ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Using the diagram above, suppose the country is initially engaged in free trade and the world

Group of answer choices

a. $200

b. $225

c. $100

d. $400

e. $375

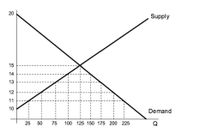

Transcribed Image Text:The image is a graph illustrating the basic economic principles of supply and demand. It displays two lines intersecting on a coordinate plane.

**Axes:**

- The vertical axis represents price, ranging from 10 to 20 in equal increments.

- The horizontal axis represents quantity (Q) ranging from 25 to 225 in increments of 25.

**Lines:**

- The upward sloping line is labeled "Supply."

- The downward sloping line is labeled "Demand."

**Equilibrium Point:**

- The point where the supply and demand lines intersect represents the equilibrium. At this point, the quantity supplied equals the quantity demanded.

- The equilibrium price is approximately 14, and the equilibrium quantity is about 125.

**Conceptual Explanation:**

- **Supply Curve:** This upward sloping line indicates that as prices increase, producers are willing to supply more of the good.

- **Demand Curve:** This downward sloping line shows that as prices decrease, consumers are willing to purchase more of the good.

- The intersection represents market equilibrium, where there is no excess supply or demand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Refer to Figure 9-1. With free trade, total surplus is Group of answer choices $210.00. $552.50. $80.00. $245.50. $472.50. Refer to Figure 9-1. If international trade is prohibited, total surplus will fall by: Group of answer choices $245. $97.5. $210. $102.5 $80.arrow_forwarda. Consider a closed economy (an autarky). The equilibrium price of computers in this autarky is equal to $1,000. Suppose that the world price of computers is equal to $800. Does this country have comparative advantage in producing computers? If this autarky opens up to international trade, will this country export or import computers? b. Show the consumer surplus, producer surplus, equilibrium price and quantity traded for the closed economy in part-a in the market for computers.arrow_forwardThe US, the domestic country, is currently operating a price of $14 per hammer. The US and China are not engaging in international trade. A new treaty is signed, and the world price and domestic price of the product are now $10 per unit. The US producers claim that this new treaty will harm them. The world price of hammers is $10 per hammer before and after the treaty. A. Calculate the consumer surplus before international trade is allowed. Show your work. A. Calculate the consumer surplus after international trade is allowed. Show your work. C. Will the producers in the domestic economy support or argue against opening up to international trade? Briefly explain and support your answer.arrow_forward

- Consider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThe United States imports a lot of cars, despite having its own auto industry. Each of the following statements are arguments some people could make for restricting imports of cars into the United States. For each statement, identify the threat to the U.S. industry that the argument is trying to counter, and identify the opportunities that would be given up if the argument wins. SELECT THE CORRECT ANSWER a. “Foreign manufacturers are offloading their cheap cars onto the U.S. market. We should stop this so that consumers have access to higher-quality U.S. cars.” -National security requires that strategically important goods be produced domestically. -Protection can help infant industries develop. -Foreign competition may lead to job losses. -Anti-dumping laws prevent unfair competition. -Trade should not enable foreign firms to skirt U.S. regulations. b. “We must foster the innovation of small car companies, like Tesla. Allowing foreign electric vehicle manufacturers…arrow_forward

- Please explain/show steps as to how you arrived at your answer. Thank you.arrow_forwardIs it good or bad for American consumers when the United states puts tariffs on imports?arrow_forwardQuestion 39 Before imposing the tariff, consumer surplus was after tariff. p pw E A B Q1 K F Q2 G L H M Q3 Q4 , then became 4arrow_forward

- Consider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forwardPresident Trump increased tariffs on some goods from China. China retaliated by increasing tariffs on some U.S. goods. If free trade is the ideal, what was President Trump’s goal when increasing tariffs? Do you think this was an effective strategy? Why or why not?arrow_forwardEconomics Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education