FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

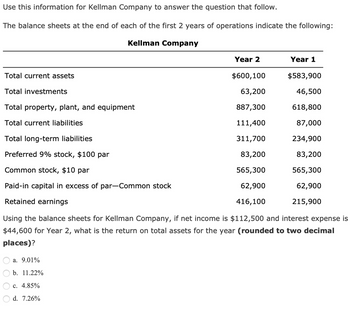

Transcribed Image Text:Use this information for Kellman Company to answer the question that follow.

The balance sheets at the end of each of the first 2 years of operations indicate the following:

Kellman Company

Total current assets

Total investments

Total property, plant, and equipment

Total current liabilities

Total long-term liabilities

Preferred 9% stock, $100 par

Common stock, $10 par

Paid-in capital in excess of par-Common stock

Retained earnings

a. 9.01%

b. 11.22%

Year 2

c. 4.85%

d. 7.26%

$600,100

63,200

887,300

111,400

311,700

83,200

565,300

62,900

416,100

Year 1

Using the balance sheets for Kellman Company, if net income is $112,500 and interest expense is

$44,600 for Year 2, what is the return on total assets for the year (rounded to two decimal

places)?

$583,900

46,500

618,800

87,000

234,900

83,200

565,300

62,900

215,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is certain information pertaining to Edson Company. Assets, January 1 P240,000; Assets, December 31 230,000; Liabilities, January 1 150,000; Share capital, December 31 80,000; Retained earnings, December 31 31,000; Ordinary shares sold during the year 10,000; Dividends declared during the year 13,000; Compute the net income for the year. 24,000 11,000 37,000arrow_forwardVertical Analysis of Balance Sheet Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Y2 20Υ1 Current assets $ 752,000 $ 602,000 Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000 Current liabilities 504,000 427,000 Long-term liabilities 1,504,000 1,197,000 Common stock 1,248,000 1,253,000 Retained earnings 4,744,000 4,123,000 | Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $752,000 % $602,000 % Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000arrow_forwardPlease fill out vertical analysis of this balance sheet to determine component percentage of assets liabilities and stockholders equity based on data. Round percentages to the nearest hundredths percentarrow_forward

- [The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 10. What is the…arrow_forwardHere is a simplified balance sheet for Locust Farming: Locust Farming Balance Sheet ($ in millions) Current assets Long-term assets $ 42,529 46,842 Current liabilities Long-term debt Other liabilities Equity $ 29,750 27,757 14,327 17,537 $ 89,371 Total $ 89,371 Total Locust has 662 million shares outstanding with a market price of $88 a share. a. Calculate the company's market value added. b. Calculate the market-to-book ratio. c. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent of the net capital contributed by shareholders? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the company's market value added. Note: Enter your answers in millions. Market value Market value added million millionarrow_forwardFrom the balance sheet of M/s Sharma Limited, for the year ending 31 March 2020, compute the following ratios: M/s Sharma Limited Balance sheet as on 31st March 2020 Liability Amount (Rs.) Assets Amount (Rs.) Equity Share Capital 300,000 Land 50,000 Preference Share Capital 400,000 Building 300,000 General Reserve 50,000 Plant & Machinery 300,000 Profit & Loss A/c 50,000 Furniture 40,000 12% Debentures 200,000 Debtors 200,000 Trade Creditors 60,000 Stock 150,000 Outstanding expenses 15,000 Cash 40,000 Provision for tax 20,000 Prepaid Expenses 10,000 Proposed dividends 30,000 Preliminary Expense* 35,000 *(to the extent not written off) 1,125,000 1,125,000 Current ratio Debt–equity ratio Capital gearing ratio Liquidity ratioarrow_forward

- Helparrow_forwardFinancial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forwardThe accompanying data represent the annual rates of return of two companies' stock for the past 12 years. Complete parts (e) through (k). Year Rate of Return of Company 1 Rate of Return of Company 21996 0.203 0.3981997 0.310 0.5101998 0.267 0.4101999 0.195 0.4362000 -0.101 -0.0602001 -0.130 -0.1512002 -0.234 -0.3572003 0.264 0.3282004 0.090 0.2072005 0.030 -0.0142006 0.128 0.0932007 -0.035 0.027 (k) Are there any years where the rate of return of Company 2 was unusual?arrow_forward

- The balance sheet data of Randolph Company for two recent years appears below: Assets: Year 2 Year 1 Current assets $445 $280 Plant assets 680 520 Total assets $1,125 $800 Liabilities and stockholders' equity: Current liabilities $285 $120 Long-term debt 255 160 Common stock 325 320 Retained earnings 260 200 Total liabilities and stockholders' equity $1,125 $800 Required: b. Using vertical analysis, prepare a comparative balance sheet. If required, round your answers to one decimal place. Randolph Company Comparative Balance Sheet For the Years Ended December 31, Year 2 and Year 1 Assets Year 2Amount Year 2Percent Year 1Amount Year 1Percent Current assets $445 fill in the blank 2e1a1e0b0fbcf94_1% $280 fill in the blank 2e1a1e0b0fbcf94_2% Plant assets 680 fill in the blank 2e1a1e0b0fbcf94_3 520 fill in the blank 2e1a1e0b0fbcf94_4 Total assets $1,125 fill in the blank 2e1a1e0b0fbcf94_5% $800 fill in the…arrow_forwardExamine the following selected financial information for Best Value Corporation and Modern Stores, Inc., as of the end of their fiscal years ending in 2018: Data table (In millions) Best Value Corporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . $15,256 $203,110 2. Total common stockholders' equity. . . . . $3,075 $71,460 3. Operating income. . . . . . . . . . . . . . . . . . . . $1,350 $26,820 4. Interest expense. . . . . . . . . . . . . . . . . . . . . . $88 $2,020 5. Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . . 6. Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Times interest earned. . . . . . . . . . . . . . . . . Requirements…arrow_forward[The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 2. What is the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education