FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

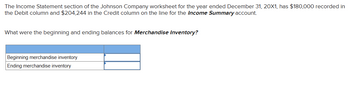

Transcribed Image Text:The Income Statement section of the Johnson Company worksheet for the year ended December 31, 20X1, has $180,000 recorded in

the Debit column and $204,244 in the Credit column on the line for the Income Summary account.

What were the beginning and ending balances for Merchandise Inventory?

Beginning merchandise inventory

Ending merchandise inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SCC Company reported the following for the current year: Net sales Cost of goods sold Beginning balance in inventory Ending balance in inventory Compute (a) Inventory turnover and (b) days' sales In Inventory. Hint Inventory turnover uses average Inventory and days' sales in Inventory uses the ending balance in Inventory. $ 52,000 45,900 2,489 8,400 Complete this question by entering your answers in the tabs below. Inventory Days Sales In Turnover Inventory Compute the days' sales in inventory. Numerator: Days' Sales In Inventory Denominator: =arrow_forwardThe records of Alaska Company provide the following information for the year ended December 31. At Cost $ 473,050 2,771,405 At Retail $928,850 6,281,050 5,512,700 46,300 Beginning inventory, January 1 Cost of goods purchased Sales Sales returns Required: 1. Use the retail inventory method to estimate the company's year-end inventory at cost. 2. A year-end physical inventory at retail prices yields a total inventory of $1,692,800. Prepare a calculation showing the company's loss from shrinkage at cost and at retail. Complete this question by entering your answers in the tabs below. Required 1 Re ired 2 A year-end physical inventory at retail prices yields a total inventory of $1,692,800. Prepare a calculation showing the company's loss from shrinkage at cost and at retail. Note: Round your ratio calculations to 2 decimal places. (i.e. 10.15%) ALASKA COMPANY Inventory Shortage December 31 At Cost Estimated inventory Physical inventory Inventory shortage Required 1 1. Use the retail…arrow_forwardPrepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. July 1 Purchased merchandise from Boden Company for $6,800 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $950 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $567. July 3 Paid $100 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $2,100 for $2,500 cash. July 9 Purchased merchandise from Leight Company for $3,000 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. July 11 Returned $1,000 of merchandise purchased on July 9 from Leight Company and debited its account payable for that amount. July 12 Received the balance due from Creek Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Boden Company within the…arrow_forward

- Based upon the following data for a business with a periodic inventory system, determine the cost of goods sold for August. Inventory, August 1 Inventory, August 31 Purchases Purchases returns and allowances Purchases discounts Freight in Schedule of the Cost of Goods Sold For the Month Ended August 31 Line Item Description Cost of merchandise purchased: Net purchases Total cost of merchandise purchased $ 71,130 90,820 368,870 16,360 12,190 3,540 Amount Amount 1000 $arrow_forwardThe following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardJournalize the following merchandise transactions. The company uses the perpetual inventory system. a. Sold merchandise on account, $14,900 with terms 2/10, net 30. The cost of the goods sold was $9,685. If an amount box does not require an entry, leave it blank. b. Received payment within the discount period. If an amount box does not require an entry, leave it blank.arrow_forward

- Global Company sold merchandise for $11,700 on account. The cost of the items sold was $7,900. If the company uses the perpetual inventory system, which of the following best reflects the journal entry that should be prepared to record this transaction? Debit Credit A. Sales revenue 11,700 Accounts receivable 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 B. Accounts receivable 11,700 Merchandise inventory 7,900 Sales revenue 3,800 C. Accounts receivable 3,800 Sales revenue 3,800 D. Accounts receivable 11,700 Sales revenue 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 Group of answer choices A. B. C. D.arrow_forwardPresented here are selected transactions for the Pharoah Company during April. Pharoah uses the perpetual inventory system. April 1: Sold merchandise to Mann Company for $6,400, terms 2/10, n/30. The merchandise sold had a cost of $2,600. April 2: Purchased merchandise from Wild Corporation for $7,800, terms 1/10, n/30. April 4: Purchased merchandise from Ryan Company for $1,000, n/30. April 10: Received payment from Mann Company for purchase of April 1 less appropriate discount. April 11: Paid Wild Corporation for April 2 purchase. Journalize the April transactions for Pharoah Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)arrow_forwardA company reported the following balances in some selected accounts: Inventory, 1 March $4,000, Transportation-in $200, Inventory, 31 March $6,000, Purchases $16,000, Purchase Returns and Allowances $500, Purchase discounts $700, Sales $35,000, Sales discounts $1,500. The Cost of Goods Sold for the period is: Group of answer choices $13,000 $16,000 $12,600 $13,400arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education