ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

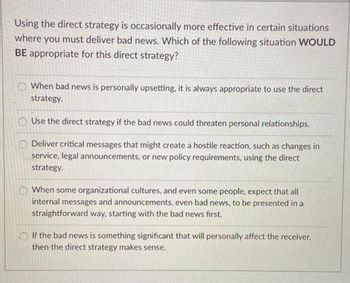

Transcribed Image Text:Using the direct strategy is occasionally more effective in certain situations

where you must deliver bad news. Which of the following situation WOULD

BE appropriate for this direct strategy?

OO

When bad news is personally upsetting, it is always appropriate to use the direct

strategy.

Use the direct strategy if the bad news could threaten personal relationships.

Deliver critical messages that might create a hostile reaction, such as changes in

service, legal announcements, or new policy requirements, using the direct

strategy.

When some organizational cultures, and even some people, expect that all

internal messages and announcements, even bad news, to be presented in a

straightforward way, starting with the bad news first.

If the bad news is something significant that will personally affect the receiver,

then the direct strategy makes sense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please solve the OPERATION RESEARCH problem with a topic of GAME THEORY as per attached file. Thanksarrow_forwardQuestion one is for information only, I need question 3arrow_forward1. What is the definition of Strategy? Why is it important? 2. What are the strategic planning processes seven (7) steps? 3. What are the strategic planning processes important? 4. What NEGATIVE impact can no strategic planning have on any business?arrow_forward

- Problem: Imagine you have two competing athletes who have the option to use an illegal and dangerous drug to enhance their performance (i.e., dope). If neither athlete dopes, then neither gain an advantage. If only one dopes, then that athlete gains a massive advantage over their competitor, reduced by the medical and legal risks of doping (the athletes believe the advantage over their competitor outweighs the risks from doping ). However, if both athletes dope, the advantages cancel out, and only the risks remain, putting them both in a worse position than if neither had been doping. What outcome do we expect from these two athletes? Please use ideas like concepts of monopolies, Oligopolies and Game Theory and Factor markets for this scenario.arrow_forwardQUESTION 8 Kelly and Shawn are both looking to sell their own car. Both cars are exactly the same and are in good condition. However, Kelly's car has a road worthy certificate whereas Shawn's car does not. Select the item from the list provided to make the following statements true. ✓ Kelly's car's road worthy certificate signals to buyers that the car 1. adverse selection is safe and functioning properly. This is an example of 2. trust ✓ A buyer will have to rely on such signal because of ✓ Kelly asked her brother, Thomas to help her sell her car instead. Kelly intends to sell the car for $12,000 in one months time and will give $1,000 to Thomas as commission. However, Thomas proceed to wait for 3 month so that he could sell the car for $13,000 and take in the extra cash for himself. This is an example of 3. asymmetric information 4. marginal benefit 5. principal-agent problem 6. expected value 7. risk loving 8. costly to fake principle 9. risk neutral 10, moral hazard 11, marginal…arrow_forwardDon't use chatgptarrow_forward

- Choice under uncertainty. Consider a coin-toss game in which the player gets $30 if they win, and $5 if they lose. The probability of winning is 50%. (a) Alan is (just) willing to pay $15 to play this game. What is Alan’s attitude to risk? Show your work.(b) Assume a market with many identical Alans, who are all forced to pay $15 to play this coin-toss game. An insurer offers an insurance policy to protect the Alans from the risk. What would be the fair (zero profit) premium on this policy? i need help with question B please.arrow_forward2. In this question, your goal will be to understand whether learning in games is always valuable for players. Consider the following incomplete-information game. First, nature chooses between one of the following two A and B tables, each with probability 0.5: A L R B L R U 0,0 6,-3 U-20,-20 -7,-16 D -3,6 5,5 D -16,-7 -5,-5 Then, players 1 and 2 simultaneously choose U or D and L or R, respectively, and obtain payoffs according to the table chosen by nature. Parts I-III present variations of this game under different assumptions about what players know about nature's move.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education