Rutland Business Services (RBS) provides miscellaneous consulting and services to local businesses. In August, RBS worked for three clients. It worked 270 hours for Selden Contracting, 170 hours for Moenhart Insurance, and 230 hours for Englewood Medical Center. RBS bills clients at $545 an hour; its labor costs are $140 an hour. A total of 750 hours were worked in August with 80 hours not billable to clients.

Required:

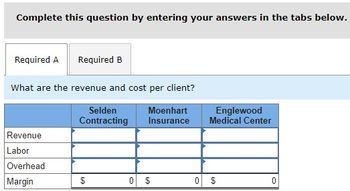

What are the revenue and cost per client?

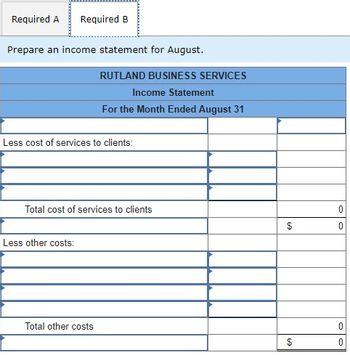

Prepare an income statement for August.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Burnham industries incurs the following costs for the month: Direct materials $2,000 Direct labor 3,000 Factory depreciation expense 3,500 Factory utilities expense 750 CEO's salary 4,000 What is the prime cost?arrow_forwardA local financial consulting firm employs 20 full-time staff. The estimated compensation per employee is $49,000 for 1,900 hours. All direct labour costs are charged to clients. Any other costs are included in a single indirect-cost pool, allocated according to labour-hours. If the total cost of a job (including both labour and overhead) that will take 23 hours is $2,450 using a job order cost system, what is the total budgeted indirect costs for the coming year? Your Answer: Answerarrow_forwardGibson Manufacturing Co. expects to make 30,800 chairs during the year 1 accounting period. The company made 3,300 chairs in January. Materials and labor costs for January were $17,800 and $24,500, respectively. Gibson produced 1,400 chairs in February. Material and labor costs for February were $9,400 and $12,900, respectively. The company paid the $770,000 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Gibson desires to sell its chairs for cost plus 25 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.)arrow_forward

- Strait Co. manufactures office furniture. During the most productive month of the year, 3,100 desks were manufactured at a total cost of $82,600. In the month of lowest production, the company made 1,160 desks at a cost of $58,100. Using the high-low method of cost estimation, total fixed costs arearrow_forwardHijinx Company projected the following overhead costs and cost drivers: Overhead Item Expected Costs Cost Driver Expected Quantity Setup costs $121,500 Number of setups 50 Ordering costs 40,500 Number of orders 30 Maintenance 174,000 Machine-hours 600 Power 27,000 Kilowatt-hours 600 Total overhead cost 363,000 Direct Labor Hours 500 Hijinx contracted for two jobs, both of which were completed during the year. Production managers reported the following data in relation to these jobs: Job 1 Job 2 Direct materials $170,000 $120,000 Direct labor $14,000 $11,000 Direct labor-hours 300 220 Number of setups 25 23 Number of orders 20 13 Machine-hours 410 200 Kilowatt-hours 380 240 If Hijinx uses a company-wide predetermined overhead rate and the allocation basis is machine hour. How much overhead costs should be assigned to Job 1. Show the calculation steps and…arrow_forward.arrow_forward

- Baird Manufacturing Co. expects to make 30,500 chairs during the year 1 accounting period. The company made 4,600 chairs in January. Materials and labor costs for January were $16,600 and $24,200, respectively. Baird produced 1,800 chairs in February. Material and labor costs for February were $9,900 and $13,700, respectively. The company paid the $518,500 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Baird desires to sell its chairs for cost plus 30 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.) January February Price per unitarrow_forward2arrow_forwardOriole Horticulture provides and maintains live plants in office buildings. The company's 934 customers are charged $38 per month for this service, which includes weekly watering visits. The variable cost to service a customer's location is $19 per month. The company incurs $2,432 each month to maintain its fleet of four service vans and $3,330 each month in salaries. Oriole pays a bookkeeping service $2 per customer each month to handle all invoicing and accounting functions.arrow_forward

- Superior, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.10 per yard. The accounting records showed that 2,900 yards of cloth were used and the company paid $1.15 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.75 per direct labor hour. Employees worked 1,400 hours and were paid $10.25 per hour. Read the requirements Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances Print Donearrow_forwardSlapshot Company makes ice hockey sticks and sold 1,880 sticks during the month of June at a total cost of $433,000. Each stick sold at a price of $400. Slapshot also incurred two types of selling costs: commissions equal to 10% of the sales price and other selling expenses of $65,000. Administrative expense totaled $53,800. Must put into a manufacturing firm income statement.arrow_forwardMatthew Diesel owns the Fredonia Barber Shop. He employs 6 barbers and pays each a base salary of $1,490 per month. One of the barbers serves as the manager and receives an extra $600 per month. In addition to the base salary, each barber also receives a commission of $10.40 per haircut. Other costs are as follows. Advertising $ 220 per month Rent $950 per month Barber supplies $0.50 per haircut Utilities $195 per month plus $0.10 per haircut Magazines $30 per month Matthew currently charges $20.00 per haircut.mpute the break-even point in sales units and in sales dollars. Break - even point haircuts Break-even point sales Break-even point Compute the break-even point in sales units and in sales dollars. Break-even point sales $ 3 Tauthooke sød Madis c haircutsarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education