FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Debit

Credit

Cash

44,000

Prepaid Insurance

8,400

A/R

7,000

Truck

85,000

Accum, Deprec. Truck

25,000

Accounts Payable,

13,100

Unearned Fees

3,920

Notes Payable

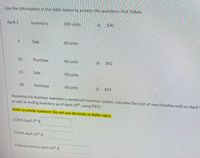

Transcribed Image Text:Use the information in the table below to answer the questions that follow.

Аpril 1

Inventory

100 units

@ $40

Sale

60 units

10

Purchase

40 units

$42

15

Sale

50units

Purchase

60 units

$45

Assuming the business maintains a perpetual inventory system, calculate the cost of merchandise sold on April 5

as well as ending inventory as of April 30th, using FIFO,

Enter as whole numbers! Do not use decimals or dollar signs.

COMS April 5h $

COMS April 15th $

Ending Inventory April 30th $

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Only typing answer Please explain step by step without table and grapharrow_forwardPlease do not give solution in image format thankuarrow_forwardesc Honest Tea, Inc. is a merchandiser. Use the following information to its Inventory balance on its December 31 year-end balance sheet. Note: All purchases of inventory are on account. Cost of Goods Sold during the year January 1 Inventory Sales during the year December 31 Accounts Receivable Purchases of Inventory on Account during the year December 31 Inventory = $. 1 Q A N Click Save and Submit to save and submit. Click Save All Answers to save all answers. 2 W S Ma # 3 E D x 'I X $34,000 $ 4 10,000 77,000 24,000 35,000 C с R % or op F 5 T MacBook Pro V < 6 G Y & 7 H B * 00 つ 8 J N O Save All Answe O 0 K Marrow_forward

- Please do not give solution in image format thankuarrow_forwardanswer in text form please (without image),,,,,,,,,,,,,,,,,,,,,, Please answer both the question , otherwise skip it, these are easy questionarrow_forwardDate Nov. 1 Nov. 10 Nov. 15 Nov. 20 November 1 Nov. 24 Nov. 30 10 15 20 24 30 15 X Inventory 27 units at $88 The business maintains a perpetual inventory system, costing by the first-in, first-out method. Sale a. Determine the cost of the goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Purchase Sale Sale Purchase 59 units at $81 48 units. 33 units at $84 17 units 18 units. Quantity Purchases Purchases Purchased Unit Cost Total Cost Cost of the Goods Sold Schedule First-in, First-out Method DVD Players Cost of Cost of Quantity Goods Sold Goods Sold Inventory Inventory Inventory Sold Unit Cost Total Cost Quantity Unit Cost Total Cost O UD 000 8 00 00arrow_forward

- Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 21 units @ $14 11 Purchase 13 units @ $17 14 Sale 27 units 21 Purchase 8 units @ $21 25 Sale 11 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using FIFO. Cost of Inventory Purchases Goods Sold Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 21 $ 14 $ 294 11 13 17 221 21 14 $ 294 13 $ 17 221 14 21 $ 14 2$ 294 17 102 21 8 21 168 $4 25 2$ 21 $4 168 3 21 63 Total Cost of goods sold $4 627 Ending inventory value %24 %24 %24 %24arrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 18 units @ $16 11 Purchase 17 units @ $14 14 Sale 23 units 21 Purchase 8 units @ $18 25 Sale 12 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using LIFO. Cost of Purchases Goods Sold Inventory Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 11 14 21 25 Total Cost of goods sold Ending inventory value 00arrow_forwardPlease don't provide answer in image format thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education