FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

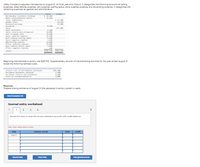

Transcribed Image Text:Valley Company's odjusted trial balance on August 31, its fiscal year-end, follows. It cstegorizes the following accounts os selling

expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It cotegorizes the

remaining expenses os general and administrative.

Debit

Credit

Merchandise inventory (ending)

Other (noninventory) assets

Total liabilitics

$ 42,680

55,518

$ 24,100

Conmon stock

15,520

Retained carnings

Dividends

Sales

Sales discounts

Sales returns and allowances

19,48e

8,700

225,480

Cost of goods sold

Sales salaries expense

Rent expense-Selling space

Store supplies expense

Advertising expense

office salaries expense

Rent expense office space

Office supplies expense

2,268

14, 000

72,600

32,180

8,600

1,se0

13,000

29,800

3,400

350

Totals

$284,420

$284,420

Beginning merchandise inventory wes $25,700. Supplementery records of merchandising octivities for the year ended August 31

reveal the following itemized costs.

Invoice cost of merchandise purchases

Purchases discounts received

Purchases returns and allowances

Costs of transportation-in

$92,100

2,580

4,980

4,880

Required:

Prepare closing entries es of August 31 (the perpetual inventory system is used).

Vlewtraneaction llat

Journal entry worksheet

1 2

3 4

Record the entry to close the income statement accounts with credit balances.

Note: Enter debits before credits.

Date

General Jourmal

Debit

Credit

Aug 31

Record entry

Clear entry

Vew general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense office salaries expense Rent expense-Office space office supplies expense Totals Debit $ 41,000 130,400 Invoice cost of merchandise purchases. Purchases discounts received Purchases returns and allowances Costs of transportation-in 8,000 2,250 12,000 74,500 32,000 8,000 1,500 13,000 28,500 3,600 400 $ 355,150 Credit $ 92,000 2,000 4,500 4,600 $…arrow_forwardMadison Company's perpetual inventory records indicate that $520,930 of merchandise should be on hand on October 31. The physical inventory indicates that $505,510 is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Madison Company for the year ended October 31. If an amount box does not require an entry, leave it blank. Oct. 31 Accounts Payable Accounts Receivable Cash Cost of Goods Sold Inventoryarrow_forwardthe adjusted trial balance of skysong at december 31 shows inventory $24,600, Sales Revenue $164,000, Sales returns and Allowances $3,950, sales discounts $3,000, cost of goods sold $94,000, interest revenue $5,600, freight-out $2,050, utilities expense $7,350, and salaries and wage expense $21,200. prepare the closing entries for skysong for these accounts.arrow_forward

- A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 330 units. Ending inventory at January 31 totals 140 units. Units Unit Cost Beginning inventory on January 1 300 $ 2.80 Purchase on January 9 70 3.00 Purchase on January 25 100 3.14 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method.arrow_forwardValley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense office salaries expense Rent expense-Office space office supplies expense Totals Debit $ 41,000 130,400 Invoice cost of merchandise purchases. Purchases discounts received Purchases returns and allowances Costs of transportation-in 8,000 2,250 12,000 74,500 32,000 8,000 1,500 13,000 28,500 3,600 400 $ 355,150 Credit $ 92,000 2,000 4,500 4,600 $…arrow_forwardPharoah Company cornmenced operations on July 1. Pharoah Company uses a periodic inventory system. During July, PharoahCompany was involved in the following transactions and events:July2Purchased $14,700 of merchandise from Suppliers Inc. on account, terms 2/10, n/30, FOB shipping point.3Returned $1,200 of merchandise to Suppliers Inc. as it was damaged. Received a credit on account from Suppliers.4Paid $580 of freight costs on July 2 shipment.8Sold merchandise for $2,200 cash.11Paid Suppliers Inc. the full armount owing.15Sold merchandise for $6,600 on account, 1/10, n/30, FOB shipping point.25Received full payment for the merchandise sold on July 15.31Pharoah did a physical count and determined there was $9,800 of inventory on hand. calculate its gross profitarrow_forward

- Help pleasearrow_forwardPost the following November transactions to T-accounts for Accounts Payable, Inventory, and Cash, indicating the ending balance. Assume no beginning balances in Accounts Payable and Inventory, and a beginning Cash balance of $21,220.A) purchased merchandise inventory on account, $9,900B) paid vendors for part of inventory purchased earlier in month, $6,500C) purchased merchandise inventory for cash, $4,750arrow_forwardAlpesharrow_forward

- Compute ending inventory and cost of good sold under LIFO, assuming Matthias Company uses the periodic inventory system.arrow_forwardA company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 310 units. Ending inventory at January 31 totals 130 units. Units Unit Cost Beginning inventory on January 1 280 $ 2.60 Purchase on January 9 60 2.80 Purchase on January 25 100 2.94 Required:Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO.arrow_forwardAdjusting entry for customer refunds, allowances, and returnsStatz Company had sales of $1,800,000 and related cost of goods sold of$1,150,000 for its first year of operations ending December 31, 20Y1.Statz provides customers a refund for any returned or damaged merchandise. At the end of 20Y1, Statz Company estimates thatcustomers will request refunds for 1.5% of sales and estimates thatmerchandise costing $16,000 will be returned. Assume that on February3, 20Y2, Buck Co. returned merchandise with an invoice amount of $5,000 for a cash refund. The returned merchandise originally cost StatzCompany $3,100. (a) Journalize the adjusting entries on December 31,20Y1, to record the expected customer returns. (b) Journalize the entriesto record the returned merchandise and cash refund to Buck Co. onFebruary 3, 20Y2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education