FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

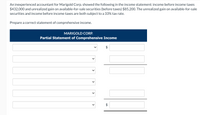

Transcribed Image Text:An inexperienced accountant for Marigold Corp. showed the following in the income statement: income before income taxes

$432,000 and unrealized gain on available-for-sale securities (before taxes) $85,200. The unrealized gain on available-for-sale

securities and income before income taxes are both subject to a 33% tax rate.

Prepare a correct statement of comprehensive income.

MARIGOLD CORP.

Partial Statement of Comprehensive Income

$

%24

%24

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Branch Corp.'s total assets at the end of last year were $310,000 and its net income after taxes was $22,750. What was its return on total assets? Select the correct answer. a. 8.34% b. 7.34% c. 6.84% d. 7.84% e. 6.34%arrow_forwardThe most recent financial statements income taxes): Income Statement Sales Costs Net income $6,700 3,85C $ 2,850 Assets Total Balance Sheet 22,050 Debt Equity Total 22,050 $ 8,050 14,000 $ 22,050 Assets and costs are proportional to sales; debt and equity are not. No dividends are paid. Next year's sales are projected to be $7.906. What is the external financing needed? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) External financing neededarrow_forwardFor the past year, Momsen Limited had sales of $47362, interest expense of $4166, cost of goods sold of $17,359, selling and administrative expense of $12,146, and depreciation of $6,995. If the tax rate was 21 percent, what was the company's net income? Multiple Choice O $5,132 $6,496 $11,550 $4,547 $2.444arrow_forward

- Giglio Inc. has the following information for the previous year: Net income = $400; Net operating profit after taxes (NOPAT) = $500; Total assets = $2,000; and Total operating capital = $1,600. The information for the current year is: Net income = $800; Net operating profit after taxes (NOPAT) = $800; Total assets = $2,300; and Total operating capital = $2,000. What is the free cash flow for the current year? If negative, use the negative sign instead of parentheses, e.g. -130.arrow_forwardhe following information is from Atlanta Corp. for the 12 months ended December 31. Sales revenue $800,000 Cost of goods sold 500,000 Selling and administrative expenses 150,000 Interest expense 5,000 Gain on sale of short-term investments 8,800 Prepare a multiple - step income statement (excluding the earnings per share disclosures) assuming a tax rate of 25 %. Report income tax expense in its own separate section.arrow_forwardAn inexperienced accountant for Crane Transport Corporation showed the following in Crane Transport's 2021 income statement: income before income taxes of $446,000; and unrealized loss on available-for-sale debt securities (before taxes) of $73,000. The unrealized loss and the income before income taxes are both subject to a 20% tax rate. Prepare a corrected partial income statement and a statement of comprehensive income CRANETRANSPORT CORPORATION Partial Income Statement and Statement of Comprehensive Income $arrow_forward

- Woods Company reports income before taxes in the amount of $925,000. The current tax expense is $365,375 and the effective tax rate is 27%. What is the conservatism ratio for Woods Company? Group of answer choices 0.45 0.19 0.40 0.68arrow_forwardCurrent Attempt in Progress An inexperienced accountant for Ayayai Corp. showed the following in the income statement: net income $187,500 and unrealized gain on available-for-sale securities (before taxes) $85,000. The unrealized gain on available-for-sale securities is subject to a 25% tax rate. Prepare a correct statement of comprehensive income. AYAYAI CORP. Partial Statement of Comprehensive Income Income Before Income Taxes Net Income /(Loss) eTextbook and Media Save for Later taarrow_forwarddog subject-Accounting Sanders Inc. reported net income of $880,000 for the year ended December 31. The company had a pretax unrealized holding gain on debt securities of $22,400 and a pretax loss on foreign currency translation adjustment of $64,000. The company’s tax rate is 25%. Prepare a separate statement of comprehensive income beginning with net income. Use a negative sign to indicate a loss. Sanders Inc. Statement of Comprehensive Income For the Year Ended December 31 Net Income Answer Unrealized holding gain on debt security investment, net of tax Answer Loss on foreign currency translation adjustment, net of tax savings Answer Comprehensive income This is a table questionarrow_forward

- The trial balance of Plano Company included the following accounts as of December 31, 2024: Debits Credits Sales revenue $ 622,000 Interest revenue 76,000 Gain on sale of investments 126,000 Cost of goods sold $ 440,000 Selling expense 134,000 Interest expense 24,000 General and administrative expenses 88,000 Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a single-step income statement with earnings per share disclosure. Note: Round earnings per share answer to 2 decimal places.arrow_forwardThe most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement. Net income Assets: Total EFN $6,800 -4,080 $2,720 Balance Sheet. $20,400 Debt $20,400 Equity Total $10,600 9,800 $20,400 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,752. What is the external financing needed? (A negative value should be indicated by a minus si Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardPlease helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education