Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Do fast answer of this accounting questions

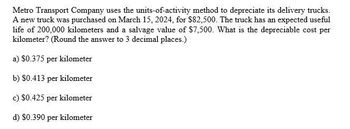

Transcribed Image Text:Metro Transport Company uses the units-of-activity method to depreciate its delivery trucks.

A new truck was purchased on March 15, 2024, for $82,500. The truck has an expected useful

life of 200,000 kilometers and a salvage value of $7,500. What is the depreciable cost per

kilometer? (Round the answer to 3 decimal places.)

a) $0.375 per kilometer

b) $0.413 per kilometer

c) $0.425 per kilometer

d) $0.390 per kilometer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. Dunedin buys equipment frequently and wants to print a depreciation schedule for each assets life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are depreciated by straight-line, others by units of production, and others by double-declining balance, DEPREC shows all three methods. You are to use this worksheet to prepare depreciation schedules for the new machine.arrow_forward

- Whispering Winds Corp. purchased a delivery truck for $34,000 on January 1, 2022. The truck has an expected salvage value of $5,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 16,100 in 2022 and 11,700 in 2023. (a1) Your answer is correct. Calculate depreciable cost per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) Depreciable cost .29 per mile eTextbook and Media List of Accounts Attempts: unlimited %24arrow_forwardYello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2020, at a cost of $299,818. Over its 4-year useful life, the bus is expected to be driven 190,600 miles. Salvage value is expected to be $8,200. (a) X Your answer is incorrect. Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depreciation cost per unit LA $ 1.40 per milearrow_forwardHelp mearrow_forward

- I want the correct answer with accounting questionarrow_forwardDaarrow_forwardSheffield Corp. purchased a delivery truck for $40,500 on January 1, 2022. The truck has an expected salvage value of $8,500, and is expected to be driven 100,000 miles over its estimated useful life of 10 years. Actual miles driven were 16,800 in 2022 and 12,600 in 2023.arrow_forward

- A company purchased a van at a cost of $42,000 and expects its salvage value to be $6,000 after 100,000 miles of service. Using the units-of-production method, what is the first year's depreciation if the van is driven 30,000 miles? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)arrow_forwardVaibharrow_forwardwhat is the depreciation expense and accumulated depreciation equipment ? 1.Please Complete Solution With Details 2.Final Answer Clearly Mentioned 3.Do not give solution in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning