FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

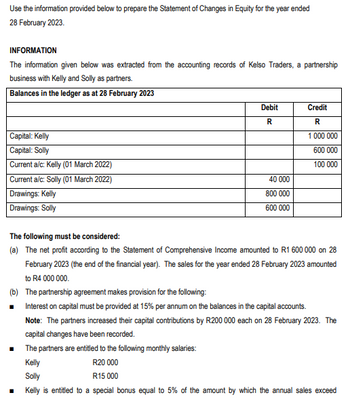

Transcribed Image Text:Use the information provided below to prepare the Statement of Changes in Equity for the year ended

28 February 2023.

INFORMATION

The information given below was extracted from the accounting records of Kelso Traders, a partnership

business with Kelly and Solly as partners.

Balances in the ledger as at 28 February 2023

Capital: Kelly

Capital: Solly

Current a/c: Kelly (01 March 2022)

Current a/c: Solly (01 March 2022)

Drawings: Kelly

Drawings: Solly

Debit

R

40 000

800 000

600 000

Credit

R

1 000 000

600 000

100 000

The following must be considered:

(a) The net profit according to the Statement of Comprehensive Income amounted to R1 600 000 on 28

February 2023 (the end of the financial year). The sales for the year ended 28 February 2023 amounted

to R4 000 000.

(b) The partnership agreement makes provision for the following:

Interest on capital must be provided at 15% per annum on the balances in the capital accounts.

Note: The partners increased their capital contributions by R200 000 each on 28 February 2023. The

capital changes have been recorded.

The partners are entitled to the following monthly salaries:

Kelly

R20 000

Solly

R15 000

Kelly is entitled to a special bonus equal to 5% of the amount by which the annual sales exceed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part c pleasearrow_forwardansser must be in table format or i will give down votearrow_forwardConcord Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 538,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. Арг. May Aug. 1 1 Sept. 1 Nov. 1 Issued 75,000 shares of common stock for cash at $4 per share. Issued 5,050 shares of preferred stock for cash at $110 per share. Issued 24,000 shares of common stock for land. The asking price of the land was $92,000. The fair value of the land was $87,500. Issued 83,500 shares of common stock for cash at $4.50 per share. Issued 10,000 shares of common stock to attorneys in payment of their bill of $38,000 for services performed in helping the company organize. Issued 11,000 shares of common stock for cash at $7 per share. Issued 2,000 shares of preferred stock for cash at $109 per share.arrow_forward

- thout making journal entries. this 4. Vaughn Company began operations in 2024. Since then, it has reported the following gains and losses for its equity investments on the income statement: 2024 2025 2026 Gains (losses) from sale of securities $14,100 $(20,900) $13,800 Unrealized holding losses on valuation of securities (25,100) Unrealized holding gain on valuation of securities At January 1, 2027, Vaughn owned the following securities: Cost BKD Common (16,000 shares @ $32) $512,000 LRF Preferred (2,400 shares @ $106) 254,400 10,400 (14,700)arrow_forwardanswer in text form please (without image)arrow_forwardplease Correct solution with Explanation and Do give image formatarrow_forward

- The following data were taken from the balance sheet accounts of Monty Corporation on December 31, 2019. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings (a) $515,000 (b) (c) 640,000 475,000 145,000 Prepare the required journal entries for the following unrelated items. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 796,000 A 4% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $41. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2020, and paid January 25, 2020, in bonds held as an investment. The bonds have a book value of $92,000 and a fair value of $131,000.arrow_forwardCreate a comparative financial statement from the following:arrow_forwardHi, How do I record these transactions? Thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education