Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

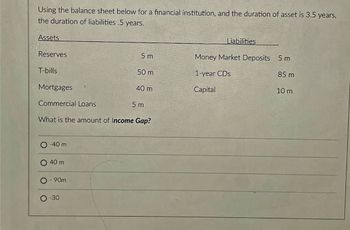

Transcribed Image Text:Using the balance sheet below for a financial institution, and the duration of asset is 3.5 years,

the duration of liabilities .5 years.

Assets

Reserves

T-bills

Mortgages

Commercial Loans

Liabilities

5 m

Money Market Deposits 5 m

50 m

1-year CDs

85 m

40 m

Capital

10 m

5 m

What is the amount of Income Gap?

-40 m

40 m

- 90m

-30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information, calculate the duration of assets and liabilities. Assets Amount Rate Duration Cash 90 Loans 800 12% 2 years Treasuries 110 9% 8 years Liabilities and Equity Time deposits 500 6% 1.75 years CDs 425 8% 2.50 years Equity 75arrow_forwardBalance Sheet (dollars in thousands) and Duration (in years) Duration AmountT-bills. 0.5 $ 90T-notes 0.9 55T-bonds 4.393 176Loans 7 2,724Deposits. 1 2,092Fed. funds 0.01 238Equity 715What is the average duration of all the assets? What is the average duration of all the liabilities? What is the FI’s leverage-adjusted duration gap? What is the FI’s interest rate risk exposure? If the entire yield curve shifted upward 0.5 percent (i.e., ΔR/(1 + R) = 0.0050), what is the impact on the FI’s market value of equity? If the entire yield curve shifted downward 0.25 percent (i.e., ΔR/(1 + R) = −0.0025), what is the impact on the FI’s market value of equity?arrow_forwardYou are given the following information. What is your liquidity ratio? Annual disposable income: $45,000 Total liabilities: $17,400 Annual savings: $2,400 Long-term assets: $85,000 Current ratio: 2 Debt-to-asset ratio: 0.2 Select one: a. 0.90 b. 0.56 c. 0.89 d. 0.53arrow_forward

- What is the weighted average duration assets?arrow_forwardFRM. (Term=30 years, Note Rate = 5.25, Loan Amount = 800,000, Points=2) What is the FTL annual percentage rate (FTLAPR) that the lender must disclose to the borrower? O 5.375% ○ 4.750% O 4.875% O 7.000% O 6.905% O 7.011%arrow_forwardQuestion 3: Use the following information on Assets to calculate the weighted average duration for each asset type in the "fill in the box" at the bottom of table. Assets: 3 year Consumer Loans with an average interest rate of 7% Cash Flow (CF) $561,300 $766,010 $2,702,883 $0 $0 Present Value Factor (PVF) 5 Year Commercial Loans with an average interest rate of 10% Cash Flow (CF) $755,299 $1,254,503 $1,855,631 $3,214,131 $4,005,543 Present Value Factor (PVF) A. Calculate the weighted average duration for 3-year consumer loans. show in the x.xx format | B. Calculate the weighted average duration for 5-year commercial loans. show in the x.xx format .935 .873 .816 N/A N/A .909 .826 .751 .683 .621arrow_forward

- The following loan was paid in full before its due date a) Find the value of h using an appropriate formula b) Use the actuarial method to find the amount of unearned interest c) Find the payoff amount Regular Monthly Payment # of Payments Remaining after Payoff APR 7.2% $247 8 What is the finance charge per $100 financed? h=$ (Round to the nearest cent)arrow_forwardFind the amount (in of interest and the maturity value of the loans. Use the formula MV = P + I to find the maturity value. (Round your answers to two decimal places.) Principal Rate (%) Time $145,000 14/12/2 Need Help? Submit Answer Read It 8 months Interest Enter a number. Maturity Value LA Xarrow_forwardAll other things being equal, the numerical difference between a present and a future value corresponds to the amount of interest earned during the deposit or investment period. Each line on the following graph corresponds to an interest rate: 0%, 8%, or 16%. Identify the interest rate that corresponds with each line. VALUE (Dollars) Line A: 01 2 3 4 5 Line B: 6 B Line C: C 7 8 9 10 TIME (Years) Investments and loans base their interest calculations on one of two possible methods: the interest and the interest methods. Both methods apply three variables-the amount of principal, the interest rate, and the investment or deposit period to the amount deposited or invested in order to compute the amount of interest. However, the two methods differ in their relationship between the variables.arrow_forward

- Consider the following balance sheet for Whiz Financial Services Limited: Assets K Liabilities K Cash 6.25 Equity 25.00 Short term consumer loans (1 yr maturity)62.50 Demand deposits 50.00 Long term consumer loans (2 yr maturity)31.25 Client Savings accounts 37.50 3 month T-Bills 37.50 3 month CDs 50.00 6 month T-Bills 43.75 3 months Bankers Acceptances 25.00 3 year T-Bonds 75.00 6 month commercial paper 75.00 10 year, fixed rate mortgages 25.00…arrow_forwardDIRECTION: ENCIRCLE THE BEST ANSWER. 4.) This refers to the interest rate per conversion period A Compound interest C Rate of interest B Periodic rate D. Simple interest 5) Thuis nefers to the amount paid or eames for the use of money A Conversion period C. Principal B. Interest D Rate 6) 30 months is equivalent to A 25 years B 2.75 years C 3 years D 3.25 years 1) How much is the simple interest on this financial transaction. P = .000 00. - * 6°.. and / 2 years AP120.00 B P600.00 CP1.300 00 D P6.000.00 6) What is the total number of conversion periods when a certain amount is borrowed are 10°. coupomded mouthly for 5 years? A.12 B 50 C 24 D. 60 How unch was the interest if Sophia borrowed P45.000 90 and paid a total of PS5.500.00 ar the end of the tem A PI0.500 00 CP11.500.00 B P45,000.00 D. P100.500.00 10.) What is the interest rate per conversion period if 125.900 00 was tvested at 3.4. compounded oruually for 4 years and 6 months 0033 C 0.110 B 0.330 D. 0 160 11. Jolu borowed…arrow_forwardPlease give Step by Step Answer Otherwise i give DISLIKE !!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning