FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hunter Photography's checkbook lists the following:

Checkbook

|

Date

|

Check No.

|

Item

|

Check

|

Deposit

|

Balance

|

|---|---|---|---|---|---|

|

Nov. 1

|

|

|

|

$535

|

|

|

Nov. 4

|

622

|

Quick Mailing

|

$30

|

|

505

|

|

Nov. 9

|

|

Service Revenue

|

|

$120

|

625

|

|

Nov. 13

|

623

|

Photo Supplies

|

50

|

|

575

|

|

Nov. 14

|

624

|

Utilities

|

55

|

|

520

|

|

Nov. 18

|

625

|

Cash

|

75

|

|

445

|

|

Nov. 26

|

626

|

Office Supplies

|

85

|

|

360

|

|

Nov. 28

|

627

|

Upstate Realty Co.

|

255

|

|

105

|

|

Nov. 30

|

|

Service Revenue

|

|

1,230

|

1,335

|

Hunter's November bank statement shows the following:

Bank Statement

|

Balance

|

|

|

|

$535

|

|

Deposits

|

|

|

|

120

|

|

Checks:

|

No.

|

Amount

|

|

|

|

|

622

|

$30

|

|

|

|

|

623

|

50

|

|

|

|

|

624

|

115*

|

|

|

|

|

625

|

75

|

|

(270)

|

|

Other charges:

|

|

|

|

|

|

Printed checks

|

|

|

$29

|

|

|

Service charge

|

|

|

5

|

(34)

|

|

Balance

|

|

|

|

$351

|

|

*This is the correct amount for check number 624.

|

Requirements

|

1.

|

Prepare

Hunter

Photography's bank reconciliation at

November

30,

2024.

|

|

2.

|

How much cash does

Hunter

actually have on

November

30,

2024?

|

|

3.

|

Journalize any transactions required from the bank reconciliation.

|

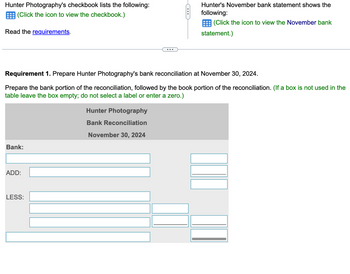

Transcribed Image Text:Hunter Photography's checkbook lists the following:

(Click the icon to view the checkbook.)

Read the requirements.

Bank:

ADD:

LESS:

C

Requirement 1. Prepare Hunter Photography's bank reconciliation at November 30, 2024.

Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation. (If a box is not used in the

table leave the box empty; do not select a label or enter a zero.)

Hunter Photography

Bank Reconciliation

November 30, 2024

Hunter's November bank statement shows the

following:

(Click the icon to view the November bank

statement.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hello, I need to do a general journal with the following directions: On May 1, a petty cash fund was established for $200 by the owner, Ilika Cash. The following vouchers were issued during the month. Prepare the journal entries to (a) establish the petty cash fund on May 1 and (b) replenish the petty cash fund on May 31. Date Voucher No. Purpose Amount 6 4-1 Office supplies 12.00 8 4-2 Taxi fare for customer (travel expense) 27.00 12 4-3 Postage due (Postage Expense) 4.00 17 4-4 Donation (Misc. Expense) 20.00 30 4-6 Ilika withdrew for personal use 50.00arrow_forwardPlease Answer With Details and Don't image formatarrow_forwardHelparrow_forward

- Jo Jo has business called, "Jo Jo's Clown Supplies." The following cash transactions happened in the month of December. Jo Jo had a December 31 cash balance of $19,940. b 5 7 B 9 Cash Receipts Date Deposit 12/1 12/4 12/9 12/14 12/17 12/22 12/31 0 01 02 03 400 4270 610 630 2280 1500 1950 Cash Payments Check No. Amount 1416 1417 1418 1419 1420 1421 1422 The 1st Federal Bank Sent Jo Jo the following statement for December: Beginning Balance: Deposits Checks 1-Dec 5-Dec 10-Dec 15-Dec 18-Dec 22-Dec 760 30 550 1390 1340 800 530 8-Dec 11-Dec 19-Dec 22-Dec 29-Dec 31-Dec 31-Dec NSF NSF SC 1416 04 05 06 07 08 09 10 11 Please prepare a Bank Reconcilliation for Jo Jo's Circus. 112 1417 1418 1419 400 4270 610 630 2280 1500 900 760 500 30 550 1390 50 Ending Balance: NSF = Non-sufficient Funds Checks were received from a client. SCA Bank service charge. 13,700 9690 4180 19,210 +arrow_forwardJul 13 The owner, Jen Beck, withdrew $2,000 cash for personal use, Check No. 78. Memorize the transaction for payments every two weeks. Next payment is July 27, 2022. Just tell me in quickbooks where do i record this transaction? bill (enter bills window) credit (enter bills window) bill pmt - check (pay bills window) check (write checks window) invoice (create invoices window) payment (receive payments window) sales receipt (enter sales receipts window) deposit (make deposit window) general journal (make general journal entries window) inventory adjust (adjust quantity/value on hand window) sales tax payment (pay sales tax window) paycheck (pay employees window) liability check (pay payroll liabilities window) transfer (transfer funds between accounts window) credit card charge (enter credit card charges window) credit memo (create credit memos/refunds window) discounts (receive payments window)arrow_forwardACCOUNTS RECEIVABLE LEDGER NAME: E. McKenzie ADDRESS: 4717 Erin St, Madison, WI 53713 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 3 J60 3,816.00 3,816.00 Aug. 18 J60 4,589.80 fill in the blank 1 J60 105.00 fill in the blank 2 ACCOUNTS RECEIVABLE LEDGER NAME: S. Rottier ADDRESS: 1008 S. 9TH St, Monona, WI 53715 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 7 J60 1,484.00 1,484.00 Aug. 10 J60 400.00 fill in the blank 3 ACCOUNTS RECEIVABLE LEDGER NAME: L. Franklin ADDRESS: 2815 Main St, Cottage Grove, WI 53711 DATE ITEM POST. REF. DEBIT CREDIT BALANCE 20-- Aug. 1 J60 1,272.00 1,272.00 Aug. 22 J60 2,120.00 fill in the blank 4 Using the information from the ledgers, prepare a schedule of accounts receivable as of August 31. If required, round your intermediate and final answers to the nearest cent. Willis Spas and PoolsSchedule of Accounts ReceivableAugust 31, 20-- E. McKenzie $fill…arrow_forward

- Based on the following information, prepare a check and stub: Date: January 15, 20-- Balance brought forward: $2,841.50 Deposit: $962.20 Check to: J. M. Suppliers Amount: $150.00 For: Office Supplies Signature: Sign your namearrow_forwardOscar's Red Carpet Store maintains a checking account with Academy Bank. Oscar's sells carpet each day but makes bank deposits only once per week. The following provides information from the company's cash ledger for the month ending February 28, 2021. Date Amount No. Date Amount $ 2,000 Checks: 1,600 2,500 Deposits: 2/4 321 2/2 $4,000 2/11 322 2/8 450 2/18 323 2/12 1,800 2/25 3,400 324 2/19 1,500 Cash receipts: 2/26-2/28 900 325 2/27 250 $10,400 326 2/28 750 327 2/28 1,200 Balance on February 1 $ 6,100 $9,950 Receipts 10,400 Disbursements (9,950) Balance on February 28 $ 6,550 Information from February's bank statement and company records reveals the following additional information: a. The ending cash balance recorded in the bank statement is $9,610. b. Cash receipts of $900 from 2/26-2/28 are outstanding. c. Checks 325 and 327 are outstanding. d. The deposit on 2/11 includes a customer's check for $250 that did not clear the bank (NSF check). e. Check 323 was written for $2,500 for…arrow_forwardJournal entry for: Feb1: paid rent for February amounting to $660, cheque#3354. Feb1: Tee R Us decided to establish a petty cash fund for the office. A cheque #3355 of $500 was issued and cashedarrow_forward

- CAN SOMEONE HELP ME FILL IN THE BLANK ? The information below relates to the Cash account in the ledger of Crane Company. Balance September 1—$17,180; Cash deposited—$64,410. Balance September 30—$18,344; Checks written—$63,246.arrow_forward2. Your checkbook balance was $206.42 on March 3. The check register shows your transactions since then. What should your new balance be? Trans Type Date Description of Transaction or Check # 284 DEP AT Payment / Debit ✓ Deposit / Credit (+) (-) Balance Brought Forward 3/9 Osbourne Pharmacy 3/15 ATM Deposit 3/20 Auto trans: Gen Phone 19 32 50 80 120 49 Balancearrow_forwardThe following information relates to the bank account of Doug's Sky Diving Supply Store on June 30. Balance per bank statement $5,327 Balance per books as of June 30 9,265 Outstanding checks: #1007 $ 241 #1008 67 #1009 597 Deposits in transit 229 4,111 Bank service charges 98 NSF check 412 Credit memo for interest earned 16 Error: Check written and recorded by bank as $454 was subtracted from the checkbook as $445. The check was used to pay the telephone bill. Required: Prepare a bank reconciliation as of June 30. Doug's Sky Diving Supply Store Bank Reconciliation June 30, 20-- Bank statement balance $fill in the blank 1 Deduct deposits in transit: $fill in the blank 3 fill in the blank 4 fill in the blank 5 $fill in the blank 6 $fill in the blank 9 fill in the blank 11 fill in the blank 13 fill in the blank 14 Adjusted bank balance $fill in the blank 15 Book…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education