FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

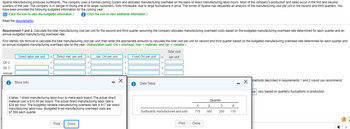

Transcribed Image Text:Spaine Manufacturing produces surfboards. The company uses a normal-costing system and allocates manufacturing overhead on the basis of direct manufacturing labor-hours. Most of the company's production and sales occur in the first and second

quarters of the year. The company is in danger of losing one of its larger customers, Sofo Wholesale, due to large fluctuations in price. The owner of Spaine has requested an analysis of the manufacturing cost per unit in the second and third quarters. You

have been provided the following budgeted information for the coming year:

(Click the icon to view the budgeted information.)

(Click the icon to view additional information.)

Read the requirements.

Requirement 1 and 2. Calculate the total manufacturing cost per unit for the second and third quarter assuming the company allocates manufacturing overhead costs based on the budgeted manufacturing overhead rate determined for each quarter and an

annual budgeted manufacturing overhead rate.

First identify the formula to calculate the total manufacturing cost per unit, then enter the appropriate amounts to calculate the total cost per unit for second and third quarter based on the budgeted manufacturing overhead rate determined for each quarter and

an annual budgeted manufacturing overhead rate for the year. (Abbreviation used: OH = overhead, mat. = materials, and Var. = variable.)

Qtr 2

Qtr 3

Annual

Direct labor per unit

i More Info

+

+

+

+

Direct mat. per unit

Print

+

Done

+

Var. OH per unit

-

It takes 1 direct manufacturing labor-hour to make each board. The actual direct

material cost is $10.00 per board. The actual direct manufacturing labor rate is

$24 per hour. The budgeted variable manufacturing overhead rate is $17 per direct

manufacturing labor-hour. Budgeted fixed manufacturing overhead costs are

$7,500 each quarter.

X

+

Fixed OH per unit

i Data Table

Total cost

per unit

Surfboards manufactured and sold

Print

1

775

Done

Quarter

2

300

3

250

4

175

- X methods described in requirements 1 and 2 would you recommend

hot vary based on quarterly fluctuations in production.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Angie March owns a catering company that stages banquets and parties for both individuals and companies. The business is seasonal, with heavy demand during the summer months and year-end holidays and light demand at other times. Angle has gathered the following cost information from the past year: A.) Identify the high and low points (Activity level) $ High Low Using the high-low method, compute the overhead cost per labor hour and the fixed overhead cost per month. (Round variable cost to 2 decimal places, eg. 15.25 and fixed cost 5 O decimal places, e.g. 5,275.) Variable cost = $________ per labor hour. Fixed cost=$____________ B.) Angie has booked 4,200 labor hours for the coming month. How much overhead should she expect to incur? Total Cost =$______ C.) If Angie books one more catering job for the month, requiring 350 labor hours. how much additional overhead should she expect to incur? Additional…arrow_forwardCarla Vista Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a finishing process that can only be completed on machines that were recently purchased for this purpose. The machines have a maximum capacity of 10,500 machine hours, and no other products that the company makes use these machines. Sarah Jacob, the company's operations manager, is preparing the production schedule for the coming month and can't seem to find enough machine time to produce enough units to meet the customer demand that the marketing department has included in the sales budget. Michael Stoner, the company's controller, has gathered the following information about the two products: Dumbbell Weight Rack Bench Selling price per unit $44 $60 Direct materials 19 16 Direct labor 4 8 Variable overhead 3 6 Fixed overhead 5 10 Profit per unit $13 $20 Unit sales demand 5,000 8,000 Machine hours per unit 0.75 1.5 LOarrow_forwardZion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $25 each. Zion uses 10 000 units of Component K2 each year. The cost per unit of this component is as follows: 1 Direct materials Direct labour Variable overhead Fixed overhead Total Refer to the information for Zion Manufacturing. The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 2 3 $12.00 8.25 4.50 2.00 $26.75 What are the alternatives facing Zion Manufacturing with respect to production of Component K2? List the relevant costs for each alternative. If Zion decides to purchase the component from Bryce, by how much will operating income increase or decrease? Which alternative is better?arrow_forward

- I need assistance with the Balance Sheet, Income Statements, and Schedule of Goods Manufactured. Please can you provide detailed information so I can see the structure.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSolve the following problem: The service department at Major Motors sold $48,000 in service last month. They had direct labor costs of $16,500 to pay their technicians. They were not given credit for any parts sales or expenses because that was the responsibility of their separate parts department. They were, however, allocated $29,250 in fixed expenses. What was Major Motors net profit?arrow_forward

- Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $1,068,000 of total manufacturing overhead for an estimated activity level of 89,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $44,400) Finished goods (includes overhead applied of $150,960) Cost of goods sold (includes overhead applied of $692,640) Required: 1. Compute the predetermined overhead rate used by the company during the year. 2. Is Manufacturing Overhead…arrow_forwardFit-For-A-King Inc. manufactures foam products for several upholstery companies. This company has two workstations, mixing/heating and cutting/assembly. The mixing/heating station is limited by the capacity of the equipment. Cutting/assembly is limited by the speed of the cutting machine workers. Cutting/assembly normally lags behind mixing/heating. Because the demand has increased in recent months, management is considering adding another person to cutting/assembly. This would increase the department's costs by $4,000 a month. If the person is moved from mixing/heating, that department's cost would decline by $3,000. By keeping mixing/heating laborer’s the same, the department can increase production on-call by 10 percent. Current idle time in mixing/heating averages one-half person a day for a net cost of $1,400 a month. Required What is the net effect of moving the employee from mixing/heating to cutting/assembly? What is the net effect if a new employee is hired for…arrow_forwardParts World (PW) designs and produces automotive parts. In 2017, actual manufacturing overhead is $316,000. PW's simple costing system allocates manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so PW's controller Duncan Johnson realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: (Click the icon to view the information.) Read the requirements. Requirement 1. Compute the manufacturing overhead allocated to each customer in 2017 using the simple costing system that uses machine-hours as the allocation base. Determine the formula needed to calculate overhead using the simple…arrow_forward

- Heidt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets. The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees worked a total of 45,300 hours last year, 30,200 on commercial jobs and 15,100 on residential jobs. Wages were $20 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Given current economic conditions and competition, HCS bills residential clients $40 per hour and commercial clients $30 per hour. Required: If overhead for the year was $404,580, what were the profits of the residential and commercial services using labor-hours as the allocation base? Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. Overhead consists of costs of supervision,…arrow_forwardYou’re in Hot Water Inc. manufactures Jacuzzi hot tubs. The company produces two models, the “Basic” and the “Superjet” which promises a jet power setting that “borders on cruel”. Since the introduction of the Superjet, the company’s profits have been faltering, despite increased sales. The company’s senior accountant believes that the costing system may be causing problems. The company uses direct-labour hours as the basis for applying overhead. Overhead is estimated to be $300,000. The following cost data is known: Basic Superjet Direct Materials $700 $1200 Direct Labour ($15 per hour) 60 90 Number of units produced 600 units 100 units The CFO wishes to explore an activity-based costing system Activity (Cost Driver) Estimated MOH Expected Activity Total Basic Superjet Assembly (Labour Hours) $60,000 3,000 2,400 600 Quality control (Inspection Hours) 75,000 800 600 200…arrow_forwardAcklin Company has two products: A and B. The annual production and sales of Product A is 600 units and of Product B is 900 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.5 direct labor-hours per unit and Product B requires 0.3 direct labor-hours per unit. The total estimated overhead for next period is $63,322. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: Activity Cost Pool Est Ovhd Cost Expected Acty - Prod A Expected Acty -Prod B Total Activity 1 $ 18,900 700 200 900 Activity 2 $ 15,631 1,000 100 1,100 General Factory $ 28,791 300 270 570 Total $ 63,322 The overhead cost per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education