FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:O 790%

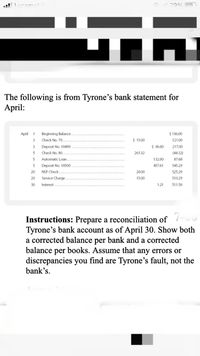

The following is from Tyrone's bank statement for

April:

April 1

Beginning Balance.

$ 136.00

3

Check No. 79....

$ 15.00

121.00

Deposit No. 10499

$ 96.00

217.00

5

Check No. 80.

261.32

(44.32)

5

Automatic Loan.

132.00

87.68

5

Deposit No. 10500

45761

545.29

20

NSF Check

20.00

525.29

20

Service Charge.

15.00

510.29

30

Interest

1.21

511.50

Instructions: Prepare a reconciliation of

Tyrone's bank account as of April 30. Show both

a corrected balance per bank and a corrected

balance per books. Assume that any errors or

discrepancies you find are Tyrone's fault, not the

bank's.

Transcribed Image Text:Annotatior

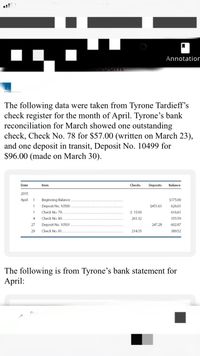

The following data were taken from Tyrone Tardieff's

check register for the month of April. Tyrone's bank

reconciliation for March showed one outstanding

check, Check No. 78 for $57.00 (written on March 23),

and one deposit in transit, Deposit No. 10499 for

$96.00 (made on March 30).

Date

Item

Checks

Deposits

Balance

2015

April

1

Beginning Balance

$175.00

1

Deposit No. 10500

$451.61

626.61

1

Check No. 79.

$ 15.00

61661

4.

Check No. 80.

261.32

35559

27

Deposit No. 10501

247.28

602.87

29

Check No. 81.

214.35

38952

The following is from Tyrone's bank statement for

April:

Expert Solution

arrow_forward

Bank Reconciliation Statement

This statement is prepared to reconcile the balance between books and bank statement . There may be some differences due to time of booking transactions in both of these records. These differences is reconciled and an adjusted balance is calculated.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Vinubhaiarrow_forwardLong Branch Company's Cash account shows an ending balance of $650. The bank statement shows a $12 service charge and an NSF check for $200. A $270 deposit is in transit, and outstanding checks total $450. What is Long Branch's adjusted cash balance? A. $438 B. $470 OC. $258 D. $862 OOOarrow_forwardOn April 3, Erin Gardner received her bank statement showing a balance of $2,086.93. Her checkbook showed a balance of $1,912.47. Outstanding checks were $234.15, $317.80, $78.10, $132.42, and $212.67. The account earned $20.43. Deposits in transit amount to $814.11, and there is a service charge of $7.00. Use the form below to calculate the reconciled balance. CHECKBOOK BALANCE Add: Interest Earned & Other Credits SUBTOTAL Deduct: Service Charges & Other Debits ADJUSTED CHECKBOOK BALANCE tA ta ta ta tA STATEMENT BALANCE Add: Deposits in Transit SUBTOTAL Deduct: Outstanding Checks LA tA ·SA $ LA ADJUSTED STATEMENT BALANCE $ LA Earrow_forward

- The ending bank statement balance at November 30 is $6,850. The bank statement shows a service charge of $85, electronic funds receipts of $500, and a NSF check for $350. Deposits in transit total $2,350 and outstanding checks are $1,535. The balance per books at November 30 is $7,600. What is the adjusted bank balance at November 30? A. $8,415 B. $6,915 C. $6,850 D. $7,665arrow_forward1arrow_forwardPlease help mearrow_forward

- 2. DETAILS rise BRECMBC9 4.11.TB.011. On May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. O $29.95 O $943.80 O $1,003.70 $1,108.88arrow_forward3. The April 30 bank statement of 10A Company showed a balance of $$24,635 and the following memoranda: Credits Collection of $1,250 note plus interest $50 Interest earned on checking account $65 Debits $75 NSF check: Banana Wang $635 Safety deposit box rent: 10A Company's cash account in the general ledger had a balance of $26,100 on April 30 and other information is as follows: (1) Cash receipts for April 30 recorded on the company's books were $6,695 but this amount does not appear on the bank statement. (2) The total amount of checks still outstanding at April 30 amounted to $6,575, including $2,000 certified checks. (3) Check No. 119 payable to 10B Company was recorded in the cash payments journal and cleared the bank for $248 but the payment should be $284. Instructions (a) (b) Prepare the bank reconciliation at April 30. Prepare any adjusting entries necessary as a result of the bank reconciliation. (Hint: Record Safety deposit box rent as Miscellaneous (Misc.) Expense)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education