FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Question 80

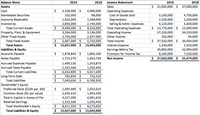

Using Financial Statements for 2018-2019. Net book value per share of common stock for 2018 is $18.46.

TRUE OR FALSE?

Transcribed Image Text:**Financial Statements Overview (2019 vs. 2018)**

**Balance Sheet**

*Assets:*

- **Cash:**

- 2019: $5,100,000

- 2018: $4,900,000

- **Marketable Securities:**

- 2019: $102,000

- 2018: $98,000

- **Accounts Receivable:**

- 2019: $1,632,000

- 2018: $1,568,000

- **Inventories:**

- 2019: $2,856,000

- 2018: $2,744,000

- **Total Current Assets:**

- 2019: $9,690,000

- 2018: $9,310,000

- **Property, Plant, & Equipment:**

- 2019: $3,264,000

- 2018: $3,136,000

- **Other Fixed Assets:**

- 2019: $2,703,000

- 2018: $2,597,000

- **Total Fixed Assets:**

- 2019: $5,733,000

- 2018: $5,733,000

- **Total Assets:**

- 2019: $15,657,000

- 2018: $15,043,000

*Liabilities & Equity:*

- **Accounts Payable:**

- 2019: $1,878,840

- 2018: $1,805,160

- **Notes Payable:**

- 2019: $1,722,270

- 2018: $1,654,730

- **Accrued Expenses Payable:**

- 2019: $1,409,130

- 2018: $1,353,870

- **Accrued Taxes Payable:**

- 2019: $1,252,560

- 2018: $1,203,440

- **Total Current Liabilities:**

- 2019: $6,262,800

- 2018: $6,017,200

- **Long-Term Debt:**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please stepwise all partsarrow_forwardQuestion 9 Common stock dividends: are guaranteed to be paid quarterly. O are guaranteed to be paid annually. O must be approved by the corporation's board of directors.arrow_forwardView Policies Current Attempt in Progress Retained earnings is increased by each of the following except O prior period adjustments. O some disposals of treasury stock. Chall of these increase retained earnings. O net income. eTextbook and Media Save for Later Attempts: 0 of 2 %23 24 2 3 4. 8 W e y h aarrow_forward

- Is earnings per share for january 2021 better or worse than last years average?arrow_forwardFind earnings per share 2019arrow_forwardP7-23 Integrative: Risk and valuation Given the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common $50.00Expected dividend per share next year $ 3.00Constant annual dividend growth rate 6.5%Risk-free rate of return 4.5%arrow_forward

- 4 XYZ stock price and dividend history are as follows: Beginning-of- Year Year Price Dividend Paid at Year-End 2018 $ 120 $ 2 2019 129 2 2020 pints 2021 2 2 115 120 An investor buys six shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all seven remaining shares at the beginning of 2021. Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.) × Answer is complete but not entirely correct. Arithmetic time-weighted average returns Geometric time-weighted average returns 1.99 % 1.59% b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. (Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. Date 01/01/2018 Cash Flow $ (720) Return to quesarrow_forwardd. mutual agency for stockholders 20. Stockholders' equity a. is usually equal to cash on hand b. is shown on the income statement c. includes paid-in capital and liabilities d. includes retained earnings and paid-in capita blec bisearrow_forwardSunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000. (a) Your answer is correct. Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. Allocation to preferred stock Allocation to common stock A 2021 4,800 0 LA 2022 7,000 6,600 2023 7,000 22,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education