FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

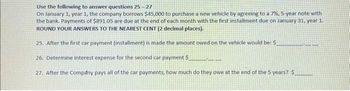

Transcribed Image Text:Use the following to answer questions 25-27

On January 1, year 1, the company borrows $45,000 to purchase a new vehicle by agreeing to a 7%, 5-year note with

the bank. Payments of $891.05 are due at the end of each month with the first installment due on January 31, year 1.

ROUND YOUR ANSWERS TO THE NEAREST CENT (2 decimal places).

25. After the first car payment (installment) is made the amount owed on the vehicle would be: $

26. Determine interest expense for the second car payment $

27. After the Company pays all of the car payments, how much do they owe at the end of the 5 years? $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction of notes payable

VIEW Step 2: Requirement 25 - Computation of the amount owed on the vehicle after the first payment

VIEW Step 3: Requirement 26 - Computation of the interest expense for the second payment

VIEW Step 4: Requirement 27 - Computation of the amount owed on the vehicle after 5 years

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- prepare a three-year (monthly) amortization schedule to classify the notes payable into its current and long-term amounts. See October 1, 2020 transaction for details of loan. October 1 - Bought office equipment for $15,000 and signed a three-year promissory note with a local bank. The annual interest rate is 5%, with monthly payments of $449.56 beginning on November 1.arrow_forwardAnswer with Formulas with upvotesarrow_forward1. Chapter-9 Homework Question. Helparrow_forward

- On January 2nd, Mobile Sales borrows $20,000 cash on a note payable from Ethical Lenders with terms 90 days, 5%. Mobile Sales and Ethical Lenders uses a 360-day year for interest calculations. Mobile Sales makes adjusting entries at the end of each calendar quarter. Journalize the initiation of the loan, the recognition of interest expense for the quarter and the payment of the note on its due date (round to the even dollar).arrow_forwardLetter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month’s outstanding balance has an interest charge at 12% APR. For the following loans, all with a $100,000 credit line, what are the required monthly interest payments and the total interest paid for the year?arrow_forwardCampus Flights takes out a bank loan in the amount of $210,000 on March 1. The terms of the loan include a repayment of principal in ten equal installments, paid annually from March 1. The annual interest rate on the loan is 9 percent, recognized on December 31. A. Compute the interest recognized as of December 31 in year 1. 15,750 ✔ 3. Compute the principal due in year 1.arrow_forward

- Assume that you start with a balance of $3900 on your credit card. During the first month you charge $400 and during the second month you charge $650 Assume that you credit card charges a 29% APR and that each month only the minimum payment of 2.5% of the balance. Table round to the nearest cent 1 month Previous balance, Finance charge- Purchase- New balance 2 month Previous balance, Finance charge- Purchase- New balancearrow_forwardOn February 1, 2021, Miter Corp. lends cash and accepts a $1,000 note receivable that offers 12% interest and is due in six months. How much interest revenue will Miter Corp. report during 2021? Multiple Choice O O O O $120. $240. $100. $60.arrow_forwardOn January 1, 20X1, Bouncy House, Inc. obtains a $50,000, 6 year, 8% installment note for the latest and greatest bouncy house. Bouncy House is required to make annual payments. The first payment occurs on December 31, 20X1. а. Calculate your annual payment amount. b. Create the loan amortization schedule (table). Record the first three journal entries. d. How much total interest does Bouncy House pay on this installment note? С.arrow_forward

- Kelly Jones and Tami Crawford borrowed $10,500 on a 7-month, 8% note from Gem State Bank to open their business, Oriole’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to accrue the interest on June 3 Date Account Titles and Explanation Debit Credit June 30arrow_forwardJanuary 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use PV of $1 and PVA of $1. (Use appropriate factor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $233,000 with a 21-month, 12% Installment note. Payments of $12.356.17 are due at the end of each month, and the first installment is due on January 31, 2024. Record the Issuance of the installment note payable for the purchase of the equipment. 2. The company can sign a 21-month lease for the equipment by agreeing to pay $9.492.50 at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. 3. As of January 1, 2024, does the installment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has…arrow_forwardplease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education