FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

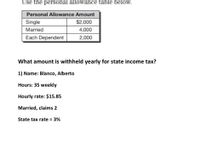

Transcribed Image Text:Use the personal allowance table below.

Personal Allowance Amount

Single

$2,000

Married

4,000

Each Dependent

2,000

What amount is withheld yearly for state income tax?

1) Name: Blanco, Alberto

Hours: 35 weekly

Hourly rate: $15.85

Married, claims 2

State tax rate = 3%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Paulina Robinson (single; 2 federal withholding allowances) earned biweekly gross pay of $1,265. She contributes $75 to a flexible spending account during the period. What is their federal income tax withholding? Please do fast i want answer in 60 minutesarrow_forwardSolve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Kristy Dunaway has biweekly gross earnings of $1,850. What are her total Social Security and Medicare tax withholdings (in $) for a whole year?Social Security $ Medicare $arrow_forwardPlease helparrow_forward

- A woman is in the 15% tax bucket and itemizes her deductions. How much will her tax bill be reduced if she makes a$200 tax deductible contribution to charity A. $30 B. $200 C. $0 D. $170arrow_forward15-16) Larry Calanan has earnings of $518 in a week. He is single and claims 2 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding, union dues of $15, and charitable contributions of $21. 15) Find the tax amounts FICA=? Select the correct total tax amount. $101.35 $114.35 $395.96 Medicare=? federal withholding=? SDI=? state withholding=? $38.93arrow_forwardWilliam Harrison (single; 1 federal withholding allowance) earned biweekly gross pay of $990. He contributes $75 to a flexible spending account during period. Federal income tax withholding=$arrow_forward

- John Moyer (married; 6 federal withholding allowances) earned monthly gross pay of $3,150. He participates in a flexible spending account, to which he contributes $265 during the period.Using wage-bracket method: Federal income tax withholding = $Using percentage method: Federal income tax withholding = $arrow_forwardSolve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Kristy Dunaway has biweekly gross earnings of $1,550. What are her total Social Security and Medicare tax withholdings (in $) for a whole year? Social Security$ Medicare$arrow_forwardCan you answer each problemarrow_forward

- 3. Loretta Goulet (married; 3 federal withholding allowances) earned monthly gross pay of $2,800. For each period, she makes a 401(k) contribution of 14 gross pay. Federal income tax withholding=$arrow_forwardSolve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Calculate the monthly Social Security and Medicare withholdings (in $) for the employee as the payroll manager for a cargo and freight company. Year-to-Date Employee Earnings Current Month Social Security Graham, C. $14,300 $1,780 Medicarearrow_forwardLinda Sykes (single; 1 federal withholding allowance) earned. semimonthly gross pay of $2,715. She participates in a cafeteria plan, to which she contributed $135 during the period. Federal income tax withholding = $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education