FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

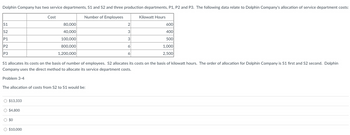

Transcribed Image Text:Dolphin Company has two service departments, S1 and S2 and three production departments, P1, P2 and P3. The following data relate to Dolphin Company's allocation of service department costs:

Number of Employees

S1

S2

IP1

P2

P3

O $13,333

The allocation of costs from S2 to S1 would be:

O $4,800

Cost

O $0

80,000

40,000

100,000

800,000

1,200,000

O $10,000

S1 allocates its costs on the basis of number of employees. S2 allocates its costs on the basis of kilowatt hours. The order of allocation for Dolphin Company is S1 first and S2 second. Dolphin

Company uses the direct method to allocate its service department costs.

Problem 3-4

2

3

3

6

6

Kilowatt Hours

600

400

500

1,000

2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fans Company has two service departments-product design and engineering support, and two production departments-assembly and finishing. The distribution of each service department's efforts to the other departments is shown below: SERVICE DEPARTMENT Product Design Engineering Support The direct operating costs of the departments (including both variable and fixed costs) were as follows: Product Design Engineering Support Assembly Finishing Multiple Choice $631,492 Design 0% 20% $1,018.633. SERVICES PROVIDED TO $ 162,000 $ 142,000 $ 552,000 $ 842,000 Support 10% 0% The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar. Assume that the engineering support department goes first): Assembly 30% 45% Finishing. 60% 35%arrow_forwardA company which uses activity-based costing has two products: A and B. The annual production and sales of Product A is 12,000 units and of Product B is 10,500 units. There are three activity cost pools, with total cost and total activity as follows: Total Activity Product Product A Activity Cost Pool Total Cost Total Activity 1 Activity 2 Activity 3 52-54 $25,420 130 490 620 $38,400 $122,670 890 310 1,200 820 3,410 4,230 The activity-based costing cost per unit of Product A is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $10.79 $1.60 $4.80 $3.10arrow_forwardRex Industries has two products. They manufactured 12,540 units of product A and 8,255 units of product B. The data are: Activity in Estimated Cost Pool Overhead Product A Product B 1 $51,850 1,100 600 53,840 100 700 3 24,600 700 5,300 What is the activity rate for each cost pool? Round your answers to two decimal places. Activity in Activity Cost Pool Rate 1 $ 2 $ 3 $arrow_forward

- Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Activity Rates Supporting direct labor $ 8 per direct labor-hour Machine processing $ 4 per machine - hour Machine setups $ 40 per setup Production orders $ 150 per order Shipments $ 120 per shipment Product sustaining $ 900 per product Activity data have been supplied for the following two products: Total Expected Activity K425 -M67 Number of units produced per year 200 2,000 Direct labor-hours 925 40 Machine - hours 2, 600 30 Machine setups 11 1 Production orders 11 1 Shipments 22 1 Product sustaining 1 1arrow_forwardKubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forwardRabia Company has two support departments, Human Resources and Maintenance, and two producing departments, Fabrication and Assembly Support Departments Producing Departments Human Resources Maintenance Fabrication Assembly Budgeted overhead Direct labor hours Machine hours Number of employees $40,000 $72,000 $140,000 $160,000 2,000 2,500 8,000 10,000 12,000 8,000 4 5 15 25 The company only had mixed cost. Human Resource costs are allocated based on the number of employees, and maintenance costs are allocated based on machine hours. Predetermined overhead rates for fabrication and assembly are based on direct labor hours. Required: 1. Calculate the allocation ratios. 2. Using the direct method, allocate the costs of the Human Resources and Maintenance deportments to the Fabrication and Assembly departments. Also write the final cost of both the production departments. 3. What if the Maintenance Department had 50 employees? How would that affect the allocation of Human Resources…arrow_forward

- Martinez Company's relevant range of production is 15,000 units to 25,000 units. When it produces and sells 20,000 units, its unit costs are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Amount Per Unit $6.32 $3.82 $ 1.82 $5.32 $ 4.32 $ 3.32 $ 1.82 $ 0.91 Required: For financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? Total product costarrow_forwardneed answer with given information pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education