Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

options:

|

|

A)11.5% |

|

|

B)10.1% |

|

|

C)5.1% |

|

|

D)7.35% |

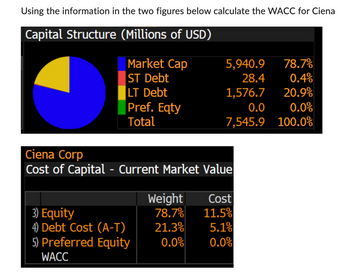

Transcribed Image Text:Using the information in the two figures below calculate the WACC for Cienal

Capital Structure (Millions of USD)

Market Cap

ST Debt

LT Debt

Pref. Eqty

Total

5,940.9 78.7%

28.4

0.4%

1,576.7

20.9%

0.0

0.0%

7,545.9 100.0%

Ciena Corp

Cost of Capital - Current Market Value

3) Equity

4) Debt Cost (A-T)

5) Preferred Equity

WACC

Cost

11.5%

Weight

78.7%

21.3%

5.1%

0.0% 0.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the month PITI (in $) for the mortgage. (Round dollars to the nearest cent.) Amount Interest Financed Rate $280,000 3.50% Term of Loan (years) 25 $ Monthly PI Annual Property Tax $6,573 Annual Insurance $2,186 $ Monthly PITIarrow_forward48 The Sunland Products Co. currently has debt with a market value of $300 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,434.63 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $10 per share. The preferred shares pay an annual dividend of $1.20. Sunland also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever. If Sunland is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen…arrow_forwardN7arrow_forward

- Options for A: 1.10% , 1.89% , 2.43% , 3.12% , 3.90% Options for B: 7.78% , 6.22% , 3% , 4% , 5.38% Options for C: 3.18% , 2.43% , 5.01% , 5.89% , 4.24%arrow_forward5. 6. Use the following information to answer Questions 5 and 6 You are given the following binomial interest model. Compounding is annual. t = 0 t = 1 i1,H = 3.6% io = 2% ίο i1,L = 2.8% Bond F is a 2-year 4% annual coupon bond with a face value of $100, callable at time t = 1. Find the price of the call option embedded in Bond F. Bond G is 2-year 2.5% annual coupon bond with a face value of $100, putable at times t = 0, and t = 1. Find the price of the put option embedded in Bond G.arrow_forwardThe highest current CMHC premium is a. 4.00%. b. 4.50%. c. 5.50%. d. 5.00%.arrow_forward

- a2arrow_forwardExercise 9-21 (Static) Part 1 Required: 1-a. If the market rate is 8%, calculate the issue price. (EV of $1. PV of $1. EVA of $1, and PVA of $1) 1-b. Will the bonds issue at face amount, a discount, or a premium? Complete this question by entering your answers in the tabs below. Req 1a Req 1b If the market rate is 8%, calculate the issue price. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Enter your answers in dollars not in millions (i.e., $5.5 million should be entered as 5,500,000). Round your final answers to the nearest whole dollar.) Bond Characteristics Amount $ 41,000,000 Face amount Interest payment Number of periods Market interest rate Issue price Ren 1a Rea 1barrow_forwardQ1. Price and Yield. Yield (%) Price at required yield ( coupon rate/ maturity) 6% / 5 6% / 20 3%/5 3% / 20 0% / 5 0% / 20 year year year year year year 3.00 4.00 5.50 5.90 5.99 6.00 6.01 6.10 7.50 8.00 Assume face value is $100. a. Plot the table. b. What is the shape of the price-yield relationship? c. Describe the general relationship you observe between changes in bond prices and changes in yield to maturity.arrow_forward

- What was the Bond Fund's annualized return over the period specified? (Pick the closest answer) Question 1 options: 8% 406 IPO 600 Iarrow_forwardD2arrow_forwardWhat is the result in B12? A 1 Settlement Date 2 Maturity Date 3 First Call Date 4 Time to Maturity (Years) 5 Coupon Rate 6 Required Return 7 Frequency 8 9 10 Basis 11 Value 12 Yield to Call 12 Face Value Call Price O a. 7.39% O b. 12.68% O c. 10.05% O d. 5.58% B 10/23/2020 10/23/2030 10/23/2025 $ $ 10 7.00% 10.00% 2 1,000 1,035 0 $813.07 ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education