ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

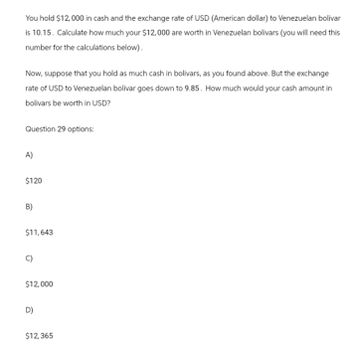

Transcribed Image Text:You hold $12,000 in cash and the exchange rate of USD (American dollar) to Venezuelan bolivar

is 10.15. Calculate how much your $12,000 are worth in Venezuelan bolivars (you will need this

number for the calculations below).

Now, suppose that you hold as much cash in bolivars, as you found above. But the exchange

rate of USD to Venezuelan bolivar goes down to 9.85. How much would your cash amount in

bolivars be worth in USD?

Question 29 options:

A)

$120

B)

$11,643

$12,000

D)

$12,365

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the end of 2021 , the Federal Reserve took an inventory of its foreign currency reserves. Since the previous year, the following had change Currency Yen (+1-) Change (millions) -26.17 -22.80 Yuan US Dollars 47.57 92.04 Rupees Riyals Pesos 85.61 38.33 Shekels |-30.87 How much did NCO change during this time period? Round to two (2) decimal placesarrow_forwardPlease see photoarrow_forwardOver the past 20 years, Brazil has experienced relatively high inflation while Japan has experienced relatively low inflation. What do you think has happened to the number of Brazilian reais a person can buy with a Japanese yen?arrow_forward

- A UK-manufactured car sells for GBP 14.000. A french-manufactured car sells for EUR 15.750. If the EUR/GBP exchange rate is 1.17, how much does the french-made car cost in GBP? a. 13.467 b. 14.500 c. 16.380 d. 18.427arrow_forwardImagine you are a German investor trying to decide whether to buy American or European bonds. A ten-year bond issued by America’s Treasury today offers about 3%; German bonds return only 1.2%. But buying American means taking a gamble on the euro-dollar exchange rate. You are interested in the return in euros. The bond issued in the US will be attractive only if the extra yield exceeds any expected loss due to swings in currency markets. This thinking explains why the dollar has recently soared against the euro. In July 2022 the dollar reached a one-for-one exchange rate with the euro for the first time since 2002. Is it always true that a currency appreciates in value when the interest rate it offers increases relative to foreign interest rates? Explain.arrow_forwardThe following graph plots the forward premium for a foreign currency along the horizontal axis, while measuring the interest rate differential (between a home country and a foreign country) along the vertical axis. in refers to the interest rate in the home country, while if refers to the interest rate in a foreign country. On the following graph, use the blue line (circle symbol) to plot the combinations of the forward premium and interest rate differential that are consistent with interest rate parity (IRP). ih - if (%) 7 6 -7 -6 -5 -4 -3 -2 5 4 3 2 0 -1 -2 -3 -4 -5 -6 -7 -1 1 2 3 4 5 6 7 Forward Premium (%) IRP Line ?arrow_forward

- Between 1879 and 1914, the world's major nations adhered to the gold standard. Under the gold standard, a country maintained a fixed relationship between its stock of gold and its money supply. Suppose that Germany defined a German mark as 30 grains of gold, and the United States defined $1 as 60 grains of gold. Under the gold standard, a German mark would have been worth U.S. dollars.arrow_forwardAssume that you buy a 1-year, 168,000-peso Philippine bond that pays 9 percent when the exchange rate is 1 Canadian dollar for 42 pesos. If, after one year, the peso falls to 1 Canadian dollar equals 45 pesos, how much have you gained or lost in Canadian dollars? Round your answer to the nearest dollar amount. loss * $ 4353arrow_forwardAnswer last two questionsarrow_forward

- Options are gain or loss. Note : don't use chat gp8arrow_forwardOolong tea is produced in China and sold in many countries. In the province of Fujian, per 100 grams of Oolong tea sells for 50 yuan. In Kuala Lumpur, per 100 grams of the same Oolong tea sells for RM20. Suppose that the exchange rate is RM0.45 1 yuan. Please do the following calculations based on the above information: 1. How much would it cost in Malaysian currency to buy the tea in Fujian? 2. How much would it cost in China currency to buy the tea in Kuala Lumpur?arrow_forwardHow much of their local currency would someone from UK (local currency is Pound) need to buy an iPad that is being sold for #=$500 in the US?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education