FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

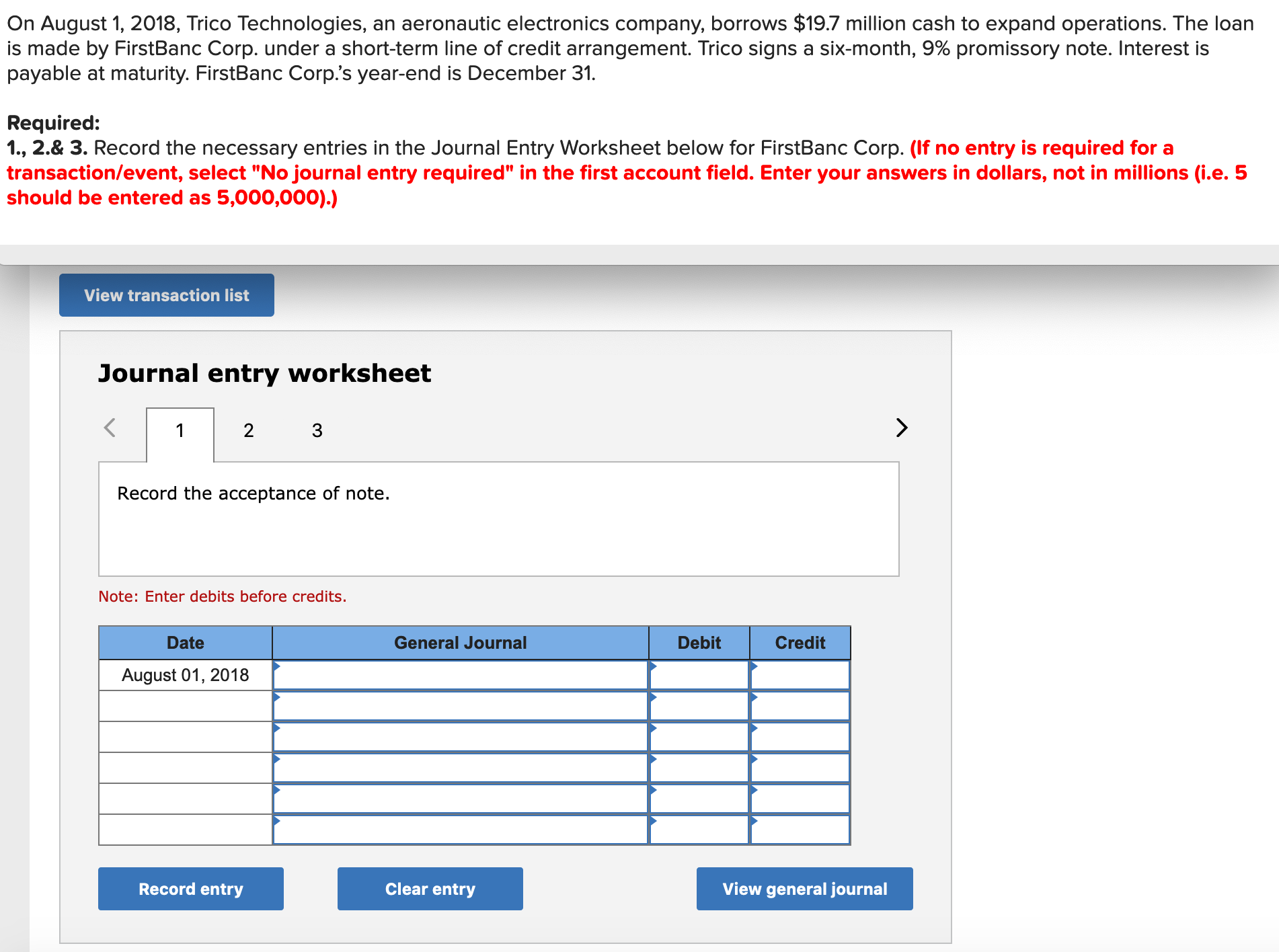

Transcribed Image Text:On August 1, 2018, Trico Technologies, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan

is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Interest is

payable at maturity. FirstBanc Corp's year-end is December 31.

Required:

1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below for FirstBanc Corp. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5

should be entered as 5,000,000).)

View transaction list

Journal entry worksheet

2 3

Record the acceptance of note.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

August 01, 2018

Record entry

Clear entry

View general journal

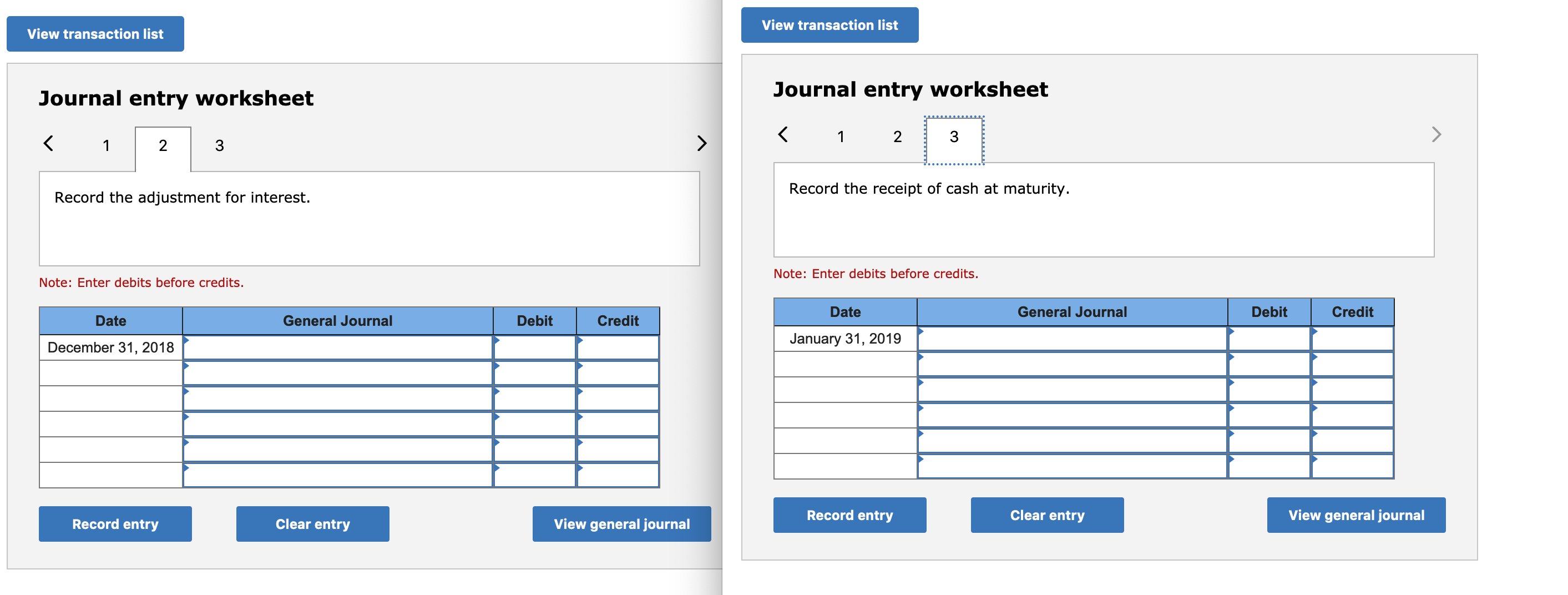

Transcribed Image Text:View transaction list

View transaction list

Journal entry worksheet

Journal entry worksheet

3

3

Record the adjustment for interest.

Record the receipt of cash at maturity.

Note: Enter debits before credits.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Date

General Journal

Debit

Credit

December 31, 2018

January 31, 2019

Record entry

Clear entry

View general journal

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On August 1, Year 1, Company A, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by Company B under a short-term line of credit arrangement. Company A signs a six-month, 9% promissory note. Interest is payable at maturity. Company A's year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below for Company A. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet 1 3 > Record the issuance of note. Note: Enter debits before credits. Date General Journal Debit Credit August 01arrow_forwardMidshipmen Company borrows $18,000 from Falcon Company on July 1, 2024. Midshipmen repays the amount borrowed and pays interest of 12% (1%/month) on June 30, 2025. Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below for Midshipmen Company. 3. Calculate the 2024 year-end adjusted balances of Interest Payable and Interest Expense (assuming the balance of Interest Payable at the beginning of the year is $0).arrow_forwardOn August 1, Year 1, Company A, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by Company B under a short-term line of credit arrangement. Company A signs a six-month, 9% promissory note. Interest is payable at maturity. Company B's year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below for Company B. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet 1 > Record the acceptance of note. Note: Enter debits before credits. Date General Journal Debit Credit August 01arrow_forward

- On August 1, Year 1, Company A, an aeronautic electronics company, borrows $19.7 million cash to expand operations. The loan is made by Company B under a short-term line of credit arrangement. Company A signs a six-month, 9% promissory note. Interest is payable at maturity. Company B's year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below for Company B. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) X Answer is complete but not entirely correct. No Date General Journal Debit Credit 1 August 01 Notes Receivable 19,700,000 Notes Payable 19,700,000 2 December 31 Interest Receivable 738,750 Interest Revenue 738,750 January 31 Cash 20,586,500 Interest Receivable 147,750 X Notes Receivable 738,750 X Cash 19,700,000 Xarrow_forwardPART - E Toner Limited (“Toner") borrows $180,000 on 1 July 2020 from Lighthouse Bank and signs a $180,000, 5%, 1-year promissory note. Assuming yearly accounting periods and a financial year end balance date of 31 December. Required: (i) Prepare the general journal entries to record the issuance of the promissory note. (ii) Prepare the general journal entries to record the adjusting journal entries as at 31 December 2020. (iii) Prepare the general journal entries to record the repayment on 1 July of 2021.arrow_forwardCucina Corporation signed a new installment note on January 1, 2021, and deposited the proceeds of $51,800 in its bank account. The note has a 3-year term, compounds 5 percent interest annually, and requires an annual installment payment on December 31. Cucina Corporation has a December 31 year-end and adjusts its accounts only at year-end. Required: 1. Use an online application, such as the loan calculator with annual payments at mycalculators.com, to complete the amortization schedule. 2. Prepare the journal entries on (a) January 1, 2021, and December 31 of (b) 2021, (c) 2022, and (d) 2023. 3. If Cucina Corporation's year-end were March 31, rather than December 31, prepare the adjusting journal entry it would make for this note on March 31, 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Use an online application, such as the loan calculator with annual payments at mycalculators.com, to complete the amortization schedule. (Do…arrow_forward

- On the first day of the fiscal year, Shiller Company borrowed $32,000 by giving a 5-year, 11% installment note to Soros Bank. The note requires annual payments of $8,783, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $3,520 and principal repayment of $5,263. Journalize the entries to record the following: Question Content Area a1. Issued the installment note for cash on the first day of the fiscal year. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blank Question Content Area a2. Paid the first annual payment on the note. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardOn January 1, 2021, Nantucket Ferry borrowed $14,600,000 cash from BankOne and issued a four-year, $14,600,000, 8% note. Interest was payable annually on December 31. Prepare the journal entries for both firms to record interest at December 31, 2021.arrow_forwardPrecision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.4 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the…arrow_forward

- The transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November 1, 2019 Coe borrowed $25,000 at 6 percent for 6 months. The entry to record the November 1 borrowing transaction would include a: A. Credit to notes payable for $750 B. Credit to notes payable for $24,250 C. Debit to cash for $24,250 D. Debit to cash for $25,000arrow_forwardOn January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year. Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1, Year 1. Which of the following shows the effect of this event on the financial statements? Assets A. 2,000 B. 2,000 C. 2,000 D. 2,000 Multiple Choice O OOO Balance Sheet Liabilities + 2,000 n/a n/a 2,000 Option B Option D Option A Option C Stockholders' Equity n/a 2,000 2,000 n/a Revenue n/a 2,000 2,000 n/a Income Statement Expense n/a n/a n/a n/a = Net Income n/a 2,000 2,000 n/a Statement of Cash Flows 2,000 IA 2,000 IA 2,000 OA 2,000 FAarrow_forwardOn November 1, 2021, Aviation Training Corp. borrows $44,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 6% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Record the adjusting entry for interest. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education