Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

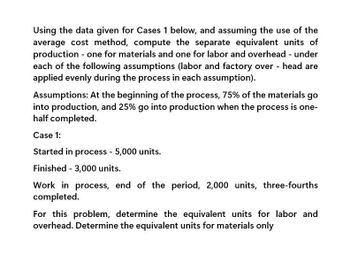

Transcribed Image Text:Using the data given for Cases 1 below, and assuming the use of the

average cost method, compute the separate equivalent units of

production - one for materials and one for labor and overhead - under

each of the following assumptions (labor and factory overhead are

applied evenly during the process in each assumption).

Assumptions: At the beginning of the process, 75% of the materials go

into production, and 25% go into production when the process is one-

half completed.

Case 1:

Started in process - 5,000 units.

Finished 3,000 units.

Work in process, end of the period, 2,000 units, three-fourths

completed.

For this problem, determine the equivalent units for labor and

overhead. Determine the equivalent units for materials only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The cost behavior patterns below are lettered A through H. The vertical axes of the graphs represent total dollars of expense, and the horizontal axes represent production in units, machine hours, or direct labor hours. In each case, the zero point is at the intersection of the two axes. Each graph may be used no more than once. Required: Select the graph that matches the lettered cost described here. a. Depreciation of equipmentthe amount of depreciation charged is computed based on the number of machine hours that the equipment was operated. b. Electricity billflat fixed charge, plus a variable cost after a certain number of kilowatt hours are used. c. City water billcomputed as follows: d. Depreciation of equipmentthe amount is computed by the straight-line method. e. Rent on a factory building donated by the citythe agreement calls for a fixed fee payment, unless 200,000 labor hours are worked, in which case no rent need be paid. f. Salaries of repair workersone repair worker is needed for every 1,000 machine hours or less (i.e., 0 to 1,000 hours requires one repair worker, 1,001 to 2,000 hours requires two repair workers, etc.).arrow_forwardAssuming that all materials are added at the beginning of the process and that labor and factory overhead are applied evenly during the process, compute the figures to be inserted in the blank spaces of the following data, using the weighted average cost method. [Hint: for best success in solving each Case, solve them in numerical order starting with (1)]arrow_forwardThe following data appeared in the accounting records of Craig Manufacturing Inc., which uses the weighted average cost method: Case 1All materials are added at the beginning of the process, and labor and factory overhead are added evenly throughout the process. Case 2One-half of the materials are added at the start of the manufacturing process, and the balance of the materials is added when the units are one-half completed. Labor and factory overhead are applied evenly during the process. Make the following computations for each case: a. Unit cost of materials, labor, and factory overhead for the month b. Cost of the units finished and transferred during the month c. Cost of the units in process at the end of the montharrow_forward

- Overhead costs are assigned to each product based on __________________. A. the proportion of that products use of the cost driver B. a predetermined overhead rate for a single cost driver C. price of the product D. machine hours per productarrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added at the beginning of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forward

- A company has the following information relating to its production costs: Compute the actual and applied overhead using the companys predetermined overhead rate of $23.92 per machine hour. Was the overhead over applied or under applied, and by how much?arrow_forwardRath Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Using the data given for Cases 1 below, and assuming the use of the average cost method, compute the separate equivalent units of production - one for materials and one for labor and overhead - under each of the following assumptions (labor and factory over - head are applied evenly during the process in each assumption). Assumptions: At the beginning of the process, 75% of the materials go into production, and 25% go into production when the process is one- half completed. Case 1: Started in process - 5,000 units. Finished - 3,000 units. Work in process, end of the period, 2,000 units, three-fourths completed. For this problem, determine the equivalent units for labor and overhead. Determine the equivalent units for materials onlyarrow_forwardComputing Equivalent Units, FIFO and Weighted Average Cost Methods Assume each of the following conditions concerning the data given: All materials are added at the beginning of the process. All materials are added at the end of the process. (Note that this would have to be a department subsequent to the first department for all materials to be added at the end of the process, but ignore that fact for purposes of this solution.) Half of the materials are added at the beginning of the process, and the balance of the materials is added when the units are three-fourths completed. In all cases, labor and factory overhead are added evenly throughout the process.arrow_forwarda) Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year b) The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below. Using the data below and an activity-based costing approach, determine the unit product cost of each product for the current year. Expected Activity Activity Cost Estimated Product B Product H Total Pools Overhead Costs Machine setups required Purchase orders issued $180,000 600 1,200 1,800 38,382 500 100 600 Machine- 92,650 6,800 10,200 17,000 hours required Maintenance 138.968 693 907 1,600 requests ued $450,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning