FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

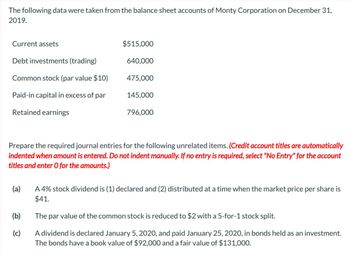

Transcribed Image Text:The following data were taken from the balance sheet accounts of Monty Corporation on December 31,

2019.

Current assets

Debt investments (trading)

Common stock (par value $10)

Paid-in capital in excess of par

Retained earnings

(a)

$515,000

(b)

(c)

640,000

475,000

145,000

Prepare the required journal entries for the following unrelated items. (Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account

titles and enter O for the amounts.)

796,000

A 4% stock dividend is (1) declared and (2) distributed at a time when the market price per share is

$41.

The par value of the common stock is reduced to $2 with a 5-for-1 stock split.

A dividend is declared January 5, 2020, and paid January 25, 2020, in bonds held as an investment.

The bonds have a book value of $92,000 and a fair value of $131,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You’ve been hired to perform an audit of Hubbard Company for the year ended December 31, 2019. You find the following account balances related to shareholders’ equity: Preferred stock, $100 par $ 33,000 Common stock, $10 par 68,000 Capital surplus (15,100) Retained earnings 172,000 Because of the antiquated terminology and negative balance, you examine the Capital Surplus account and find the following entries: Credit (Debit) Additional paid-in capital on common stock $ 27,700 Capital from donated land 16,900 Treasury stock (400 common shares at cost) (5,600) Additional paid-in capital on preferred stock 2,000 Stock dividend (50%) (20,000) Prior period adjustment (net of income taxes) (10,100) Loss from fire (uninsured), 2018 (18,100) Property dividend declared (5,600) Cash dividends declared (23,300) Balance $ (36,100) Your examination of the Preferred Stock and Common Stock accounts reveals that the amounts shown correctly state the…arrow_forwardanswer in text form please (without image)arrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2024. Your accounting group provided you the following information on the company's debt: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. On July 1, 2024, Moonlight Bay issued bonds with a face amount of $2,600,000. The bonds mature in 15 years and interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 12%. Moonlight Bay records interest at the effective rate. 2. At December 31, 2023, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $560,000. The annual payment is $90,000, payable each June 30. 3. On January 1, 2024, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $55,000 beginning January 1, 2024.…arrow_forward

- The following data were taken from the balance sheet accounts of Wildhorse Corporation on December 31, 2024. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings a. b. C. $513,000 605,000 Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.) 501,000 Date 144,000 910,000 A 6% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $40. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds have a book value of $104,000 and a fair…arrow_forwardOn January 1, 2022, the stockholders' equity section of Bridgeport Corporation shows common stock ($4 par value) $1,200,000; paid- in capital in excess of par $1,000,000; and retained earnings $1,240,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 50,000 shares for cash at $15 per share. July 1 Sold 11,000 treasury shares for cash at $17 per share. Sept. 1 Sold 9,500 treasury shares for cash at $14 per share.arrow_forwardni.3arrow_forward

- Prime Corporation prepared its annual financial statements for its shareholders for the fiscal year ending December 31, 2029. Record whether the transaction below for Prime Corporation overstated (O), understated (U), or correctly stated (C) total assets, total liabilities, stockholders' equity, and net income in 2029. You must write "O", "U", or "C" in each blank for credit. Prime Corp. did not adjust its unearned revenue account for the $8,000 of revenue earned in December 2029. Assets: O/U/C? Liabilities: O/U/C? Equity: O/U/C? Net income: O/U/C?arrow_forwardWhat would be the classified Balance Sheet for Sandpiper as of December 31, 2020? After calculations, does the ASSETS sheet and Liabilities and Stockholders' Equity balance? Accounts Payable $34,600 Accounts Receivable $35,100 Accrued Liabilities $11,500 Accumulated Depreciation $35,600 Allowance for Doubtful Accounts $900 Bonds Payable[Long-term] $80,000 Cash and Cash Equivalents $33,600 Common Stock at par $1.50 (authorized 200,000 shares, issued xxxxx? shares, and XXXX? outstanding)-CALCULATE $75,000 Cost of goods sold $204,800 Current Portion of Long-Term Debt $5,600 Discounts on Bonds Payable $2,300 Equipment and vehicles $89,100 General and administrative expenses $92,100 Intangilbles - Net $14,300 Investments in Equity Securities[long-term] $5,000 Land[not used in operations] $25,600 Land and Building $145,300 Long-Term Debt Payable [not including current portion] $40,200 Merchandise Inventory (FIFO, Lower of Cost or Market) $28,700 Notes Payable[short-term] $6,500 Notes…arrow_forwardYour firm has been engaged to examine the financial statements of Almaden Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the following information. Almaden CorporationBalance SheetDecember 31, 2020 Assets Liabilities Current assets $1,881,100 Current liabilities $ 962,400 Other assets 5,171,400 Long-term liabilities 1,439,500 Stockholders' equity 4,650,600 $7,052,500 $7,052,500 An analysis of current assets discloses the following. Cash (restricted in the amount of $300,000 for plant expansion) $ 571,000 Investments in land 185,000 Accounts receivable less allowance of $30,000 480,000 Inventories (LIFO flow assumption) 645,100 $1,881,100 Other assets include: Prepaid expenses $ 62,400 Plant and equipment less accumulated depreciation of…arrow_forward

- You are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2024. Your accounting group provided you the following Information on the company's debt Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. On July 1, 2024, Moonlight Bay Issued bonds with a face amount of $2,700,000. The bonds mature in 15 years and Interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield Investors 12%. Moonlight Bay records Interest at the effective rate. 2. At December 31, 2023, Moonlight Bay had a 10% Installment note payable to Third Mercantile Bank with a balance of $700,000. The annual payment is $160,000, payable each June 30. 3. On January 1, 2024, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $85,000 beginning January 1, 2024.…arrow_forwardPlease help solvearrow_forwardYou’ve been hired to perform an audit of Hubbard Company for the year ended December 31, 2019. You find the following account balances related to shareholders’ equity: Preferred stock, $100 par $ 33,000 Common stock, $10 par 68,000 Capital surplus (15,100) Retained earnings 172,000 Because of the antiquated terminology and negative balance, you examine the Capital Surplus account and find the following entries: Credit (Debit) Additional paid-in capital on common stock $ 27,700 Capital from donated land 16,900 Treasury stock (400 common shares at cost) (5,600) Additional paid-in capital on preferred stock 2,000 Stock dividend (50%) (20,000) Prior period adjustment (net of income taxes) (10,100) Loss from fire (uninsured), 2018 (18,100) Property dividend declared (5,600) Cash dividends declared (23,300) Balance $ (36,100) Your examination of the Preferred Stock and Common Stock accounts reveals that the amounts shown correctly state the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education