FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

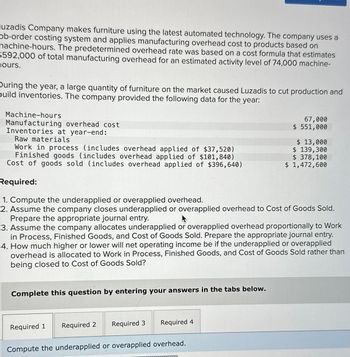

Transcribed Image Text:uzadis Company makes furniture using the latest automated technology. The company uses a

ob-order costing system and applies manufacturing overhead cost to products based on

nachine-hours. The predetermined overhead rate was based on a cost formula that estimates

$592,000 of total manufacturing overhead for an estimated activity level of 74,000 machine-

ours.

During the year, a large quantity of furniture on the market caused Luzadis to cut production and

puild inventories. The company provided the following data for the year:

Machine-hours

Manufacturing overhead cost

Inventories at year-end:

Raw materials

Work in process (includes overhead applied of $37,520)

Finished goods (includes overhead applied of $101,840)

Cost of goods sold (includes overhead applied of $396,640)

Required:

1. Compute the underapplied or overapplied overhead.

2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold.

Prepare the appropriate journal entry.

Complete this question by entering your answers in the tabs below.

3. Assume the company allocates underapplied or overapplied overhead proportionally to Work

in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry.

4. How much higher or lower will net operating income be if the underapplied or overapplied

overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than

being closed to Cost of Goods Sold?

Required 1

Required 2

Required 3

67,000

$ 551,000

Required

Compute the underapplied or overapplied overhead.

$ 13,000

$ 139,300

$ 378,100

$ 1,472,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $814,000 of total manufacturing overhead for an estimated activity level of 74,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Machine-hours 60,000 Manufacturing overhead cost $ 782,000 Inventories at year-end: Raw materials $ 17,000 Work in process (includes overhead applied of $39,600) $ 115,200 Finished goods (includes overhead applied of $112,200) $ 326,400 Cost of goods sold (includes overhead applied of $508,200) $ 1,478,400 Required: 1. Compute the underapplied or…arrow_forwardThe following transactions occurred this period for Larkspur Corp. as it created custom-order scented bubble bath: cost of labor, $16,300; cost of scented oils used, $9,800; and applied MOH, $7,200. Larkspur started the period with $4,900 in its WIP Inventory account. The total cost of jobs completed this period was $30,500. What is the ending balance of Larkspur's WIP Inventory account this period? Ending balance in WIP Inventory account $arrow_forward2. Assume Delph chooses to combine its departmental rates from requirement 1 into a plantwide predetermined overhead rate based on machine-hours. a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year? Complete the question by entering your answers in the tabs given below. Required 2A Required 2B Required 2C Required 2D Assume Delph chooses to combine its departmental rates from requirement 1 into a plantwide predetermined overhead rate based on machine-hours. Compute the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.)arrow_forward

- Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $1,426,000, and management budgeted 92,000 direct labor hours. Mooresville had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of August. These transactions were recorded during August: Purchased 6,000 square feet of oak on account at $26 per square foot. Purchased 150 gallons of glue on account at $36 per gallon (indirect material). Requisitioned 4,200 square feet of oak and 41 gallons of glue for production. Incurred and paid payroll costs of $208,900. Of this amount, $56,000 were indirect labor costs; direct labor personnel earned $22 per hour. Paid factory utility bill, $16,930 in cash. August’s insurance cost for the manufacturing property and equipment was $4,000. The premium had been paid in March. Incurred $9,150…arrow_forwardPlease I want to learn how to make this problem with a good explanation. One of those there is the possible answer. Thank youarrow_forwardKingsford Furnishings Company manufactures designer furniture. Kingsford Furnishings uses job order costing. Balances on April 1 from the materials ledger are as follows: Fabric $58, 300 Polyester filling 30,000 Lumber 58, 800 Glue 9,950 The materials purchased during April are summarized from the receiving reports as follows: Fabric $820,000 Polyester filling 315,000 Lumber 555,000 Glue 80,000 Details The glue is not a significant cost, so it is treated as indirect materials (factory overhead). Journalize the entry to record the purchase of materials in April. Journalize the entry to record the requisition of materials in April.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education