FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

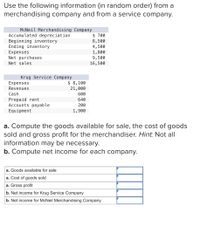

Transcribed Image Text:Use the following information (in random order) from a

merchandising company and from a service company.

McNeil Merchandising Company

Accumulated depreciation

Beginning inventory

Ending inventory

Expenses

Net purchases

$ 700

8,500

4,500

1,800

9,500

Net sales

16,500

Krug Service Company

Expenses

$ 8,100

21,000

Revenues

Cash

600

Prepaid rent

Accounts payable

Equipment

640

200

1,900

a. Compute the goods available for sale, the cost of goods

sold and gross profit for the merchandiser. Hint. Not all

information may be necessary.

b. Compute net income for each company.

a. Goods available for sale

a. Cost of goods sold

a. Gross profit

b. Net income for Krug Service Company

b. Net income for McNeil Merchandising Company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ramos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 1 Required: 1. Compute Net Sales and Gross Profit for Ramos Hair Styling. Net Sales Gross Profit Sarrow_forwardPlease see below. I need help making a made up purchase schedule of inventory. Please include parts listed below. Note that these can be made up one but they need to make sense.arrow_forwardi need the answer quicklyarrow_forward

- Debit $ 3,580 31,400 1,715 Credit Cash Merchandise inventory Store supplies Office supplies Prepaid insurance Store equipment Accumulated depreciation, store equipment Office equipment Accumulated depreciation, office equipment Accounts payable Zen Woodstock, capital Zen Woodstock, withdrawals Rental revenue 645 3,960 57,615 $ 6,750 13,100 6,550 4, 000 52, 000 31, 500 14,600 501,520 Sales Sales returns and allowances 2,915 5,190 331, 315 Sales discounts Purchases 2,140 4,725 Purchase returns and allowances Purchase discounts Transportation-in Sales salaries expense Rent expense, selling space Advertising expense Store supplies expense Depreciation expense, store equipment Office salaries expense Rent expense, office space Office supplies expense Insurance expense Depreciation expense, office equipment 3,690 34,710 24,080 6,400 27,630 13,000 Totals $592, 285 $592, 285 a. The balance on January 1, 2020, in the Store Supplies account was $480. During the year, $1,235 of store supplies…arrow_forwardRamos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 2 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage %arrow_forwardDon't provide answer in image formatarrow_forward

- The following inventory information is gathered from the accounting records of Tucker Enterprises: # of Units x Unit Cost = Total Beginning Inventory 4000 x 5 Purchases 6000 x 7 Sales 9000 x 10 Ending Inventory 1000 a. Calculate Ending Inventory # of Units Unit Cost Ending Inventory 1.FIFO 0 $- 2.LIFO 0 $- 3.Weighted Average Cost 0 $- $- $- $- b. Cost of Goods Sold # of Units # of Units Unit cost Unit cost Cost of Goods Sold 1.FIFO $- 2.LIFO $- 3.Weighted Average Cost $- $- 0 $- c.Gross profit using each of the following methods: Sales Cost of Goods Sold Gross Profit 1.FIFO $- $- $- 2.LIFO $- $- $- 3.Weighted Average Cost $- $- $-arrow_forwardYou are provided with the following information for Geo Inc., which purchases its inventory from a supplier on account. All sales are also on account. Geo uses the FIFO cost formula in a perpetual inventory system. Increased competition has recently decreased the price of the product. Date Explanation Oct. 1 Beginning inventory 5 Purchases 8 Sales Purchases 15 20 Sales 26 Purchases Units 60 100 (120) 35 (60) 15 Unit Cost Price $140 130 200 120 160 110 Instructions (a) Prepare all journal entries for the month of October for Geo, the buyer. (b) Determine the cost of goods sold and ending inventory amount for Geo. (c) On October 31, Geo learns that the product has a net realizable value of $108 per unit. What amount should ending inventory be valued at on the October 31 statement of financial position? (d) Now assume that Geo uses the average cost formula in a perpetual inventory system. Determine the cost of goods sold and ending inventory amount for Geo, ignoring the effect of (c). (e)…arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward

- Joker Inc. has only two retail and two wholesale customers. Information relating to each customer for 2020 follows: (Click the icon to view the data.) Requirement Calculate customer-level operating income. Begin by calculating each customer's gross margin. Then calculate the operating income for each customer. (Use parentheses or a minus sign to enter a negative gross margin or a customer-level operating loss. Abbreviations used: cust = customer; oper. = operating.) Gross margin Customer-level operating income (loss) Wholesale West Region Wholesaler East Region Wholesaler Blake Inc. Retail Robin Corparrow_forwardCastillo Styling is a wholesaler of hair supplies. Castillo Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $32, 757). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition). for cash refund (original cost of merchandise $330). c. Sold merchandise (costing $7,885) to a customer on account with terms n/60.. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $250) after year-end from sales made during the year. A6-3 (Algo) Part 2 Compute the gross profit percentage. (Round your answer to 1 decimal place.) $ 58,240 360 16, 600 8,300 182 370arrow_forwardPlease do not give solution in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education