Disney is considering park-specific pricing along with a “weekender” bundle. Disney media have different appeal to boys and girls, which affects demand for theme parks. Disney estimates demand for three family types: Boy (B), Girl (G) and Mixed (M). Each family buys at most one ticket of each type, and there are 1 million families of each type each month. Maximum willingness to pay for each park for each family is shown in the table below. Assume the marginal cost per family per park is $150. Family Type Disneyland (DL) CA Adventure (CA) Bundle G $700 $200 $900 M $300 $300 $600 B $200 $500 $700 Cost = $150 per family per park a. What are the profit-maximizing prices for Disneyland and California Adventure if tickets are…arrow_forward

- 2narrow_forwardThe demand for a product is more inelastic: the lower the average income of consumers. the poorer the available substitutes. the longer the time period covered. the better the available substitutes. the more narrowly defined the product.arrow_forwardThe demand for a product is inelastic with respect to price if: consumers are largely unresponsive to a per unit price change. the elasticity coefficient is greater than 1. a drop in price is accompanied by a decrease in the quantity demanded. a drop in price is accompanied by an increase in the quantity demanded.arrow_forward

- You are the owner of a local Honda dealership. Unlike other dealerships in the area, you take pride in your “No Haggle” sales policy. Last year, your dealership earned record profits of $1.5 million. In your market, you compete against two other dealers, and the market-level price elasticity of demand for midsized Honda automobiles is -1.6. In each of the last five years, your dealership has sold more midsized automobiles than any other Honda dealership in the nation. This entitled your dealership to an additional 25 percent off the manufacturer’s suggested retail price (MSRP) in each year. Taking this into account, your marginal cost of a midsized automobile is $12,000.What price should you charge for a midsized automobile if you expect to maintain your record sales?arrow_forwardYour firm, Content Colleague, is similar to Happy Worker, a Canadian company that designs and manufactures toys and collectibles. Your research analyst has estimated the demand function for your stuffed toy animals is: If you set the price of a plush toy at $6, the number of toys that consumers will buy is [ million. Q=30 million - (4 million x P).arrow_forwardYou are the owner of a local Honda dealership. Unlike other dealerships in the area, you take pride in your "No Haggle" sales policy. Last year, your dealership earned record profits of $1.3 million. In your market, you compete against two other dealers, and the market- level price elasticity of demand for midsized Honda automobiles is -1.5. In each of the last five years, your dealership has sold more midsized automobiles than any other Honda dealership in the nation. This entitled your dealership to an additional 20 percent off the manufacturer's suggested retail price (MSRP) in each year. Taking this into account, your marginal cost of a midsized automobile is $12,000. What price should you charge for a midsized automobile if you expect to maintain your record sales? Instructions: Enter your response rounded to two decimal places. $arrow_forward

- A Premier League football club estimates that whilst the price elasticity of demand for itsfirst-team fixtures is (–) 0.3, for second-team games the corresponding elasticity is (–)2.2. Provide an explanation for this difference in elasticities and advise the club how this might influence its pricing strategy.arrow_forwardSuppose you're trying to compare the year-to-year performance of one of your regional salespeople over a period during which income grew by 3%. If demand for your products has an income elasticity of 2, how would you measure the salesperson's performance?arrow_forwardYou are the owner of a local Honda dealership. Unlike other dealerships in the area, you take pride in your “no-haggle” sales policy. Last year, your dealership earned record profits of $1.5 million. In your market, you compete against two other dealers, and the market-level price elasticity of demand for midsized Honda automobiles is −.3. In each of the last five years, your dealership has sold more midsized automobiles than any other Honda dealership in the nation. This entitled your dealership to an additional 30 percent off the manufacturer’s suggested retail price (MSRP) in each year. Taking this into account, your marginal cost of a midsized automobile is $12,000. What price should you charge for a midsized automobile if you expect to maintain your record profits?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education