International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Answer? ? Financial accounting question

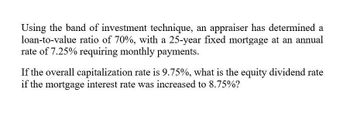

Transcribed Image Text:Using the band of investment technique, an appraiser has determined a

loan-to-value ratio of 70%, with a 25-year fixed mortgage at an annual

rate of 7.25% requiring monthly payments.

If the overall capitalization rate is 9.75%, what is the equity dividend rate

if the mortgage interest rate was increased to 8.75%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume you are purchasing an income-producing property for $10,000,000. The estimated NOI in the next year is $600,000. A lender is willing to provide a mortgage with an annual interest rate of 4.0%. Payments will be made monthly based on a 30-year amortization schedule. The lender requires a minimum debt coverage ratio of 1.25. Based on this required minimum debt coverage ratio, what is the largest loan the lender is willing to make (rounded to the nearest dollar)? Assume the lender will not allow the loan to exceed 85% of the acquisition price under any circumstances. $8,500,000 O $8,478,000 O None of the selections is within a $2 of the correct answer O $8,378,450 O $13,964,083arrow_forwardYou purchase a building that generates a stabilized NOI of $900,000 and has a capitalization rate of 8%. It has been financed with a mortgage loan of $6,750,000 with a 5-year term, a 25-year amortization and an interest rate of 6%. a) Calculate the Loan to Value (LTV) b) Calculate the Debt Service Coverage (DSCR). c) Calculate the loan balance at the end of one year. d) If you sell the building at the end of the year for $12,000,000 what is your Return on Equity (ROE)?arrow_forwardDebt Service Coverage Ratio (DSCR or DCR): Assume that a property has a monthly net operating income (NOI) of $25,000, and that a lender has a minimum DSCR requirement of 1.35. What is the maximum loan that you could obtain assuming a 4.5% interest rate and a 30-year term with monthly payments?arrow_forward

- 15. An investment has an NOI of $40,000. There is market rate mortgage financing available for 75% of the value at 7.5% interest per year with monthly payments, an amortization over 20 years, and an equity dividend rate (R) of 9.5%. What, is the value rounded to the nearest $100,000? Use the band-of- investment technique.arrow_forwardYour property has net operating income of 4,500,000. Assuming you value the property with a cap rate of 6.5%, what is the DSC ratio if the lender will lend up to 75% of value and the rate is 4.5% based on a monthly pay, 30 years, fully amortizing loan? Group of answer choices 1.43 1.35 1.51 1.27arrow_forwardAssume that a lender offers a 30-year, $148,000 adjustable rate mortgage (ARM) with the following terms: Initial interest rate = 7.5 percent Index = one-year Treasuries Payments reset each year Margin = 2 percent Interest rate cap = 1 percent annually; 3 percent lifetime Discount points = 2 percent Based on estimated forward rates, the index to which the ARM is tied is forecasted as follows: Beginning of year (BOY) 2 = 7 percent; (BOY) 3 = 8.5 percent; (BOY) 4 = 9.5 percent; (BOY) 5 = 11 percent. Required: a. Compute the payments and loan balances for the ARM for the five-year period. b. Compute the yield for the ARM for the five-year period.arrow_forward

- Assume that a lender offers a 30-year, $158,000 adjustable rate mortgage (ARM) with the following terms: Initial interest rate = 7.5 percent Index = one-year Treasuries Payments reset each year Margin = 2 percent Interest rate cap = 1 percent annually; 3 percent lifetime Discount points = 2 percent Based on estimated forward rates, the index to which the ARM is tied is forecasted as follows: Beginning of year (BOY) 2 = 7 percent; (BOY) 3 = 8.5 percent; (BOY) 4 = 9.5 percent; (BOY) 5 = 11 percent. Required: a. Compute the payments and loan balances for the ARM for the five-year period. b. Compute the yield for the ARM for the five-year period. Complete this question by entering your answers in the tabs below. Required A Required B Compute the payments and loan balances for the ARM for the five-year period. Note: Do not round intermediate calculations. Round "Payments" to 2 decimal places and "Loan Balance" to the nearest dollar amount. Payments Loan Balance Year 1 Year 2 Year 3 Year 4…arrow_forwardConsidering the following information, what is the NPV if the borrower refinances the loan? Expected holding period: 3 years; current loan balance: $400,000; current loan interest: 5.875%; remaining term on current mortgage: 15 years; new loan interest: 3.625%; new loan term: 15 years; cost of refinancing: $6,000. Assume that the opportunity cost is 10%. Should the borrower refinancearrow_forwardConsider a GNMA mortgage pool with principal of $50 million. The maturity is 30 years with a monthly mortgage payment of 13 percent per annum. Assume no prepayments. a) What is the monthly mortgage payment (100 percent amortizing) on the pool of mortgages? b)If the GNMA insurance fee is 5 basis points and the servicing fee is 45 basis points, what is the yield on the GNMA pass‑through? c) What is the monthly payment on the GNMA in part (b)? d)Calculate the first monthly servicing fee paid to the originating FIs. e) Calculate the first monthly insurance fee paid to GNMA.arrow_forward

- 1. You have just obtained a commercial mortgage for $6.25M with a 5-year term, 25-year amortization period and 6.50% mortgage interest rate. (a) Construct an amortization table for the term of the loan assuming annual payments. What is the annual payment? What is the balance at maturity? (b) What is the e¤ective cost of borrowing if the borrower pays an origination fee of $30,000? (c) The borrower can repay the balance of the loan at any time prior to its maturity, but must pay a penalty of 5% of the outstanding balance. What is the cost of borrowing if the borrower pays an origination fee of $30,000 and pays off the remaining balance of the loan after making payments for 4 years?arrow_forwardAssume a variable - rate mortgage of 500,000 with j 12 = 4% , amortized over 25 years with monthly payment. The term is 5 years. Now 2 years into the term, the borrower is thinking of refinancing it. How much would be the refinancing costs? Figure out exact number with these variablesarrow_forwardI have an NOI of$172,400. The lender indicated that I can borrow funds at a 7.0% interest rate with a 25 year amortization and 5 year term at a 1.20 Debt Service Ratio(DCR). The lender will charge 2 points. a. What is the monthly payment? b. What is the APR (annual percentage rate) if fully amortized? C. What is the APR at the end of the loan term? d. What if I pay the loan off at the end of the second year, what is my APR? e. What if there was a prepayment penalty of 1.5% at the end of year 4, what is myAPR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you