FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

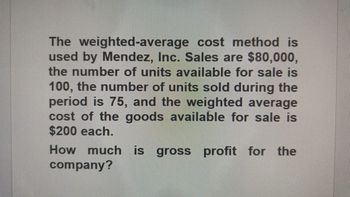

Transcribed Image Text:The weighted-average cost method is

used by Mendez, Inc. Sales are $80,000,

the number of units available for sale is

100, the number of units sold during the

period is 75, and the weighted average

cost of the goods available for sale is

$200 each.

How much is gross profit for the

company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following Income statement was drawn from the records of Fanning Company, a merchandising firm: Sales revenue (7,000 units x $160) Cost of goods sold (7,000 units * $87) Gross margin Sales commissions (5% of sales) Administrative salaries expense Required For the Year Ended December 31, Year 1 Advertising expense Depreciation expense Shipping and handling expenses (7,000 units * $1) Net income FANNING COMPANY Income Statement Req A a. Reconstruct the Income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net Income Fanning will earn If sales Increase by 20 percent. Complete this question by entering your answers in the tabs below. Reg B and C FANNING COMPANY Income Statement For the Year Ended December 31, Year 1 Less: Variable costs Reconstruct the income statement using the contribution margin format. Less: Fixed costs $1,120,088 (609,000) 511,000 (56,000)…arrow_forwardLj Company's total sales was P125,750. If the gross profit is 57.75% of the sales, how much is the cost of goods sold of the company? A) P54,720.05 B P53,029.73 P54,072.50 P53,129.37arrow_forwardA company reports the following information for the current year: Units Produced (25,000)< Units Sold (15,000), DM ($9 per unit), DL ($11 per unit), VOH (total $75,000) and FOH (total $137,500). If the product is sold for $50 per unit and operating expenses are $200,000, compute the net income under absorption costing. O a. $80,500 O b. $122,500 c. $55,000 O d. $67,500arrow_forward

- Please Provide answer of this Questionarrow_forwardIn the Augie Company, sales were $750,000, sales returns and allowances were $30,000, and cost of goods sold was $450,000. The gross profit % (rate) was a) 41.7%. b) 40%. c) 37.5%. d) 36%.arrow_forwardKingsbury Manufacturing has net sales revenue of $940,000, cost of goods sold of $346,400, and all other expenses of $329,200. The net profit margin is: Multiple Choice 0.76 0.72 0.63 0.28arrow_forward

- Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases. Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 2,700,000 112,000 146,000 190,000 515,000 618,000. 93,000 74,000 148,000 237,000 379,000 134,000 175,000 228,000 Prepare an income statement for Delray Manufacturing (a manufacturer). Assume that its cost of goods manufactured is $1,397,00arrow_forwardThe gross margin for Corona Company for the third quarter of the year was R3 250 000, when sales were R7 000 000. The beginning inventory of finished goods was R600 000 and the ending inventory of finished goods was R850 000. The cost of goods manufactured for the third quarter would have been:A.R3 850 000B.R3 750 000C.R4 000 000D.R3 500 000arrow_forwardHow do I find costs of goods sold and operating expenses with the following information? Net Income (Net Loss) 70,000 Sales 890,000 Gross Profit 465,000arrow_forward

- Swank Clothiers had sales of $383,000 and cost of goods sold of $260,000. What is the gross profit margin (ratio of gross profit to sales)? b. If the average firm in the clothing industry had a gross profit of 25 percent? how is the firm doing? SOLVE BOTH QUESTIONSarrow_forwardCushman Company had $814,000 in sales, sales discounts of $12,210, sales returns and allowances of $18,315, cost of goods sold of $386,650, and $280,015 in operating expenses. Gross profit equals: O Multiple Choice $396,825. O $415,140. $409,035. $783,475. $116,810.arrow_forwardThe gross profit margin excludes all costs except the cost of goods sold. If Miller Company recorded Net Sales of $17,260 for the month of March 2021, and cost of goods sold of $11,042, what is the company’s gross profit margin for the month of March. 37.4% 36% 39.2% 38.6%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education