FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

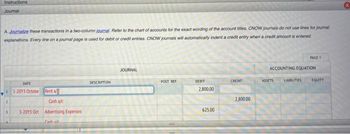

Transcribed Image Text:Instructions

Journal

A. Journalize these transactions in a two-column journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal

explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered

PAGE 1

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

CREDIT

LIABILITIES

DEBIT

2,800.00

11-2013 Octobe

Rent a/

2

625.00

Cash a/c

3-2013 Oct Advertising Expenses

Cash ale

2,800.00

ASSETS

EQUITY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Make a journal entry for the 5 listed items above for a thumbs uparrow_forwardOn August 1, 2018, Trico Technologies, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Interest is payable at maturity. FirstBanc Corp's year-end is December 31. Required: 1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below for FirstBanc Corp. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet 2 3 Record the acceptance of note. Note: Enter debits before credits. Date General Journal Debit Credit August 01, 2018 Record entry Clear entry View general journalarrow_forwardLi Corp. purchased a container load of antiques for resale at an invoice cost of $1,600,000. The goods were paid for when they were shipped in early June. The container arrived in Canada at the end of August, and then at Li's location, by rail, at the end of September. The goods were then available for sale. Freight costs of $168,000 were paid in October. Li has recorded $100,800 of total interest expense from $2,400,000 of general borrowing over the year. Required: Prepare the adjusting journal entry to capitalize borrowing costs on inventory at year-end December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet 1 Record entry to capitalize borrowing cost. Note: Enter debits before credits. Transaction General Journal Debit Credit 1arrow_forward

- Bramble Corporation was organized on January 1, 2022. It is authorized to issue 10,500 shares of 8%, $100 par value preferred stock, and 477,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Apr. May Aug. Issued 75,500 shares of common stock for cash at $4 per share. Issued 5,650 shares of preferred stock for cash at $105 per share. Issued 25,000 shares of common stock for land. The asking price of the land was $86,500. The fair value of the land was $83,000. Issued 84,500 shares of common stock for cash at $4.25 per share. 1 Issued 11,000 shares of common stock to attorneys in payment of their bill of $41,000 for services performed in helping the company organize. Issued 10,000 shares of common stock for cash at $6 per share. 1 Issued 2,500 shares of preferred stock for cash at $111 per share. Sept. Nov. 1 1 1arrow_forwardDrawing is recorded in the Balance Sheet Credit column of a worksheet True or falsearrow_forwardThe general ledger of Zips Storage at January 1, 2024, includes the following account balances: Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable! Deferred Revenue Common Stock Retained Earnings Totals Debits $25,500 16,300 13,800 157,000 $212,600 Credits $7,600 6,700 Pay property taxes, $9,400. Pay on accounts payable, $12,300. 152,000 46,300 $212,600 The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $143,100, and on account, $56,700. Collect on accounts receivable, $52,400. Receive cash in advance from customers, $13,800.. Purchase supplies on account, $11,000. Pay salaries, $132,600. Issue shares of common stock in exchange for $36,000 cash. Pay $3,700 cash dividends to stockholders. Insurance expired during the year is $7,900. Supplies remaining on hand at the end of the year equal $3,800.…arrow_forward

- Asked this question before but the answer does not allow me to scroll and see the account titles and debit/credit. Only shows a grid.arrow_forwardJournal entry: If a company uses the ALLOWANCE method for valuing Accounts Receivable on the balance sheet, what will the journal entry be (with out amounts) at the end of the accounting period. Journal: Debit Account Credit Accountarrow_forwardThe following comments each relate to the recording of journal entries. Which statement is true? Question 1 Select one: a. Journalization is the process of converting transactions and events into debit/credit format. b. For any given journal entry, debits must exceed credits c. The chart of accounts reveals the amount to debit and credit to the affected accounts d. It is customary to record credits on the left and debits on the rightarrow_forward

- During the current year ended December 31, Rank Company disposed of three different assets. On January 1 of the current year, prior to their disposal, the asset accounts reflected the following: Asset Machine A Machine B Machine C a. Machine A. b. Machine B. c. Machine C. The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $6,750 cash. b. Machine B: Sold on December 31 for $8,000; received cash, $2,000, and a $6,000 interest-bearing (10 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident and was scrapped. Required A Required: 1. Give all journal entries related to the disposal of each machine in the current year. Original Cost Residual Value $24,000 16,500 59,200 Complete the following questions by preparing worksheet and journal entries given below. View transaction list Required B Required C 1 Journal entry worksheet Give all journal…arrow_forwardInstructions The following equity investment transactions were completed by Romero Company during a recent year. Apr. July Sept. 10 Purchased 4,700 shares of Dixon Company for a price of $49 per share plus a brokerage commission of $120. 8 Received a quarterly dividend of $0.70 per share on the Dixon Company investment. 10 Sold 1,900 shares for a price of $41 per share less a brokerage commission of $75. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers the nearest dollar.arrow_forwardReyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education