FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using the chart of accounts in Figure 2-1, determine the changes to the

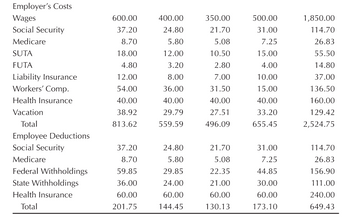

Transcribed Image Text:Employer's Costs

Wages

Social Security

Medicare

SUTA

FUTA

Liability Insurance

Workers' Comp.

Health Insurance

Vacation

Total

Employee Deductions

Social Security

Medicare

Federal Withholdings

State Withholdings

Health Insurance

Total

600.00

37.20

8.70

18.00

4.80

12.00

54.00

40.00

38.92

813.62

37.20

8.70

59.85

36.00

60.00

201.75

400.00

24.80

5.80

12.00

3.20

8.00

36.00

40.00

29.79

559.59

24.80

5.80

29.85

24.00

60.00

144.45

350.00

21.70

5.08

10.50

2.80

7.00

31.50

40.00

27.51

496.09

21.70

5.08

22.35

21.00

60.00

130.13

500.00

31.00

7.25

15.00

4.00

10.00

15.00

40.00

33.20

655.45

31.00

7.25

44.85

30.00

60.00

173.10

1,850.00

114.70

26.83

55.50

14.80

37.00

136.50

160.00

129.42

2,524.75

114.70

26.83

156.90

111.00

240.00

649.43

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bonita Consulting Inc's gross salaries for the biweekly period ended August 24 were $15,000. Deductions included $743 for CPP, $282 for El, and $6,308 for income tax. The employer's payroll costs were $743 for CPP and $395 for El. Prepare journal entries to record (a) the payment of salaries on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to the government until September; and (c) the payment to the government on September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Date Account Titles and Explanation Debit Credit (a) (Ь) (c)arrow_forwardAlpine Company pays its employees time-and-a-half for hours worked in excess of 40 per week. The information available from time cards and employees’ individual earnings records for the pay period ended October 14 is shown in the following chart: Earnings at End Daily Time Income Tax Name of Previous Week M T W T F S Pay Rate Allowances or Amount Bardin, J. 43,627.00 8 8 8 8 8 2 21.30 2 Caris, A. 44,340.00 8 8 8 8 8 8 21.60 1 Drew, W. 43,845.00 8 10 10 8 8 0 21.50 1 Garen, S. 117,600.00 8 8 8 8 8 0 49.00 $227.83 North, O. 43,875.00 8 8 8 8 8 5 21.40 3 Ovid, N. 40,150.00 8 8 8 8 8 0 21.50 1 Ross, J. 6,430.00 8 8 8 8 8 4 20.50 1 Springer, O. 44,175.00 8 8 8 8 8 3 21.25 2 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. *Round to the nearest penny. Required: 1. Complete the payroll register…arrow_forwardDuring the month of January, an employee earned $4,400 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $272.80, FICA Medicare taxes of $63.80, federal income taxes of $468.60, and medical insurance deductions of $187.00. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. Note: Round your final answers to 2 decimal places. View transaction list Journal entry worksheet 1 Record payroll for period. Note: Enter debits before credits. Date January 31 + General Journal Debit Credit Xarrow_forward

- During the month of January, an employee earned $5, 800 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $359.60, FICA Medicare taxes of $84.10, federal income taxes of $617.70, and medical insurance deductions of $246.50. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. Note: Round your final answers to 2 decimal places.arrow_forwardThe post-closing trial balance of Custer Products, Inc. on April 30 isreproduced as follows:arrow_forwardDuring the month of March, Oriole Company's employees earned wages of $80,000. Withholdings related to these wages were $6,120 for FICA $9,600 for federal income tax, $4,000 for state income tax, and $480 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $800 for state unemployment tax. (a) Prepare the necessary March 31 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Mar. 31 Debit Credit NOarrow_forward

- This problem continues the computing and recording employee payroll for the Olney Company for the pay period ending January 8th, 20--. Tasks previously performed include determining gross earnings, FICA withholding, federal, state and city taxes. These computations are shown in the Employee Payroll Register. Requirements: Compute and record the employee's SUTA contributions. Compute and record the Olney Company's SUTA and FUTA contributions. Payroll Register The State Unemployment Tax Act, better known as SUTA, is a form of payroll tax that all states require employers to pay for their employees. SUTA is a counterpart to FUTA, the federal unemployment insurance program. Your tasks now are to compute FUTA and SUTA. Complete the following step: Compute and record the employee's SUTA contributions (employees pay 0.06% on total gross pay). Note: Round your final answers to nearest cent. ONLEY COMPANY, INC.Employee Payroll Register For Period Ending January 8, 20-- EARNINGS…arrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forwardThe gross earnings of factory workers for Blossom Company during the month of January are $320,000. The employer's payroll taxes for the factory payroll are $64,000. Of the total accumulated cost of factory labor, 75% is related to direct labor and 25% is attributable to indirect labor. (a) Prepare the entry to record the factory labor costs for the month of January. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Your answer has been saved. See score details after the due date. Account Titles and Explanation (b) (c) Factory Labor Payroll Liabilities Your answer has been saved. See score details after the due date. Account Titles and Explanation Work in Process Inventory Manufacturing Overhead Prepare the entry to assign factory labor to production. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit…arrow_forward

- E3-3 Modified wage plan Randy Wetzel earns $25 per hour for up to 400 units of produc- tion per day. If he produces more than 400 units per day, he will receive an additional piece rate of $.50 per unit. Assume LO1arrow_forwardDuring January, time tickets show that the factory labor of $6,000 was used as follows: Job 1 $2,200, Job 2 $1,600, Job 3 $1,400, and general factory use (indirect labor) $800.Prepare a summary journal entry to record factory labor used. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31arrow_forwardDetermine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education