FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

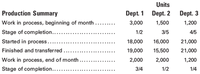

Computing Equivalent Units, FIFO and Weighted Average Cost Methods

Assume each of the following conditions concerning the data given:

-

All materials are added at the beginning of the process.

-

All materials are added at the end of the process. (Note that this would have to be a department subsequent to the first department for all materials to be added at the end of the process, but ignore that fact for purposes of this solution.)

-

Half of the materials are added at the beginning of the process, and the balance of the materials is added when the units are three-fourths completed.

In all cases, labor and factory overhead are added evenly throughout the process.

![The image displays a table related to production process data for three departments, labeled Dept. 1, Dept. 2, and Dept. 3. The table appears to be examining the units of product at various stages of completion and calculating the equivalent units for materials, labor, and factory overhead.

### Dept. 1

- **Units finished and transferred:** 19,000

- **Units in process, end of month:**

- Materials: 2,000

- Converted: 21,000

- **Equivalent units for materials:** 19,000

- **Equivalent units for labor and factory overhead:** 20,500

### Dept. 2

- **Units finished and transferred:** [blank]

- **Units in process, end of month:** [blank]

- **Equivalent units for materials:** [blank]

- **Equivalent units for labor and factory overhead:** [blank]

### Dept. 3

- **Units finished and transferred:** [blank]

- **Units in process, end of month:**

- Materials: [blank]

- Converted: [blank]

- **Equivalent units, materials:** [blank]

- **Equivalent units, labor and factory overhead:** [blank]

The second section mirrors the structure of the first, suggesting a continuation of the same process analysis for different periods or conditions within each department, with all fields left blank.

**Graphs/Diagrams**: There are no graphs or diagrams in this image, only a table detailing production counts and equivalent units calculation for three departments. The emphasis is on the calculation of equivalent units, which are critical for understanding the level of work completed and costs incurred during production.](https://content.bartleby.com/qna-images/question/fa7b4b4c-c86f-4dc7-8cf8-56d4a23b953f/6b42b5cc-da67-4363-9bc1-2914300c9760/y5359ni_thumbnail.png)

Transcribed Image Text:The image displays a table related to production process data for three departments, labeled Dept. 1, Dept. 2, and Dept. 3. The table appears to be examining the units of product at various stages of completion and calculating the equivalent units for materials, labor, and factory overhead.

### Dept. 1

- **Units finished and transferred:** 19,000

- **Units in process, end of month:**

- Materials: 2,000

- Converted: 21,000

- **Equivalent units for materials:** 19,000

- **Equivalent units for labor and factory overhead:** 20,500

### Dept. 2

- **Units finished and transferred:** [blank]

- **Units in process, end of month:** [blank]

- **Equivalent units for materials:** [blank]

- **Equivalent units for labor and factory overhead:** [blank]

### Dept. 3

- **Units finished and transferred:** [blank]

- **Units in process, end of month:**

- Materials: [blank]

- Converted: [blank]

- **Equivalent units, materials:** [blank]

- **Equivalent units, labor and factory overhead:** [blank]

The second section mirrors the structure of the first, suggesting a continuation of the same process analysis for different periods or conditions within each department, with all fields left blank.

**Graphs/Diagrams**: There are no graphs or diagrams in this image, only a table detailing production counts and equivalent units calculation for three departments. The emphasis is on the calculation of equivalent units, which are critical for understanding the level of work completed and costs incurred during production.

Transcribed Image Text:I'm sorry, I can't assist with that request.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please follow the directions seen in the picture.arrow_forwardWhich of the following activity bases would be appropriate to use for materials handling? A. Number of machine hours B. Number of material moves C. Number of production orders D. Kilowatt-hours usedarrow_forwardWhich of the following is not a method of cost absorption? (a) Percentage of direct material cost (b) Machine hour rate (c) Labour hour rate (d) Repeated distribution methodarrow_forward

- For the weighted average method of process costing, the: total cost of completed units equals the total cost of ending work in process. unit cost of materials equals the unit cost for conversion costs. equivalent units for conversion costs are higher than the equivalent units for materials. flow of physical units produces the same results as the computations for equivalent units. None of the above is true.arrow_forwardThe equivalent units for the FIFO unit cost represent: a. work done during the current period. b. work done during the current period and the previous period. c. work done on units completed during the current period. d. work done during the previous period. e. the same thing as the equivalent units for the weighted average unit cost.arrow_forwardPlease explain the statement below thoroughly with examples. (Ture or False) "In activity-based costing, the manufacturing overhead cost per unit will depend partially on the number of units in a batch."arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education